E*TRADE Review

E*TRADE from Morgan Stanley has cemented its status as a premier online broker by mastering a difficult balancing act: delivering professional-grade power without sacrificing accessibility. In my E*TRADE review for 2026, I explore how the platform leverages the institutional strength of its parent company, Morgan Stanley, to provide a research and trading ecosystem that rivals any in the industry.

With two distinct trading platforms, the streamlined E*TRADE Web and the formidable Power E*TRADE, the broker successfully caters to both the set-it-and-forget-it investor and the high-volume derivatives trader. Whether you are looking to build a long-term retirement portfolio or execute complex options strategies, E*TRADE offers a sophisticated, reliable environment that scales with your ambition.

-

Minimum Deposit:

$0.00 -

Stock Trades:

$0.00 -

Options (Per Contract):

$0.65

| Range of Investments | |

| Mobile Trading Apps | |

| Advanced Trading | |

| Research | |

| Education | |

| Ease of Use | |

| Customer Service |

Check out StockBrokers.com's picks for the best stock brokers in 2026.

| #1 Passive Investors | Winner |

| #1 Active Trading Web Platform | Winner |

| 2026 | #4 |

| 2025 | #4 |

| 2024 | #2 |

| 2023 | #3 |

| 2022 | #3 |

| 2021 | #5 |

| 2020 | #4 |

| 2019 | #4 |

| 2018 | #4 |

| 2017 | #4 |

| 2016 | #3 |

| 2015 | #3 |

| 2014 | #4 |

| 2013 | #2 |

| 2012 | #2 |

| 2011 | #1 |

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

- Offers distinct, high-quality experiences for both passive investors and active traders.

- Access to Morgan Stanley’s deep market analysis and interactive reports is a significant value-add.

- Excellent bond resource center with a yield curve visualizer and a user-friendly ladder tool.

Cons

- Base margin rates start at over 12%, which is significantly higher than competitors like Interactive Brokers.

- Investors cannot buy spot Bitcoin or Ethereum directly; exposure is limited to ETFs and futures.

- You cannot buy fractional shares of individual stocks (only available via DRIP or specific ETFs via auto-investing).

My top takeaways for E*TRADE in 2026:

- Two distinct platforms: E*TRADE brilliantly segments its experience to serve two different investor types. E*TRADE Web provides a clean, intuitive hub for passive investors to manage portfolios and access research without getting lost in the weeds. Conversely, Power E*TRADE is a professional workspace that delivers advanced charting, spectral analysis, and rapid order entry directly in your browser.

- Institutional-grade intelligence: The integration with Morgan Stanley has transformed E*TRADE’s research from standard to standout. It delivers actionable, institutional-grade analysis. From interactive research reports that are mobile-friendly to deep-dive thematic insights, the platform leverages its parent company's resources to give retail investors a professional edge.

- Great for options: For options traders, E*TRADE remains a top-tier destination. The Snapshot Analysis tool simplifies risk/reward visualization, while the "Dime Buyback" program, which waives commissions on closing short options priced at $0.10 or less, actively encourages responsible risk management. Whether you are a beginner learning the ropes or a pro managing complex spreads, the platform scales with your ambition.

Range of investments

E*TRADE functions as more of a comprehensive financial hub than a simple trading venue. Whether you are building a legacy for your grandchildren or managing corporate capital, the platform accommodates the full lifecycle of wealth with a maturity that few competitors can match.

How do I diversify my portfolio?

Start with ETFs or mutual funds for instant diversification, especially in a 401(k) or IRA. As your portfolio grows, strategic asset allocation becomes key — adding stocks, bonds, and options to balance risk and growth. If you're new to building a diversified portfolio, check out our guide to passive investing strategies for a smart starting point.

Range of assets and accounts: E*TRADE delivers a vast range of asset classes, covering stocks, ETFs, mutual funds, options, and futures. While many brokers stop at individual and joint accounts, E*TRADE supports the complexity of real life. I found the selection of account types to be exhaustive, ranging from standard custodial and Coverdell options for minors to intricate business structures like SEP IRAs, Solo 401(k)s, Trusts, and even Investment Clubs. For fixed-income investors, the ability to trade bonds and CDs ensures that conservative strategies are just as viable as aggressive futures speculation.

Portfolio management and automation: For investors who prefer a hands-off approach, E*TRADE’s automated solutions are seamless. I was able to set up a recurring weekly investment of $25 into a passive index ETF with just a few clicks, an ideal "set it and forget it" tool for beginners. For a more managed experience, the Core Portfolios offering provides professional oversight for a reasonable 0.30% annual advisory fee with a low $500 minimum.

Platform experience: Managing these assets is done primarily through the "Complete View" dashboard, which lives up to its name. It aggregates total assets, daily gains, and even external accounts into a single, cohesive snapshot. I particularly appreciated the launchpad sidebar, which offers quick access to Power E*TRADE and streaming Bloomberg TV, keeping market news front and center. The customization here is detailed. The positions page alone offers 96 different data columns, allowing you to display up to 16 metrics that matter most to your strategy, from income data to risk assessments.

The gaps: Despite its breadth, E*TRADE is not a universal solution for every niche. The platform does not offer forex trading, and the absence of cryptocurrency will deter digital asset investors. Additionally, while you can automate dollar-based ETF investing, true fractional share trading for individual stocks is not available, which may limit flexibility for smaller accounts targeting high-priced equities.

| Feature |

E*TRADE E*TRADE

|

|---|---|

| Stock Trading | Yes |

| Account Feature - Margin Trading | Yes |

| Fractional Shares (Stocks) | No |

| OTC Stocks | Yes |

| Options Trading | Yes |

| Complex Options Max Legs | 4 |

| Fixed Income (Treasurys) | Yes |

| Futures Trading | Yes |

| Forex Trading | No |

| Crypto Trading | No |

| Crypto Trading - Total Coins | 0 |

| Traditional IRAs | Yes |

| Roth IRAs | Yes |

| Advisor Services | Yes |

One of the best for high net worth

We analyzed online brokers' offerings for clients with over $1 million of liquid, investable assets. See our guide to the Best Brokerage Firms for High Net Worth Individuals.

E*TRADE fees

E*TRADE adheres to the industry standard $0 commission for online stock and ETF trades, but it distinguishes itself through policies that actively support smart trading habits rather than just minimizing costs.

Options: For options traders, the standard contract fee is $0.65, which aligns with most major competitors. However, the standout feature in E*TRADE’s pricing structure is their "Dime Buyback" program. This policy waives commissions when you close short options positions priced at $0.10 or less. As someone who frequently sells premium, I find this feature incredibly valuable. It removes the hesitation to buy back cheap options to close a trade, encouraging traders to take risk off the table and lock in profits rather than letting a position linger into expiration.

Futures: Beyond standard equities, E*TRADE caters to a diverse range of strategies with a competitive fee structure. Futures traders pay $1.50 per contract, a reasonable rate for the access provided.

Fixed-income: Income investors will appreciate the $0 commission on US Treasury trades, a critical benefit in a yield-focused market environment.

Margin rates: However, the cost of leverage remains steep. Margin rates start at 12.95% for balances under $25,000. While this is typical for bank-affiliated brokers, active traders using significant leverage may find more attractive rates elsewhere.

Penny stocks: One area where E*TRADE imposes a barrier is the over-the-counter (OTC) market. Trading penny stocks incurs a $6.95 fee, which is a substantial price point compared to competitors like Fidelity that offer them with zero commissions.

| Feature |

E*TRADE E*TRADE

|

|---|---|

| Minimum Deposit | $0.00 |

| Stock Trades | $0.00 |

| Penny Stock Fees (OTC) | $6.95 |

| Options (Per Contract) | $0.65 |

| Options Exercise Fee | $0.00 |

| Options Assignment Fee | $0.00 |

| Futures (Per Contract) | $1.50 |

| Mutual Fund Trade Fee | $0.00 |

| Broker Assisted Trade Fee | $25 |

Mobile trading apps

E*TRADE solves the classic dilemma of "simplicity vs. power" by offering two distinct mobile experiences: the E*TRADE Mobile app for everyday investors and the Power E*TRADE app for active traders. I personally appreciate this separation because data can easily overwhelm new investors, and visually condensing market information to suit everyone’s needs is no small task. This dual approach allows E*TRADE to cater to a broader audience without sacrificing usability for either group.

E*TRADE Mobile App: The flagship app is a fantastic companion for the stock picker and long-term investor. Research is a standout feature. Pulling a quote reveals a wealth of data, including mobile-friendly Morgan Stanley research reports that are interactive rather than static PDFs, a huge win for readability on a small screen. I found the watch lists particularly useful, offering 19 customizable data fields. One of the most useful is the "price added" field, which effectively allows you to paper trade or track ideas without committing capital.

Charting on the flagship app is surprisingly detailed. You can access 107 technical studies and easily adjust chart types and intervals. However, the app struggles with the broader market context. While you can stream Bloomberg TV live, I felt in the dark when trying to understand market drivers. Key data points like sector performance and commodity prices are missing from the standard view.

Power E*TRADE App: For options traders and technical analysts, the Power E*TRADE app is the necessary choice. While the flagship app allows trading options, I found the experience tedious since multi-leg orders required too many clicks, and critical data like net Greeks was absent. The Power E*TRADE app resolves these issues, offering the advanced order entry, risk analysis, and complex charting capabilities that active traders demand.

Power E*TRADE’s mobile app delivers advanced charting tools designed for active traders on the go. This customized view shows a candlestick chart with 13, 26, and 40-week moving averages applied. The platform makes it easy to personalize technical charts and monitor market momentum from your phone.

Overall, if you are building a portfolio of stocks and ETFs, the flagship app is sleek and intuitive. If you are managing complex option spreads or hunting for technical setups, Power E*TRADE will be the superior app for your needs.

| Feature |

E*TRADE E*TRADE

|

|---|---|

| iPhone App | Yes |

| Android App | Yes |

| Apple Watch App | Yes |

| Stock Alerts | Yes |

| Charting - After-Hours | Yes |

| Charting - Technical Studies | 107 |

| Charting - Study Customizations | Yes |

| Watchlist (Streaming) | Yes |

| Mobile Watchlists - Create & Manage | Yes |

| Mobile Watchlists - Column Customization | Yes |

Advanced trading platforms

E*TRADE continues this separation with its desktop platform offerings, providing two dedicated experiences: E*TRADE Web for the long-term investor and Power E*TRADE for the active trader. This dual approach ensures that passive investors aren't overwhelmed, while active traders aren't starved for data.

Power E*TRADE: Power E*TRADE is the offering aimed at advanced traders. It is an HTML5-based platform, meaning it runs directly in your browser with the speed and complexity typically reserved for downloadable desktop software. However, for those who prefer a dedicated application, E*TRADE does offer downloadable versions for both Windows and Mac. The platform is widget-based and highly customizable. I was able to easily populate my workspace with any of the 120+ available tools, including the "Live Action" scanner, which identifies unusual volatility and volume in real-time.

Charting: For technical analysts, the platform is comprehensive, offering 121 technical indicators and 37 drawing tools. You can save views, choose from 19 chart styles, and overlay automated technical analysis patterns. However, I did find the drawing tools to be a bit finicky. I missed the ability to snap lines to specific prices, which can be a point of frustration for precision-focused chartists. If you rely heavily on manual trendline drawing, this is a minor annoyance in an otherwise smooth experience.

Options: Trading on Power E*TRADE is intuitive, particularly for options. The "Snapshot Analysis" tool provides a visual representation of risk and reward, displaying max profit, max loss, and breakeven points in a clean, digestible format. Constructing multi-leg spreads is simple; selecting a bid and an ask on the chain immediately populates the ticket, and the system automatically recognizes the strategy (e.g., Vertical, Iron Condor).

Power E*TRADE’s snapshot analysis makes options trading more approachable by visually mapping out key outcomes like max gain, max loss, and breakeven. In this example of purchasing a long call, the platform uses intuitive smiley face icons to highlight these critical points, adding a touch of fun to a typically complex strategy. It’s a great way to help traders quickly grasp potential risk and reward.

Paper trading: For those looking to test strategies without risking capital, E*TRADE offers a fully functional paper trading environment. This mirrors the live Power E*TRADE platform, allowing you to practice with real market data. This is a critical feature for anyone learning to navigate complex option spreads or fast-moving markets.

| Feature |

E*TRADE E*TRADE

|

|---|---|

| Active Trading Platform | Power E*TRADE |

| Desktop Trading Platform | Yes |

| Desktop Platform (Mac) | Yes |

| Web Trading Platform | Yes |

| Paper Trading | Yes |

| Trade Journal | No |

| Watchlists - Total Fields | 43 |

| Charting - Indicators / Studies | 121 |

| Charting - Drawing Tools | 37 |

| Charting - Study Customizations | 8 |

| Charting - Save Profiles | Yes |

| Trade Ideas - Technical Analysis | Yes |

| Streaming Time & Sales | Yes |

| Trade Ideas - Backtesting | No |

Research

E*TRADE has successfully bridged the gap between retail accessibility and institutional power, leveraging its integration with Morgan Stanley to provide a research experience that is both deep and digestible. Whether you are a top-down macro investor or a bottom-up stock picker, the platform offers a cohesive journey from idea generation to validation.

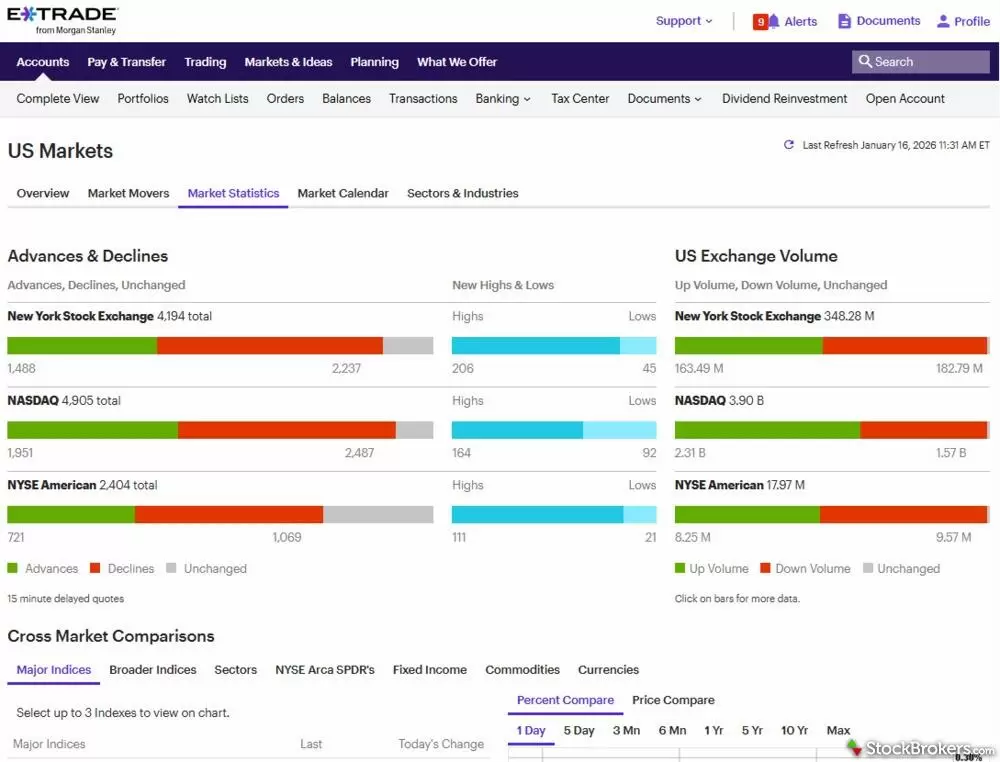

Market analysis: The US Markets page contains much of what you need for full market awareness. Beyond the standard indices, the "Market Statistics" tab provides critical breadth data, such as advances/declines, new highs/lows, and volume flow, that helps confirm the strength of a trend.

E*TRADE’s market breadth tool offers a clear snapshot of advancers and decliners across the Nasdaq and NYSE, helping traders gauge overall market strength. With visual breakdowns of new highs and lows, plus exchange volume metrics, it’s a powerful data visualization tool for understanding market momentum at a glance.

Jessica's take

My favorite tool here is the Sectors & Industries analysis. It allows you to visualize valuations (P/E, Price to Book) and growth metrics across all 11 GICS sectors against the S&P 500. This is an incredibly powerful way to spot sector rotation or undervalued pockets of the market.

Stock research: When researching a specific stock, E*TRADE moves beyond basic quote data. The "Snapshot" view includes a visual breakdown of revenue exposure by Trefis, helping you understand exactly how a company makes money. For active traders, the Earnings Move Analysis is an excellent tool. It displays the implied move derived from options pricing against historical moves, giving you a clear picture of what the market expects from an upcoming earnings release.

Fund research: Mutual fund and ETF investors are treated to a curated experience. The "Morgan Stanley Choice List" and "Income-Producing Funds" provide high-quality starting points backed by analyst expertise. I was particularly impressed by the Tax & Income tab on fund quotes, which projects the tax implications of distributions. It is a critical detail often overlooked by other brokers.

Expert opinion: With access to 8 downloadable report providers, including Argus and TipRanks, the range of opinion is vast. However, the integration of Morgan Stanley research is a true differentiator. Unlike the static PDFs found at many competitors, these reports are interactive and mobile-friendly, allowing you to scan key takeaways, valuation models, and risk factors without pinching and zooming through a dense document.

| Feature |

E*TRADE E*TRADE

|

|---|---|

| Research - Stocks | Yes |

| Stock Research - ESG | No |

| Stock Research - PDF Reports | 8 |

| Screener - Stocks | Yes |

| Research - ETFs | Yes |

| Screener - ETFs | Yes |

| Research - Mutual Funds | Yes |

| Screener - Mutual Funds | Yes |

| Research - Pink Sheets / OTCBB | Yes |

| Research - Fixed Income | Yes |

Education

E*TRADE struggles with a problem common with best-in-class brokers for education: the content is exceptional, but finding it can be an adventure. The "Knowledge" library is vast, featuring polished videos, deep-dive articles, and a busy schedule of live webinars. However, the organization often feels disjointed, requiring you to search around on your own rather than guiding you down a clear learning path.

E*TRADE’s investor education includes practical articles that explain foundational concepts like risk tolerance and asset allocation. This example focuses on an aggressive growth portfolio, showing that true diversification goes beyond just owning stocks. E*TRADE helps investors understand how to balance risk and reward across multiple asset classes.

Content highlights: When you do find a relevant article, E*TRADE truly excels. The Fixed Income education is some of the best I’ve tested. It goes beyond dry definitions to include visual aids, like "see-saw" diagrams illustrating the relationship between bond prices and yields, that make complex concepts click. Similarly, the options education offers a logical progression from "Why trade options?" to advanced Greeks, supported by high-quality videos and webinars.

The Tax Resource Center also deserves special mention, earning a rare perfect score in my testing. It is comprehensive, searchable, and packed with contextual FAQs on everything from wash sales to cost basis adjustments. For self-directed investors navigating tax season, this centralized hub is a lifesaver.

Navigation and gaps: The struggle lies in the user experience. Searching for basic concepts like "What is a stock?" or "Yield Curve" often yielded jargony results or unrelated articles, leaving me feeling overwhelmed rather than informed. The platform lacks a cohesive "start here" journey for absolute beginners, often mixing advanced day trading guides with fundamental concepts in the same feed.

Live learning: For those who prefer interactive learning, E*TRADE offers a strong lineup of Webinars. Live webcasts air every Monday, Tuesday, and Wednesday, covering everything from technical analysis to options strategies. If you can navigate the library to find them, these sessions provide invaluable access to market pros.

| Feature |

E*TRADE E*TRADE

|

|---|---|

| Education (Stocks) | Yes |

| Education (ETFs) | Yes |

| Education (Options) | Yes |

| Education (Mutual Funds) | Yes |

| Education (Fixed Income) | Yes |

| Education (Retirement) | Yes |

| Videos | Yes |

| Webinars | Yes |

| Progress Tracking | No |

| Interactive Learning - Quizzes | No |

Customer service

To score Customer Service, StockBrokers.com partners with customer experience research firm Confero to conduct phone tests from locations throughout the United States. For this year's testing, 132 customer service tests were conducted over six weeks, with wait times logged for each call.

Customer service representatives were asked for assistance or details for prospective customers in several areas of broker services, including account opening, trading tools, apps, crypto offerings, active trading, and more. Here are the results for E*TRADE.

- Average Connection Time: Under a minute

- Average Net Promoter Score: 6.9 / 10

- Average Professionalism Score: 7.6 / 10

- Overall Score: 7.27 / 10

- Ranking: 10th of 11

Banking services

Since joining forces with Morgan Stanley, E*TRADE has evolved from a standalone brokerage into a comprehensive financial hub. The banking suite is powered by Morgan Stanley Private Bank, giving self-directed investors access to institutional-grade cash management and lending products.

Checking & savings: For daily cash management, E*TRADE offers the Max-Rate Checking account, yielding a competitive 2.00% APY with unlimited worldwide ATM fee refunds, which is a significant perk for travelers. Just note the $15 monthly fee, which is waived if you maintain a $5,000 average monthly balance. For uninvested cash, the Premium Savings Account currently offers a competitive interest APY with no minimum deposit requirement, making it an effortless place to park liquidity.

Lending & credit: Sophisticated investors can leverage the Line of Credit (LOLA), a flexible borrowing tool that lets you access liquidity against your eligible securities without triggering a taxable sale. Additionally, E*TRADE clients gain exclusive access to the Morgan Stanley Platinum Card from American Express, a prestige card offering enhanced rewards tailored to high-net-worth lifestyles.

CDs & mortgages: Rounding out the offering, investors can access competitive Bank CDs with rates reaching up to 4.10%, as well as a full suite of mortgage and home lending solutions provided directly through Morgan Stanley Private Bank.

| Feature |

E*TRADE E*TRADE

|

|---|---|

| Bank (Member FDIC) | Yes |

| Checking Accounts | Yes |

| Savings Accounts | Yes |

| Credit Cards | Yes |

| Debit Cards | Yes |

| Mortgage Loans | Yes |

E*TRADE IRA review

For investors focused on the long game, E*TRADE offers a retirement experience that is accessible and remarkably easy to navigate. It is a hub designed to support every stage of your financial journey and not merely a place to park your tax-advantaged cash. The account lineup covers every base: beyond standard Roth and Traditional IRAs, you will find Rollover IRAs, Inherited IRAs, and Custodial IRAs for minors. For the self-employed, the suite expands to SEP IRAs, SIMPLE IRAs, and Individual 401(k) accounts. These are all offered with zero annual fees that would otherwise eat into your returns.

Where E*TRADE truly distinguishes itself is in its planning tools. The Retirement Planning feature is much more than a simple compound interest calculator. It allows you to input specific life expectancies, income needs, and Social Security benefits to generate a personalized "Retirement Score." E*TRADE also helps you navigate complex decisions with specialized resources like the Early Distribution Calculator, which breaks down the potential tax implications of tapping into your retirement early, helping you to avoid costly mistakes.

Retirement planning at E*TRADE

If retirement planning is top of mind for you, zero in on our comprehensive review of E*TRADE's individual retirement accounts and tools: E*TRADE IRA Review.

Final thoughts

E*TRADE has successfully navigated the transition from a dot-com disruptor to a large institutional presence, largely thanks to the muscle provided by its parent company, Morgan Stanley. By maintaining two separate environments, E*TRADE Web or Mobile for wealth management and Power E*TRADE for active trading, the broker prevents feature bloat on a universal app. I also found the integration of Morgan Stanley’s research to be a genuine value-add, transforming the research hub from a simple data repository into a place of actionable institutional insight.

There are tradeoffs for this premium experience. Base margin rates will make active traders wince, and the $6.95 fee for penny stocks can be prohibitive. Additionally, the lack of direct crypto trading means exposure must be found through derivatives or another platform. However, for the serious equity and options trader, or the investor looking to consolidate banking and brokerage under one roof, E*TRADE delivers a professional-grade experience that is hard to outgrow.

E*TRADE Star Ratings

| Feature |

E*TRADE E*TRADE

|

|---|---|

| Overall |

|

| Range of Investments |

|

| Mobile Trading Apps |

|

| Advanced Trading |

|

| Research |

|

| Customer Service |

|

| Education |

|

| Ease of Use |

|

StockBrokers.com Review Methodology

Why you should trust us

Jessica Inskip is Director of Investor Research at StockBrokers.com, bringing 15 years of experience in brokerage and trading strategy. A former FINRA-licensed rep, she held Series 7, 63, 66, and 4 licenses. Jessica focuses on investor education and brokerage industry research, appears regularly on CNBC, Bloomberg, The Schwab Network, Fox Business, and Yahoo! Finance, and hosts the Market MakeHer podcast.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Trading platforms tested in 2026

We tested 14 online trading platforms in 2026:

Read next

- Best Stock Trading Platforms for Beginners of 2026

- Best Brokers for Penny Stock Trading of 2026

- Best Stock Trading Apps for 2026

- Best Stock Brokers for 2026

- Best Day Trading Platforms of 2026 for Beginners and Active Traders

- Best Futures Trading Platforms for 2026

- Best Paper Trading Apps & Platforms for 2026

- Best Options Trading Platforms for 2026

More Guides

Popular Stock Broker Reviews

About E*TRADE

E*TRADE’s roots go back to the 1980s, when founder William Porter had a clever idea of trading stock via one of those newfangled Apple II personal computers. After meeting Porter at a party, Bernie Newcomb turned the idea into computer code. Now, thanks to them, virtually anyone can make or, heavens forbid, lose money investing in stocks via the World Wide Web.

E*TRADE acquired online broker OptionsHouse in September 2016 for $725 million, paving the way for what is now branded as the Power E*TRADE platform. In October 2020, E*TRADE was acquired by Morgan Stanley (NYSE: MS).