Why you can trust us

Why you can trust us

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

Choosing the right stock broker is as important as choosing the right investments. With commission-free trading now the industry standard, competition between brokerage firms is no longer about pricing — it’s about tools and features.

Whether you’re a beginner, an active trader looking for institutional-grade tools, or a long-term investor building a retirement portfolio, a great broker can make all the difference. I spent hundreds of hours testing online trading platforms and mobile apps, placing trades, exploring tools, and gathering thousands of data points; here are my picks for the best stock brokers of 2026.

To choose the best online broker, I went beyond marketing brochures and opened real accounts funded with my own capital. I tested these platforms exactly how you would: executing trades, stress-testing mobile apps during market volatility, and challenging customer service teams with complex questions. My rigorous evaluation process analyzes more than 300 variables across six core categories to separate the marketing hype from the reality of the user experience.

In a crowded field of best stock brokerages, the winners are those that provide a cohesive experience across all devices while maintaining a high standard for security and execution. My criteria for the best stock trading platform combines quantitative verification of features with qualitative hands-on testing of workflow design, proprietary research, and technology stack stability. Whether you are a beginner or a seasoned pro, the following list represents the pinnacle of what the industry has to offer in 2026.

Winners Summary

1. Charles Schwab - Best stock broker

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Charles Schwab Charles Schwab

|

|

$0.00 |

$0.00 |

$0.65 |

Charles Schwab is the best stock broker for 2026 because it successfully bridges the gap between a user-friendly beginner app and a professional-grade trading platform. Following the final integration of TD Ameritrade, Schwab now offers a dual-platform approach that satisfies every type of investor: the flagship web/mobile experience for wealth management and the legendary thinkorswim (TOS) for active trading.

Charles Schwab stands out in the following areas:

Education and research: For most investors, the strength lies in Schwab’s "contextual education." Instead of burying tutorials in a separate library, Schwab integrates definitions and strategy guides directly into the trade tickets and research pages. The research offering is equally impressive. The "widgetized" layout allows you to compare stock valuations against peer groups and indices instantly. I particularly valued the "Schwab Market Update," a daily podcast that condenses macro headlines into actionable insights, making market analysis accessible during a morning commute.

Advanced trading platform: For active traders, thinkorswim remains the industry benchmark. Whether on desktop or mobile, the ability to overlay economic data, like Federal Reserve interest rate probabilities, directly onto price charts is a fantastic feature. While the primary Schwab app is excellent for managing a long-term portfolio, TOS handles complex multi-leg options and futures with precision. With 24/5 trading on hundreds of securities and a massive selection of no-transaction-fee funds, Schwab delivers the most complete brokerage experience on the market.

This screenshot showcases a desktop chart of U.S. unemployment rates alongside a live news feed and streaming headlines, enabling traders to track macroeconomic trends in real time. Access to this level of economic insight helps investors connect data with market movement.

Jessica's take

"My favorite feature within TOS charting, and probably the whole platform, is the integration of economic data. You can pull data on interest rates, employment costs, population, labor markets, international data, business surveys, and so much more! "

Jessica Inskip

2. Fidelity - Best for everyday investors

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Fidelity Fidelity

|

|

$0.00 |

$0.00 |

$0.65 |

Fidelity is the ultimate "do-it-all" platform, securing its spot as the second best online brokerages for 2026. While it narrowly misses the top spot due to Schwab's superior active trading technology, Fidelity arguably offers a better daily driver experience for the everyday investor. It excels at being a holistic financial hub, seamlessly blending sophisticated market analysis with the ease of use typically found in modern fintech banks.

Fidelity stands out in the following areas:

Education and research: The unique feature for stock pickers is the proprietary "Equity Summary Score." Instead of forcing you to sift through dozens of conflicting analyst reports from third-party firms, Fidelity consolidates them into a single, color-coded sentiment score. This simplifies the research process significantly. I also found their economic calendar to be the best in the industry. Rather than simply listing data releases, it provides context on "why investors care," helping you understand how specific metrics like CPI or unemployment claims impact your holdings.

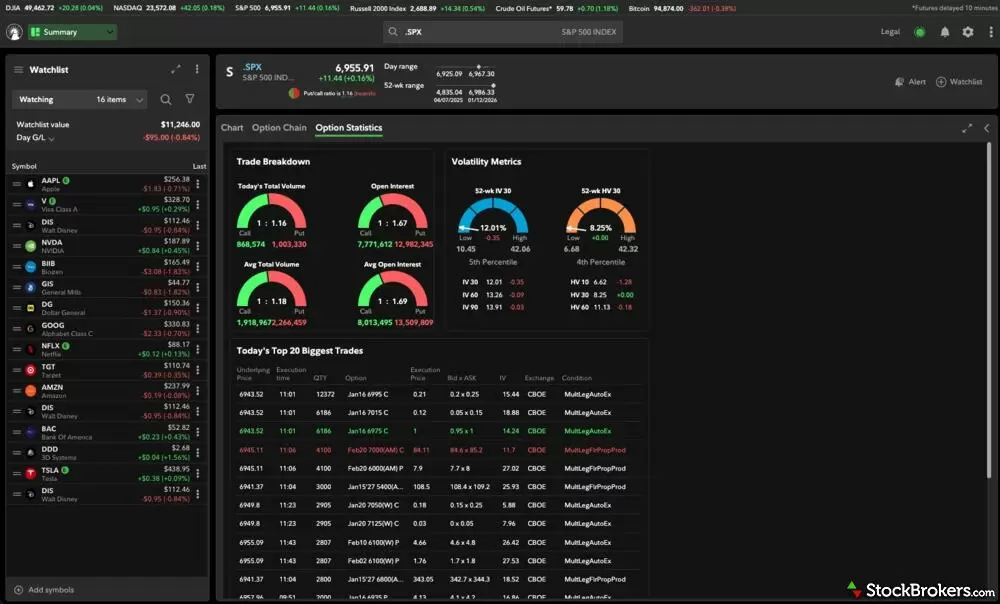

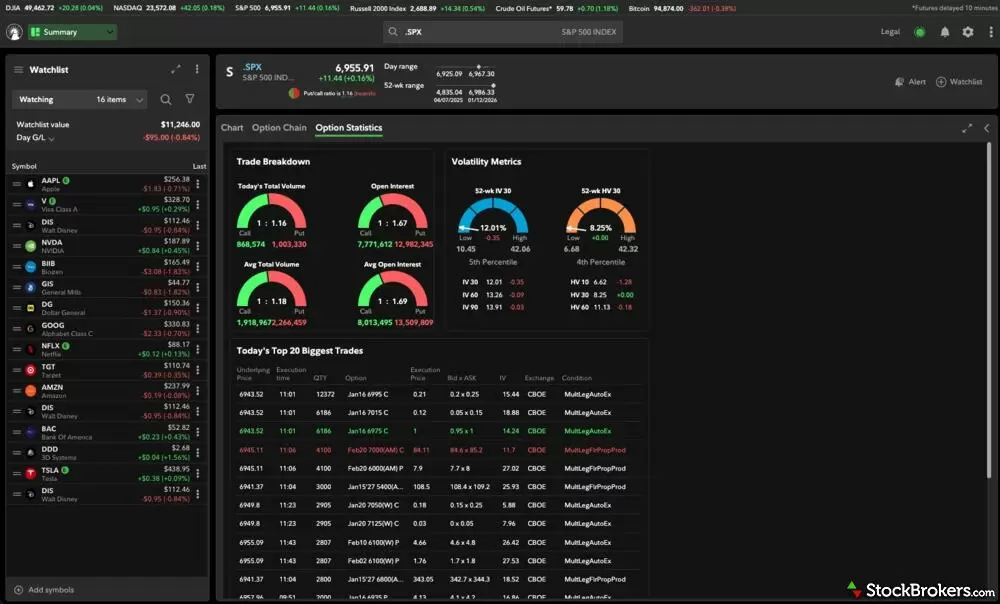

Fidelity’s trading dashboard brings everything together in one place. Here, I’ve linked SPY across all widgets for a seamless view. You can dive into options statistics, volatility indices, and my personal favorite: the trade breakdown activity, which gives great insight into how traders are positioning.

Fixed-income: For income-focused investors trading bonds, Fidelity is unrivaled. It provides access to primary bond auctions, a rarity among retail brokers, and features an intuitive CD ladder tool that simplifies generating yield in a complex rate environment.

Mobile app: On the mobile front, Fidelity has aggressively modernized its interface. The new "Discover" tab delivers bite-sized, short-form market updates that allow you to learn without endlessly scrolling. While the desktop Active Trader Pro platform remains a reliable workhorse for complex charting, the mobile experience is the real star here. Combined with the ability to set automated, recurring dollar-based investments into individual stocks and ETFs, Fidelity effectively allows you to put your portfolio on autopilot.

3. Interactive Brokers - Best for professionals

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Interactive Brokers Interactive Brokers

|

|

$0.00 |

$0.00 |

$0.65 info |

Interactive Brokers (IBKR) has long been the choice for Wall Street veterans, but recent updates have made it one of the best brokerage platforms for any serious investor looking to graduate from a basic app. If your strategy involves global markets, currency trading, or complex derivatives, IBKR provides a depth of access that domestic-focused brokers simply cannot match.

Interactive Brokers stands out in the following areas:

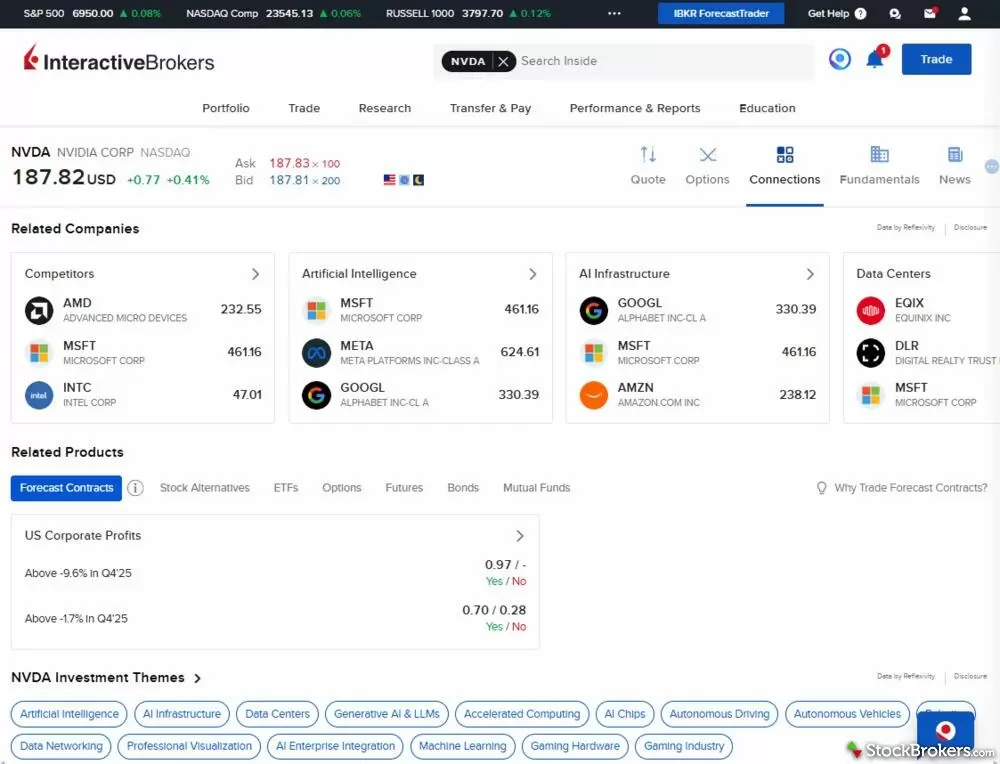

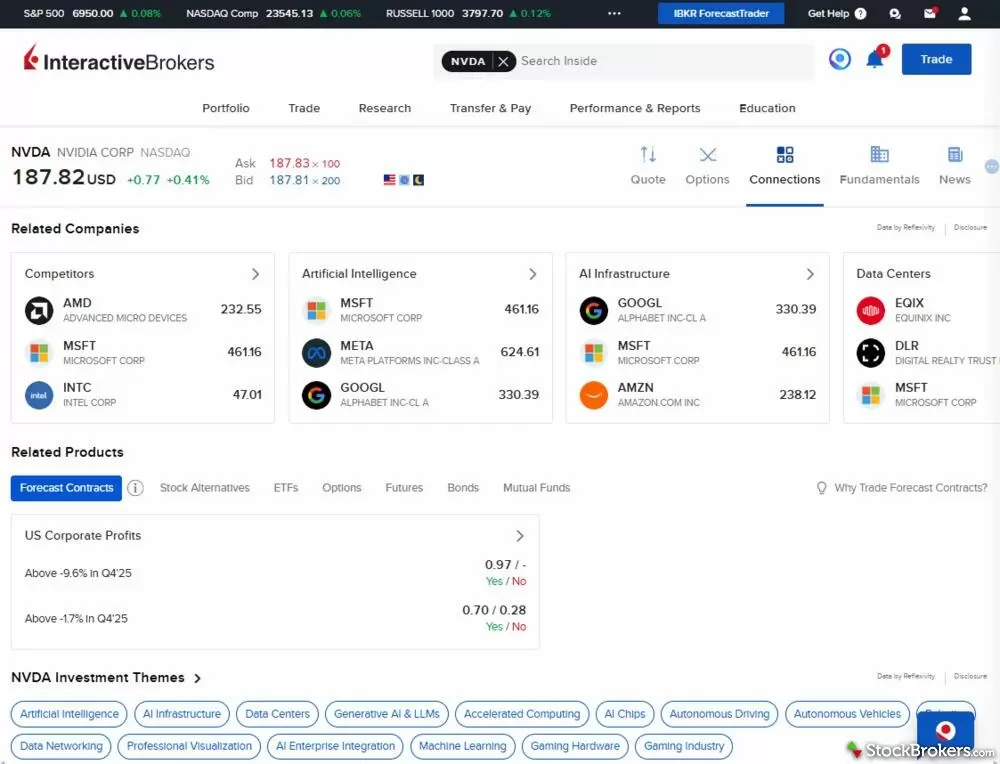

Advanced trading: The Trader Workstation (TWS) operates as the flagship component of the offering, anchored by the 'Daily Lineup' feature. In my testing, this was the most efficient way to start a trading day. It aggregates a snapshot of world markets, analyst upgrades, and an AI-driven summary of top news into a single, scannable window. I also found the new "Connections" tool to be a game-changer for idea generation. It instantly links a stock to its competitors, suppliers, and ETF exposure, allowing you to visualize the entire market around a specific trade rather than viewing it in isolation.

Interactive Brokers’ Connections tab, shown here for NVIDIA (NVDA), gives investors a 360° contextual research view by linking the selected stock to related competitors, thematic sectors like AI infrastructure and data centers, and tradable products such as Forecast Contracts and ETFs. Connections helps traders uncover peers, trends, and broader market relationships beyond just the price quote.

Portfolio management: For portfolio management, IBKR offers the "PortfolioAnalyst" tool, which is essentially an institutional-grade risk engine available to retail clients. It allows you to run "what-if" scenarios, beta-weight your portfolio against specific indices, and even consolidate external accounts to analyze your true net worth. While the learning curve is steeper than its peers, the payoff is unparalleled control over order execution and risk management.

4. E*TRADE from Morgan Stanley - Best web-based platform

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

E*TRADE E*TRADE

|

|

$0.00 |

$0.00 |

$0.65 |

E*TRADE remains one of the best choices for traders who want professional-grade tools without downloading clunky desktop software. It essentially offers the best trading account for versatility. Passive investors get a clean, modern dashboard for managing IRAs, while active traders get access to Power E*TRADE, a robust web-based platform that rivals downloadable software.

The standout feature is the Power E*TRADE web interface. It simplifies complex options strategies into intuitive "risk slides," allowing you to visually see how a trade will perform if the market moves against you. I also found the mobile app to be exceptionally easy to use for quick check-ins, although serious analysis is better done on the web. E*TRADE is particularly strong for investors who want to automate their portfolio. The automatic investing options for ETFs are seamless, making it easy to set up recurring weekly deposits into low-cost funds.

5. Merrill Edge Self-Directed – Best for banking integration

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Merrill Edge Merrill Edge

|

|

$0.00 |

$0.00 |

$0.65 |

For existing or prospective Bank of America clients, Merrill Edge is arguably the best trading account to maximize the value of your entire financial life. The platform's "Preferred Rewards" program is the value proposition: by linking your Merrill investment portfolio with your BofA checking account, you can unlock tier-based boosters on credit card rewards, savings interest rates, and mortgage discounts.

Beyond the banking perks, Merrill’s research tools are surprisingly comprehensive for a bank-affiliated broker. The "Stock Story" feature is worth a mention, transforming dense financial data into an interactive, question-and-answer format that makes researching companies approachable for beginners. While the active trading platform, MarketPro, feels a bit dated compared to Schwab's thinkorswim or Power E*TRADE, the seamless integration of banking and investing makes Merrill the clear winner for anyone looking to consolidate their finances under one roof.

Other stock brokers I tested

6. Webull - Best community experience

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Webull Webull

|

|

$0.00 |

$0.00 |

$0.00 |

Webull continues to gain ground among the top online brokerages by catering to the modern, mobile-first trader who values community and technicals over traditional research reports. It distinguishes itself with a social feed integrated directly into the stock quote pages. The "Comments" tab allows you to discuss trade ideas and sentiment with fellow investors in real-time, effectively creating a social network within your brokerage app.

For chartists, the mobile experience is surprisingly powerful. The new "Replay Mode" allows you to replay historical price action bar-by-bar, a fantastic tool for backtesting strategies visually on a small screen. Additionally, the "Sage Tracker" offers a glimpse into institutional order flow, helping retail traders spot where the "smart money" might be positioning. While it lacks the deep fundamental research and account types (like custodial IRAs) found at legacy firms, Webull is the premier choice for traders who want a collaborative, data-rich mobile trading platform.

7. Robinhood - Easy to use and sleek

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Robinhood Robinhood

|

|

$0.00 |

$0.00 |

$0.00 info |

Rounding out our list of the top online brokerages is Robinhood, which has matured significantly beyond its mobile-only roots. The introduction of "Robinhood Legend," a sleek, widget-based desktop platform, demonstrates a serious commitment to active traders. It offers the most user-friendly charting experience I’ve tested, allowing you to drag, drop, and customize technical indicators with zero friction.

The mobile app remains the gold standard for simplicity. The "Digests" feature, powered by AI, provides concise explanations for why a stock is moving, stripping away the noise of traditional financial news feeds. While it lacks some fundamental data (like free cash flow or payout ratios) found at legacy brokers, Robinhood’s intuitive design and high-quality educational content make it the perfect entry point for new investors or those who prefer a minimalist trading environment.

8. TradeStation - Best-in-class for active traders

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

TradeStation TradeStation

|

|

$0.00 |

$0.00 |

$0.60 |

For serious technical traders, TradeStation remains a top contender among the best trading accounts for pure execution and charting power. The launch of its new Titan X platform has modernized the experience significantly, offering a drag-and-drop interface that rivals the ease of TradingView while retaining the institutional-grade muscle TradeStation is famous for.

The standout feature here is the "Portfolio Maestro," a tool that allows you to run Monte Carlo simulations and correlation analyses on your entire portfolio. This is critical for hedging risk in volatile markets. While it lacks the fundamental research depth of a Fidelity or Merrill, its "Hot Lists" scanner is exceptional for finding pre-market movers based on volume and volatility. If your strategy relies on technical analysis and automated trading scripts, TradeStation provides the most robust sandbox to build and test your edge.

9. Firstrade - A great deep discount offering

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Firstrade Firstrade

|

|

$0.00 |

$0.00 |

$0.00 |

Firstrade secures its place as a top online brokerage by offering a rare combination: a true discount cost structure with a full-service investment menu. While many low-cost apps restrict you to just stocks and ETFs, Firstrade provides fee-free access to mutual funds, fixed income, and even options strategies without per-contract fees. It is the ideal destination for the cost-conscious investor who refuses to compromise on asset class variety.

The platform also shines in research depth. The data provided on fund composition is exceptionally deep. You can analyze fixed income exposure within a balanced fund down to the effective duration and credit quality, a level of detail usually reserved for institutional terminals. Additionally, it remains a top choice for international investors, accepting accounts from over 60 countries with a fully translated Mandarin interface.

10. J.P. Morgan Self-Directed Investing - Best for all-in-one financial management

If you already bank with Chase, J.P. Morgan Self-Directed Investing is one of the best brokerage platforms to consolidate your finances. The seamless integration means you can view your checking, savings, and investment accounts in a single app, with instant transfers between them.

While it lacks the advanced trading tools of a Schwab or IBKR, it compensates with exceptional proprietary research. The Markets page offers a clean, widget-based view of what’s moving the indices, and the fixed income section is surprisingly comprehensive, offering clear visualizations of yield curves that many competitors lack. For the "set it and forget it" investor who values simplicity and institutional-grade insights over complex charting, J.P. Morgan is a solid, reliable choice.

How to get started in stock trading

Understand how stocks and orders work

Buying a stock means owning a slice of a company. ETFs bundle many stocks into one trade, which can reduce the risk of simply choosing the wrong single company in an otherwise successful industry, theme, or strategy. Before placing your first order, it’s important to understand price discovery, market hours, and how settlement works.

U.S. stock trades settle on T+1 (the day after the trade date), which determines how quickly proceeds and buying power update. Knowing how orders work is just as important. Market orders prioritize speed, while limit orders focus on price. Stop orders can help define exits, and time-in-force instructions control how long an order remains active. Treat these tools as essentials since using them properly helps avoid common mistakes like chasing price or overtrading illiquid stocks.

Open the right brokerage account

Start with a standard taxable brokerage if your goal is flexibility. If you are saving for retirement, consider an IRA or Roth IRA to benefit from tax advantages. With most standard brokerage accounts, you can choose to trade in a cash account or apply for margin.

Cash accounts keep things straightforward and avoid interest costs, but you need to be mindful of good faith and free-riding violations tied to unsettled funds. Margin accounts increase buying power but bring added risks, interest charges, and the possibility of a margin call. Active traders with less than $25,000 must also consider the pattern day trader rule, which can limit trading activity. I only enable margin if there is a clear need and a written plan for risk. Confirm SIPC coverage and review the broker’s fee schedule, platform access, and research. Your account type and broker choice should align with your strategy and time horizon.

Fund your account and start small

Transfer only what fits your plan and emergency fund. Fractional shares make it possible to buy blue chips and ETFs without spending hundreds of dollars for a single share, which is a great way to build consistency. I like starting with a broad market ETF to anchor a portfolio, then adding single stocks slowly. Dollar-cost averaging helps tame volatility and reduces the pressure to time entries. Reinvest dividends if your goal is growth, and keep position sizes small at first. The goal is to learn execution and routine while keeping risk contained.

Use the trading platform

Set up watchlists organized by theme or strategy and take time to learn the order ticket, including advanced fields like bracket orders if your broker offers them. Use screeners to filter by fundamentals or technicals, and keep charts clean and consistent. A few indicators are often enough if you understand what they measure. News feeds and earnings calendars provide context before you trade, not after. If your broker offers paper trading, practice entries and exits there first. I always validate a new process in simulation before committing real capital.

Build a routine and a strategy

Building a routine and refining your strategy are just as important as placing the trade itself. Read platform tutorials and stock trading books, attend webinars, and study real examples. Define your risk per trade and total portfolio risk, and write down your reasons to buy and what would make you sell. A trading journal helps enforce this discipline. Review results weekly and track mistakes, not just wins. Taxes matter too - holding for more than a year can qualify gains for long-term rates in a taxable account. Stay disciplined around catalysts like earnings, and avoid trading out of boredom. A simple plan you can follow is always better than a complex plan you can’t.

FAQs

What is a stock broker?

A brokerage account is an account provided by a brokerage firm that allows you to buy and sell stocks, bonds, ETFs, and mutual funds using an online trading platform. Think of it as your direct link to the markets, giving you access to a variety of investment products and the tools you need to build and manage your portfolio. Depending on what the stock broker offers, you might also be able to explore more advanced trading options, including complex derivatives such as options and futures, or use helpful features like in-depth research and portfolio analysis to guide your decisions.

There are different flavors of brokerage accounts tailored to your investing style. With a cash account, you pay for each investment in full at the time of purchase, keeping things simple and limiting your risk, but it’s important to be mindful of settlement dates to avoid any penalties for premature trading. On the other hand, a margin account lets you borrow funds to potentially boost your buying power, which can amplify gains but also comes with its own drawbacks. You’ll need to pay interest on the borrowed amount, and if your investments decline in value, you could face a margin call requiring you to deposit more funds or liquidate positions, increasing the risk and complexity of your investment strategy.

How much money do I need to trade stocks?

The amount of money needed to open a brokerage account and trade stocks varies by firm. While some stock brokers require a minimum deposit, others have no minimum at all, which is increasingly becoming more common. However, even with no set minimum, you'll need enough funds to purchase at least a fractional share of the investment you're interested in, ensuring you can start building your portfolio right away.

Even as little as $5 is enough to start investing with at a broker like Charles Schwab, which offers Stock Slices — fractional shares of S&P 500 companies. For other ideas on where to invest your initial capital, read more about how to invest $100, $1,000, $10,000 or more.

Can I use multiple stock brokers?

Yes, you can have multiple brokerage accounts. Many investors choose to open accounts with different brokers to access unique tools, optimize fees, or separate investment strategies. This approach can offer enhanced portfolio management and diversification while also allowing you to take advantage of each broker's specific strengths and features.

What are some tips for choosing a stock broker?

When choosing a stock broker, it's important to consider your unique trading style and long-term investment goals. Here are some key factors to help you narrow down your options:

- Great for Mobile Trading: If you prefer trading on the go, look for brokers with top-rated mobile apps. Check out our mobile trading guide.

- Best for IRAs: For retirement planning, choose brokers offering robust IRA options and expert retirement planning tools. See our IRA guide.

- Options Trading: If options are your focus, look for brokers offering advanced options trading tools, risk management features, and clear pricing structures. Head on over to our guide to the best options trading platforms.

- Futures Trading: For those interested in futures, select a broker with specialized platforms and competitive margins that cater to fast-paced markets. Visit our guide to the best brokers for futures trading.

- Low Fees & Minimum Deposits: Compare commission structures and account minimums to ensure you're getting a cost-effective solution that fits your budget. Check out our guide to the best free stock trading accounts.

- Powerful Research & Tools: Opt for brokers that provide comprehensive market research, analysis tools, and educational resources to support your trading decisions. Visit our guide to the best brokers for research or our guide to the best brokers for education.

- User-Friendly Platform & Support: A well-designed, intuitive trading platform paired with reliable customer support can make all the difference in your investing experience. To that end, head on over to our guide to the best brokers for user experience.

What stock broker offers the best trading platform?

Charles Schwab offers the best online trading platform for most people due to its strong overall rankings across key categories, particularly in its ease of use and mobile trading apps. That said, there will often be specific concerns for you as a trader or investor that'll make a different broker an even better fit. The brokerage account testing team at StockBrokers.com maintained live accounts at 14 brokers in 2026 and used them to evaluate each broker’s tools, ease of use, data, design, and content. Here are the five top-scoring brokerage firms and the accolades won in the StockBrokers.com Annual Awards for 2026:

- Charles Schwab —

: Our pick for #1 Overall Broker, including Best for Advanced Trading, Mobile Trading Apps, and Ease of Use. We also found it to be Best for High Net Worth Investors, and Customer Service. Schwab also won industry awards for #1 Active Trading Desktop Platform and #1 Stock Research.

: Our pick for #1 Overall Broker, including Best for Advanced Trading, Mobile Trading Apps, and Ease of Use. We also found it to be Best for High Net Worth Investors, and Customer Service. Schwab also won industry awards for #1 Active Trading Desktop Platform and #1 Stock Research.

- Fidelity —

: Best for Research, Education, Beginners, and Retirement Accounts. Fidelity also won industry awards for #1 Investor App, #1 Stock Trading Platform, #1 Bond Investing, #1 Youth Investors, and #1 Small Business Owners.

: Best for Research, Education, Beginners, and Retirement Accounts. Fidelity also won industry awards for #1 Investor App, #1 Stock Trading Platform, #1 Bond Investing, #1 Youth Investors, and #1 Small Business Owners.

- Interactive Brokers —

: Best Range of Investments, Best for Active Traders, and Best for Futures Trading. It also won industry awards for #1 International Trading, #1 Thematic Investing, #1 Professional Trading, #1 Trader App, #1 Client Dashboard, #1 New Tool, and #1 24-Hour Trading.

: Best Range of Investments, Best for Active Traders, and Best for Futures Trading. It also won industry awards for #1 International Trading, #1 Thematic Investing, #1 Professional Trading, #1 Trader App, #1 Client Dashboard, #1 New Tool, and #1 24-Hour Trading.

- E*TRADE from Morgan Stanley —

: Industry awards for #1 Active Trading Web Platform and #1 Passive Investors.

: Industry awards for #1 Active Trading Web Platform and #1 Passive Investors.

- Merrill Edge —

: Best Bank Brokerage.

: Best Bank Brokerage.

Our testing

Why you should trust us

Jessica Inskip is Director of Investor Research at StockBrokers.com, bringing 15 years of experience in brokerage and trading strategy. A former FINRA-licensed rep, she held Series 7, 63, 66, and 4 licenses. Jessica focuses on investor education and brokerage industry research, appears regularly on CNBC, Bloomberg, The Schwab Network, Fox Business, and Yahoo! Finance, and hosts the Market MakeHer podcast.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Trading platforms tested

We tested 14 online trading platforms for this guide:

Webull

Webull

Robinhood

Robinhood

TradeStation

TradeStation

Firstrade

Firstrade

J.P. Morgan Self-Directed Investing

J.P. Morgan Self-Directed Investing

Charles Schwab

Charles Schwab

Fidelity

Fidelity

Interactive Brokers

Interactive Brokers

E*TRADE

E*TRADE

Merrill Edge

Merrill Edge