eToro Review

EToro is an early pioneer in social investing and has the most vibrant community of all the brokers we test. Even putting the social activity stream aside, eToro is still a fine choice for casual traders who prefer a fun and easy-to-use investing platform over swan-diving into details. I’m not quite as bullish on eToro’s options trading — yet.

EToro USA LCC does not offer CFDs; only real crypto assets available.

-

Minimum Deposit:

$100.00 -

Stock Trades:

$0.00 -

Options (Per Contract):

$0.00

Pros & Cons

Pros

- EToro’s influencers offer opinions and viewpoints on breaking news.

- Crypto investors, rejoice! eToro gives you 24 coins to choose from.

- The website and mobile apps are easy to navigate and easy on the eyes. EToro also punches above its weight class in charting.

- I’m a big fan of eToro’s beginner-friendly presentation of stocks’ basic financial data.

Cons

- Investment choices are limited to approximately 2,000 stocks, 270 ETFs, a strong crypto presence and basic options trading.

- You can neither go short nor borrow on margin.

- No limit orders for stocks.

- Experienced investors and traders will crave more capabilities than the skinny tools and features available on eToro. Options trading is only on a dedicated eToro Options app that provides little information on the underlying stocks.

Note: If you are in the United States, check whether eToro is licensed to trade stocks in your state. At the time of my test, eToro wasn’t licensed to trade in Nevada, Minnesota, New York, Puerto Rico, Hawaii, and the U.S. territories of Samoa and Guam. Also important to know: eToro operates differently in other countries. If you are outside the U.S. or interested in forex trading, you might like to read our reviews of eToro on our sister sites, UK.StockBrokers.com and ForexBrokers.com.

Overall summary

| Feature |

eToro eToro

|

|---|---|

| Overall |

|

| Investment Options |

|

| Commissions & Fees |

|

| Mobile Trading Apps |

|

| Platforms & Tools |

|

| Research |

|

| Customer Service | N/A |

| Education |

|

| Ease Of Use |

|

Recent news

January 2024: Crypto ETFs. EToro now allows trading of spot bitcoin ETFs in brokerage accounts.

Social investing on eToro

EToro investors often post content in hopes of building a revenue-generating following (see its Popular Investor program). Some of the posters are quite insightful, others less so, as you might expect. The feed offers a welcome perspective that counters the Wall Street problem of too many analysts taking similar approaches and coming to similar conclusions.

On the other hand (we financial analysts say that at least 10 times a day or our hearts stop beating), more experienced investors might start yelling at their computer screens when they disagree with someone’s posts. One user’s target price for Tesla was so high I reached frantically for an oxygen mask.

Investment options

eToro offers cryptocurrencies, stocks, options, and ETFs, including fractional shares. Mutual funds, futures, forex, and bonds are not supported. EToro does not offer banking services, robo portfolios, or advisory services. It's is the only broker we reviewed this year that doesn’t offer stock limit orders.

Options trading is limited to a separate mobile app, and that’s only for basic puts and calls. Margin trading is also not available.

Cryptocurrency: EToro won the No. 1 award for Crypto Technology in our 2024 Annual Awards. It offers 24 cryptocurrencies in the U.S., allowing users to trade, among others, Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), Litecoin (LTC), Dogecoin (DOGE), Algorand (ALGO), Avalanche (AVAX), Uniswap (UNI), Chainlink (LINK), Zcash (ZEC), Stella Lumens (XLM), Ethereum Classic (ETC), Shiba Inu (SHIB) and Dash (DASH).

Options: EToro has a separate options app that allows you to log in with your eToro account. The options experience is very friendly to beginners. It takes a unique approach to option chains, order entry, and displaying basic risk measures. Complex orders aren’t supported and the detailed analytics available at tastytrade, Interactive Brokers and other top-tier brokerages are notably missing.

| Feature |

eToro eToro

|

|---|---|

| Stock Trading | Yes |

| Margin Trading | No |

| Fractional Shares | Yes |

| OTC Stocks | No |

| Options Trading | Yes |

| Complex Options Max Legs | 0 |

| Bonds (US Treasury) | No |

| Futures Trading | No |

| Forex Trading | No |

| Mutual Funds (Total) | 0 |

| Crypto Trading | Yes |

| Crypto Trading - Total Coins | 26 |

| Traditional IRAs | No |

| Roth IRAs | No |

| Advisor Services | No |

Commissions and fees

Like the competition, eToro offers $0 commissions on stock and ETF trades. It charges a 1% fee on both the entry and the exit in cryptocurrency trades, which can add up if you trade frequently. There is a minimum investment of $100 unless you want to try eToro with a virtual portfolio. Though that may not be an issue for some potential clients, many competitors don’t require an initial investment. eToro does not charge a fee for withdrawing money, but there is a $30 minimum.

Penny stocks: EToro does not currently offer penny stocks.

Options: There are no commissions, contract fees, exercise, or assignment fees for options trading, which is super groovy.

| Feature |

eToro eToro

|

|---|---|

| Minimum Deposit | $100.00 |

| Stock Trades | $0.00 |

| Penny Stock Fees (OTC) | N/A |

| ETF Trade Fee | $0.00 |

| Options (Base Fee) | $0.00 |

| Options (Per Contract) | $0.00 |

| Options Exercise Fee | $0.00 |

| Options Assignment Fee | $0.00 |

| Futures (Per Contract) | (Not offered) |

| Mutual Fund Trade Fee | N/A |

| Broker Assisted Trade Fee | $0 |

Mobile trading apps

The mobile trading app is similar to the web experience but with less customization. Again, it feels more like a social media app than a trading app.

Ease of use: Navigation is simple and reasonably intuitive, partly because there is little to see. Some of the icons aren’t particularly clear or labeled, but there is not much of a learning curve. The consistency between web and mobile adds to the ease of use.

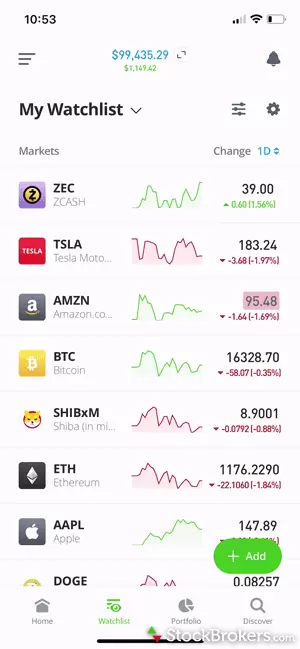

Watch lists: These are simple, clean, and very sparse compared to those of long-established brokers. The name, symbol, small chart, price, and change are shown and customization is limited. Clicking through takes you to the underlying information, where you can view social posts, stats, a chart, research, and news.

Charting: There are three different chart views. The first is on the overview page, which is mainly useful for scanning how the asset is doing. The charts on the stats page offer more time periods, and, lastly, the dedicated chart page lets you choose chart types and add indicators, of which you have 103 to choose from. Annoyingly, there is no landscape mode on the chart page.

Options trading: EToro does not charge per-contract fees for options, a major plus. Trading is only available on a separate eToro options mobile app that shares the user-friendliness, social streaming, and other design elements of eToro’s stock and crypto trading.

The options chain, along with potential profit and loss, is presented in a creative way that prevents new traders from being overwhelmed. Options positions are presented in dollar amounts instead of contract prices, which eliminates some calculations. Instead of quoting a contract for 100 shares at, say, $1.15, eToro presents a contract value of $115.00 a contract. More knowledgeable users can find four Greeks.

I don’t think it’s a good idea to offer options and stock trading in separate apps, as it’s likely to lead to investors becoming confused about what they own. Spreads and the necessary margin approval require an additional step of contacting customer support and submitting additional info via a form.

| Feature |

eToro eToro

|

|---|---|

| iPhone App | Yes |

| Android App | Yes |

| Apple Watch App | No |

| Stock Alerts | Yes |

| Charting - After-Hours | Yes |

| Charting - Technical Studies | 103 |

| Charting - Study Customizations | Yes |

| Watch List (Streaming) | Yes |

| Watch Lists - Create & Manage | Yes |

| Watch Lists - Column Customization | No |

Other trading platforms and tools

EToro’s social trading focus delivers beginners a quality community experience. There’s more useful content and less garbage on eToro’s social stream than what we’ve noticed at other brokers. That said, I recommend using the social stream solely as food for thought and supplementing those morsels with your own independent fact-checking and insights.

The CopyTrader and Smart Portfolios features allow new crypto traders to have exposure without actually having to pick, choose or monitor their own positions. There’s a minimum of $200 to use CopyTrader and $500 for Smart Portfolios.

Charting: EToro offers a nice beginner’s complement of charting tools on the web platform, including several chart types, over 60 studies, and 12 drawing tools. Expand the standard chart to access these tools.

But wait, there’s more. Above the full chart, there’s a button with a crown icon that lets you launch ProCharts. We like ProCharts for its simplified multi-chart layout. You can also buy directly from the chart tab, but — this was really weird — not sell, even if you’re long the shares in the account.

CopyTrader: The social trading aspect of eToro dominates, and the broker capitalizes on that with its CopyTrader tool. This allows you to copy other traders' portfolios. Using this feature is incredibly easy and has no fees or costs beyond the regular costs of the trades placed in that portion of the account. You choose the trader you want to copy (after viewing their track record), set an amount and hit the copy button. From there you can stop the copy at any point or even put in a stop loss order on the copy. There is a minimum of $200 to copy a trader.

Smart Portfolios: Smart Portfolios are eToro’s own cryptocurrency funds. They are offered at no fee but do incur the costs of the trades within them. There are several variations, including one that is an index of the largest cryptocurrencies by market cap, another that is driven algorithmically by social media sentiment, and another that just invests in the two largest, Bitcoin and Ethereum. There is a $500 minimum investment.

| Feature |

eToro eToro

|

|---|---|

| Active Trading Platform | N/A |

| Desktop Trading Platform | No |

| Desktop Platform (Mac) | No |

| Web Trading Platform | Yes |

| Paper Trading | Yes |

| Trade Journal | No |

| Watch Lists - Total Fields | 7 |

| Charting - Indicators / Studies | 46 |

| Charting - Drawing Tools | 48 |

| Charting - Study Customizations | 5 |

| Charting - Save Profiles | Yes |

| Trade Ideas - Technical Analysis | Yes |

| Streaming Time & Sales | Yes |

| Trade Ideas - Backtesting | No |

Research

Is eToro fun? Yes! Is it too skimpy with investment data and research? Also yes. We understand that 1) eToro likes to keep investing easy and breezy, and 2) it’s easy enough to Google information on a different browser tab, but there’s also a point where there’s just not enough there there.

Here are two examples of what’s missing: I bought shares of the Vanguard Short Term Corporate Bond Fund (VCSH) in my personal eToro account and was startled that I couldn’t find information on the fund’s dividend. There’s also nothing about how much of your portfolio is divided between stocks, bonds, and cash, though you can see the percentage allocated to each holding, which isn’t as intuitive or useful as a pie chart that shows the breakdown between stocks, bonds, crypto, and cash.

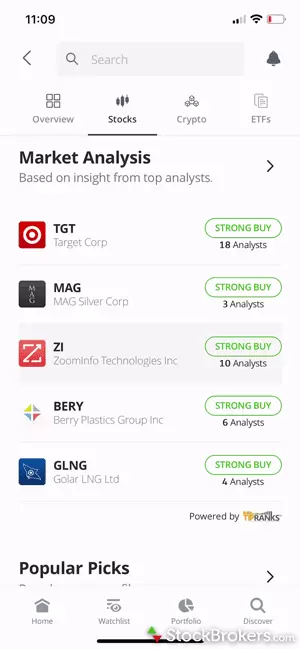

There are “Research” and “News” tabs for most of the individual cryptocurrency, stock and ETF pages (these are only available to funded accounts). The research comes from TipRanks and includes analyst ratings and consensus, price target, institutional investor activity (which is incorrectly named “hedge fund activity”), ESG ratings, and insider transactions.

| Feature |

eToro eToro

|

|---|---|

| Research - Stocks | Yes |

| Stock Research - ESG | Yes |

| Stock Research - PDF Reports | 0 |

| Screener - Stocks | No |

| Research - ETFs | Yes |

| Screener - ETFs | No |

| Research - Mutual Funds | No |

| Screener - Mutual Funds | No |

| Research - Pink Sheets / OTCBB | No |

| Research - Bonds | No |

Education

EToro offers education on its global home page in the form of its own eToro Academy as well as a News and Analysis page, a collection of news articles, and its “Digest and Invest” podcast channel. The podcasts are very good.

We wish eToro would make more of the content available on the U.S. site, which is pretty thin at the moment. Much of the global educational content is useful to U.S. investors, but readers should remember that U.S. markets are among the most closely regulated in the world, so what flies in other countries might not fly here. Current U.S. clients can find global content by logging out of their account and returning to the eToro homepage.

Learning center: The U.S. eToro Academy is a collection of guides and videos, most of which cover crypto trading and its intricacies. A significant chunk of the content is focused on how to use the eToro platforms. The articles overall are well-done and instructive, especially if you are new to crypto. The short videos cover related areas well.

| Feature |

eToro eToro

|

|---|---|

| Education (Stocks) | Yes |

| Education (ETFs) | No |

| Education (Options) | No |

| Education (Mutual Funds) | No |

| Education (Bonds) | No |

| Education (Retirement) | No |

| Paper Trading | Yes |

| Videos | Yes |

| Webinars | No |

| Webinars (Archived) | No |

| Progress Tracking | No |

| Interactive Learning - Quizzes | No |

Banking services

Banking in the U.S. with eToro is limited to the broker’s eToro Money crypto wallet. This allows users to transfer crypto from the eToro platform, send and receive crypto from or to other wallets and convert from one cryptocurrency to another. While basic cash management is also offered in a handful of countries, including the U.K., it’s not yet available in the U.S.

| Feature |

eToro eToro

|

|---|---|

| Bank (Member FDIC) | No |

| Checking Accounts | No |

| Savings Accounts | No |

| Credit Cards | No |

| Debit Cards | No |

| Mortgage Loans | No |

Final thoughts

EToro bills itself as a “social investment network.” When viewed in that light, it does a very good job, especially in the crypto space. It often feels more like a social media platform than a broker and it has good chart capabilities. Its CopyTrader and Smart Portfolios features allow traders to access crypto without needing to do their own research or constantly watch the markets.

Limitations include few offerings beyond cryptocurrency and stock and the inability to sell anything short. Those interested in copy trading face the additional challenge ofdeciding which traders to copy. If you’re interested in copy trading, consider looking beyond absolute returns and pay attention to the risk score, the number of trades placed per week, and the average profit, loss, and holding time for any traders you’re watching.

Here are our top takeaways for eToro:

- EToro offers a unique and easy-to-navigate social trading platform that is strongest in cryptocurrencies, where over 20 coins are on offer.

- Its CopyTrader feature allows clients to replicate others’ trades, and eToro’s Popular Investor program provides cash payouts and other incentives to crypto traders able to develop a CopyTrader following.

- We think eToro’s platform is best suited to beginning crypto enthusiasts who enjoy collaborating with others but have some interest in buying stocks, options and exchange-traded funds.

Read next

- Best Stock Trading Platforms for Beginners of April 2024

- Best Day Trading Platforms of April 2024

- Best Brokers for Penny Stock Trading of April 2024

- Best Stock Brokers for April 2024

- Best Stock Trading Apps of 2024

- Best Options Trading Platforms & Brokers

- Best Futures Trading Platforms of April 2024

- Best Paper Trading Platforms of April 2024

More Guides

Popular Stock Broker Reviews

Is eToro good for investing?

eToro is a good place for those who are looking to jump into buying cryptocurrency and are seeking a community and resources to get exposure. With stocks and ETFs available at $0 commissions, eToro can be a good choice for those who prioritize a simple platform.

Can eToro be trusted?

Yes, eToro can be trusted. eToro USA is a member of Finra and accounts are insured up to $500,000 by the Securities Investor Protection Corporation, or SIPC, which protects against a broker’s insolvency.

Is eToro good for beginners?

While eToro didn't make our shortlist of best platforms for beginners, its platform is simple and easy to learn. The web platform and mobile app are virtually identical. Its CopyTrader and Smart Portfolios features allow beginners to get diversified exposure to cryptocurrencies without having to constantly watch the markets. While being good for beginners doesn’t mean that it is easy to make money, it is an easier platform to use compared to some of the competition.

Can U.S. citizens use eToro?

U.S. citizens can invest through eToro’s American affiliate, eToro USA. eToro USA is a member of Finra and carries account insurance of up to $500,000 per account through the Securities Investor Protection Corporation, or SIPC. If you are in the United States, check whether eToro is licensed to trade stocks in your state; at the time of this writing, a handful of regions were not licensed. Note that its offerings for U.S. traders may differ from its offerings abroad.

Can you buy actual bitcoin on eToro?

Yes, you can buy bitcoin on eToro. Once you open and fund an account, you have access to a wide variety of cryptocurrencies or currency portfolios. Further, eToro offers fractional shares, so you do not have to buy one full bitcoin to get exposure.

What is the downside to eToro?

There are a few catches with eToro. One potential issue for some is that you can’t sell shares short, you can only buy and sell. And while I was impressed with the speed of email from customer support, there are reports that direct contact can be difficult. I didn't encounter this during my tests.

Can eToro make you rich?

Trading on eToro can be profitable, but as with any platform, and any form of trading, there is a significant risk of losing money in the markets. Never invest more than you are willing to lose — and there's no rush to lose it, either.

About eToro

An early pioneer in social copy trading, eToro was founded in Israel in 2006 as a financial trading technology developer. Since launching its first product, it has grown to service over 26 million users with an innovative platform that continually evolves to be one of the largest social networks globally, with clients in over 100 countries. eToro expanded to the U.S. in 2018 and has since grown both its user base and its offerings. In August 2022, eToro signed an agreement to purchase Gatsby, an options trading platform. The service was rebranded as eToro Options.

eToro 2024 Results

For the StockBrokers.com 2024 Annual Awards, announced on Jan. 23, 2024, all U.S. equity brokers we reviewed were assessed on over 200 different variables across eight areas: Commissions & Fees, Investment Options, Platforms & Tools, Research, Mobile Trading Apps, Education, Ease of Use, and Overall.

StockBrokers.com also presented “Best in Class” awards to brokers for additional categories Beginners, Options Trading, Futures Trading, Day Trading, IRA Accounts, Investor Community, Penny Stock Trading, Bank Brokerage, High Net Worth Investors, and Customer Service. A “Best in Class” designation means finishing in the top five brokers for that category.

For more information, see how we test.

Industry awards

eToro eToro

|

#1 Crypto Technology |

|---|---|

| Rank #1 | |

| Streak | 1 |

Disclaimer: eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro. Reink Media Group is compensated if you access certain of the products or services offered by eToro USA LLC and/or eToro USA Securities Inc. Any testimonials contained in this communication may not be representative of the experience of other eToro customers and such testimonials are not guarantees of future performance or success.

StockBrokers.com Review Methodology

Our mission at StockBrokers.com is simple: provide thorough and unbiased reviews of online brokers, based on an extraordinary level of hands-on testing and data collection. Our ratings and awards are based on this data and our in-house experts’ deep authority in the field; brokers cannot pay for preferential treatment. Here’s more about trustworthiness at StockBrokers.com.

Our research team conducts thorough testing on a wide range of features, products, services, and tools for U.S. investors, collecting and validating thousands of data points in the process; this makes StockBrokers.com home to the largest independent database on the web covering the online broker industry. We test all available trading platforms for each broker and evaluate them based on a host of data-driven variables. All research, writing and data collection at StockBrokers.com is done by humans, for humans. Read our generative AI policy here.

As part of our process, all brokers had the annual opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy. Brokers also were offered the opportunity to provide executive time for an annual update meeting.

Our rigorous data validation process yields an error rate of less than .001% each year, providing site visitors quality data they can trust. Learn more about how we test.

eToro fees and features data

The data collection efforts at StockBrokers.com are unmatched in the industry. The following tables show a deeper dive into the offerings available at this broker. You can also compare its offerings side-by-side with those of other brokers using our Comparison Tool.

In addition to meticulous annual data collection by our in-house analyst, every broker that participates in our review is afforded the opportunity to complete an in-depth data profile. We then audit each data point to ensure its accuracy.

Trading fees

| Feature |

eToro eToro

|

|---|---|

| Minimum Deposit | $100.00 |

| Stock Trades | $0.00 |

| Mutual Fund Trade Fee | N/A |

| Options (Base Fee) | $0.00 |

| Options (Per Contract) | $0.00 |

| Futures (Per Contract) | (Not offered) |

| Broker Assisted Trade Fee | $0 |

Account fees

| Feature |

eToro eToro

|

|---|---|

| IRA Annual Fee | |

| IRA Closure Fee | |

| Account Transfer Out (Partial) | $75.00 |

| Account Transfer Out (Full) | $75.00 |

| Options Exercise Fee | $0.00 |

| Options Assignment Fee | $0.00 |

Margin rates

| Feature |

eToro eToro

|

|---|---|

| Margin Rate Under $25,000 | Not offered |

| Margin Rate $25,000 to $49,999.99 | Not offered |

| Margin Rate $50,000 to $99,999.99 | Not offered |

| Margin Rate $100,000 to $249,999.99 | Not offered |

| Margin Rate $250,000 to $499,999.99 | Not offered |

| Margin Rate $500,000 to $999,999.99 | Not offered |

| Margin Rate Above $1,000,000 | Not offered |

Investment options

| Feature |

eToro eToro

|

|---|---|

| Stock Trading | Yes |

| Margin Trading | No |

| Fractional Shares | Yes |

| OTC Stocks | No |

| Options Trading | Yes |

| Complex Options Max Legs | 0 |

| Futures Trading | No |

| Forex Trading | No |

| Crypto Trading | Yes |

| Crypto Trading - Total Coins | 26 |

| Mutual Funds (No Load) | 0 |

| Mutual Funds (Total) | 0 |

| Bonds (US Treasury) | No |

| Bonds (Corporate) | No |

| Bonds (Municipal) | No |

| Advisor Services | No |

| International Countries (Stocks) | 0 |

Order types

| Feature |

eToro eToro

|

|---|---|

| Order Type - Market | Yes |

| Order Type - Limit | No |

| Order Type - After Hours | No |

| Order Type - Stop | Yes |

| Order Type - Trailing Stop | Yes |

| Order Type - OCO | No |

| Order Type - OTO | No |

| Order Type - Broker Assisted | No |

Beginners

| Feature |

eToro eToro

|

|---|---|

| Education (Stocks) | Yes |

| Education (ETFs) | No |

| Education (Options) | No |

| Education (Mutual Funds) | No |

| Education (Bonds) | No |

| Education (Retirement) | No |

| Retirement Calculator | No |

| Investor Dictionary | No |

| Paper Trading | Yes |

| Videos | Yes |

| Webinars | No |

| Webinars (Archived) | No |

| Progress Tracking | No |

| Interactive Learning - Quizzes | No |

Stock trading apps

| Feature |

eToro eToro

|

|---|---|

| iPhone App | Yes |

| Android App | Yes |

| Apple Watch App | No |

| Trading - Stocks | Yes |

| Trading - After-Hours | No |

| Trading - Simple Options | Yes |

| Trading - Complex Options | No |

| Order Ticket RT Quotes | Yes |

| Order Ticket SRT Quotes | Yes |

Stock app features

| Feature |

eToro eToro

|

|---|---|

| Market Movers (Top Gainers) | Yes |

| Stream Live TV | No |

| Videos on Demand | Yes |

| Stock Alerts | Yes |

| Option Chains Viewable | Yes |

| Watch List (Real-time) | Yes |

| Watch List (Streaming) | Yes |

| Watch Lists - Create & Manage | Yes |

| Watch Lists - Column Customization | No |

| Watch Lists - Total Fields | 7 |

Stock app charting

| Feature |

eToro eToro

|

|---|---|

| Charting - After-Hours | Yes |

| Charting - Can Turn Horizontally | No |

| Charting - Multiple Time Frames | Yes |

| Charting - Technical Studies | 103 |

| Charting - Study Customizations | Yes |

| Charting - Stock Comparisons | Yes |

Trading platforms overview

| Feature |

eToro eToro

|

|---|---|

| Active Trading Platform | N/A |

| Desktop Trading Platform | No |

| Desktop Platform (Mac) | No |

| Web Trading Platform | Yes |

| Paper Trading | Yes |

| Trade Journal | No |

| Watch Lists - Total Fields | 7 |

Trading platform stock chart features

| Feature |

eToro eToro

|

|---|---|

| Charting - Adjust Trades on Chart | No |

| Charting - Indicators / Studies | 46 |

| Charting - Drawing Tools | 48 |

| Charting - Notes | Yes |

| Charting - Index Overlays | Yes |

| Charting - Historical Trades | No |

| Charting - Corporate Events | No |

| Charting - Custom Date Range | No |

| Charting - Custom Time Bars | No |

| Charting - Automated Analysis | No |

| Charting - Save Profiles | Yes |

| Trade Ideas - Technical Analysis | Yes |

| Charting - Study Customizations | 5 |

| Charting - Custom Studies | No |

Day trading features

| Feature |

eToro eToro

|

|---|---|

| Streaming Time & Sales | Yes |

| Streaming TV | No |

| Direct Market Routing - Stocks | No |

| Ladder Trading | No |

| Trade Hot Keys | No |

| Level 2 Quotes - Stocks | No |

| Trade Ideas - Backtesting | No |

| Trade Ideas - Backtesting Adv | No |

| Short Locator | No |

| Order Liquidity Rebates | No |

Investment research overview

| Feature |

eToro eToro

|

|---|---|

| Research - Stocks | Yes |

| Research - ETFs | Yes |

| Research - Mutual Funds | No |

| Research - Pink Sheets / OTCBB | No |

| Research - Bonds | No |

| Screener - Stocks | No |

| Screener - ETFs | No |

| Screener - Mutual Funds | No |

| Screener - Bonds | No |

| Misc - Portfolio Allocation | No |

Stock research features

| Feature |

eToro eToro

|

|---|---|

| Stock Research - PDF Reports | 0 |

| Stock Research - Earnings | Yes |

| Stock Research - Insiders | Yes |

| Stock Research - Social | Yes |

| Stock Research - News | Yes |

| Stock Research - ESG | Yes |

| Stock Research - SEC Filings | Yes |

ETF research features

| Feature |

eToro eToro

|

|---|---|

| ETFs - Strategy Overview | Yes |

| ETF Fund Facts - Inception Date | No |

| ETF Fund Facts - Expense Ratio | No |

| ETF Fund Facts - Net Assets | No |

| ETF Fund Facts - Total Holdings | No |

| ETFs - Top 10 Holdings | No |

| ETFs - Sector Exposure | No |

| ETFs - Risk Analysis | No |

| ETFs - Ratings | Yes |

| ETFs - Morningstar StyleMap | No |

| ETFs - PDF Reports | No |

Mutual fund research features

| Feature |

eToro eToro

|

|---|---|

| Mutual Funds - Strategy Overview | No |

| Mutual Funds - Performance Chart | No |

| Mutual Funds - Performance Analysis | No |

| Mutual Funds - Prospectus | No |

| Mutual Funds - 3rd Party Ratings | No |

| Mutual Funds - Fees Breakdown | No |

| Mutual Funds - Top 10 Holdings | No |

| Mutual Funds - Asset Allocation | No |

| Mutual Funds - Sector Allocation | No |

| Mutual Funds - Country Allocation | No |

| Mutual Funds - StyleMap | No |

Options trading overview

| Feature |

eToro eToro

|

|---|---|

| Option Chains - Basic View | Yes |

| Option Chains - Strategy View | No |

| Option Chains - Streaming | No |

| Option Chains - Total Columns | 0 |

| Option Chains - Greeks | 4 |

| Option Chains - Quick Analysis | Yes |

| Option Analysis - P&L Charts | No |

| Option Probability Analysis | No |

| Option Probability Analysis Adv | No |

| Option Positions - Greeks | No |

| Option Positions - Greeks Streaming | No |

| Option Positions - Adv Analysis | No |

| Option Positions - Rolling | No |

| Option Positions - Grouping | No |

Banking features

| Feature |

eToro eToro

|

|---|---|

| Bank (Member FDIC) | No |

| Checking Accounts | No |

| Savings Accounts | No |

| Credit Cards | No |

| Debit Cards | No |

| Mortgage Loans | No |

Customer service options

| Feature |

eToro eToro

|

|---|---|

| Phone Support (Prospect Customers) | No |

| Phone Support (Current Customers) | No |

| Email Support | Yes |

| Live Chat (Prospect Customers) | Yes |

| Live Chat (Current Customers) | Yes |

| 24/7 Support | No |