Winners Summary

Best broker for international trading - Interactive Brokers

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Interactive Brokers Interactive Brokers

|

|

$0.00 |

$0.00 |

$0.65 info |

Interactive Brokers reliably comes up as Best in Class in many of our StockBrokers.com scoring categories. But, when I key in on international stock trading, Interactive Brokers is simply in a class of its own. Clients can trade stocks in over 90 market centers and have access to a smorgasbord of analytical tools, including GlobalAnalyst, which screens stocks across the globe and allows comparisons in one currency. Nice. I also found getting my account approved for international trading painless.

Commissions vary by the country traded, but my test trade of buying one share of Air Canada in Canadian dollars cost a minimum ticket size of $1 and a foreign exchange spread of 20 basis points (one-fifth of a percent). That’s dirt cheap.

Though many of IBKR’s services and tools are designed to appeal to institutional investors, the broker’s Global Trader mobile app is a game-changer for beginning global investors. I found it easy to buy Canadian stock and see our Canadian dollar-denominated holdings right alongside our U.S. dollar holdings. It was seamless. I like Global Trader for beginning U.S.-focused investors, too.

If you are a U.S. citizen interested in opening an account outside the United States, you can apply for an account with your legal domicile and see if it is accepted. There isn’t a minimum deposit or monthly charge (other than the data feeds you select), so there’s no risk to trying.

Read our full Interactive Brokers review for a deeper dive into its entire offering.

Best for long-term investing - Charles Schwab

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Charles Schwab Charles Schwab

|

|

$0.00 |

$0.00 |

$0.65 |

Charles Schwab is my pick for the best broker for long-term investors looking to trade foreign stocks, combining competitive fees with wide support for international markets. Schwab charges lower trade commissions than Fidelity, which adds up significantly for long-term portfolios. It also applies the same 1% currency spread as Fidelity, making it cost-effective for converting currencies during international trades. While opening a Schwab Global Account requires a paper application — a slight inconvenience — the process ensures compliance with international regulations.

Schwab’s global reach is another key advantage for long-term investors. With access to 12 international markets, including popular exchanges in Europe and Asia, Schwab enables investors to diversify their portfolios globally with ease. I’ve found the platform to offer seamless tools for monitoring and managing international holdings, making it easy to track performance and make informed decisions. For long-term investors focused on stable returns, this level of diversification can be essential, reducing risk while exposing portfolios to growth in foreign markets.

Here’s a helpful tip: if you have any questions about using Schwab for international trading or opening an account from a foreign country, skip calling the U.S. helpline. When I called Schwab’s general support line, the reps weren’t trained to answer questions about international trading. Use their specialized call line (800-992-4685) to reach their international account specialists. They were better equipped to answer the questions I had. For long-term investors navigating the complexities of international markets, Schwab’s combination of competitive fees, broad market access, and specialized customer support makes it the top choice among U.S. brokers.

Check out our complete Charles Schwab review to learn more about trading at Schwab and discover why it's our 2025 pick for #1 Overall Broker.

currency_exchangeForex trading at Schwab

Learn all about Schwab's forex offering by reading the Schwab review on ForexBrokers.com. Home of the most comprehensive forex review in the industry, you can check out forex reviews of 60+ brokers.

Well-rounded broker - Fidelity

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Fidelity Fidelity

|

|

$0.00 |

$0.00 |

$0.65 |

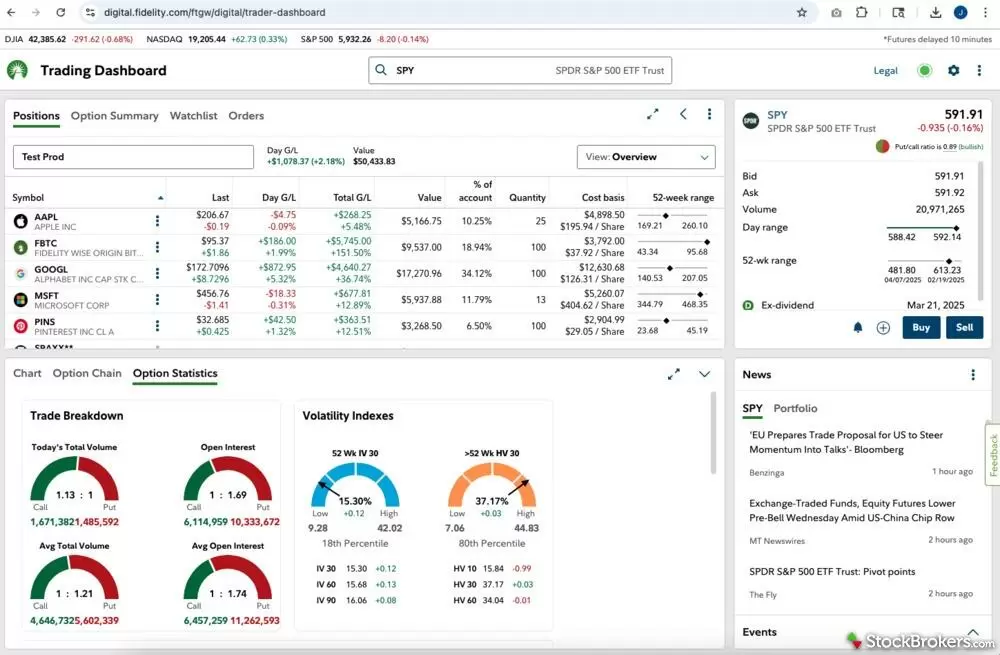

Fidelity is an excellent choice for U.S. investors who want the ability to trade foreign stocks while maintaining access to a wide range of domestic investment options. Fidelity offers a platform that combines ease of use, comprehensive research tools, and excellent customer service. While its international trading features may not rival niche brokers like Interactive Brokers, Fidelity provides enough global reach for most investors. Its ability to trade in 25 countries and 16 currencies is an impressive offering for a full-service U.S. brokerage, and it integrates seamlessly with its broader range of investment and retirement tools. This makes Fidelity an ideal choice for investors looking to diversify globally without compromising access to U.S. markets.

The commission charged by Fidelity varies by country, and currency conversion incurs a 1 percent spread for each side of the trade, which can get pricey. I entered a test trade of a share of Air Canada stock, and the charge was $19 CAD plus a currency conversion spread of 1 percent each way. That’s multiples of what IBKR charges.

For expats or clients who move abroad, Fidelity provides options for maintaining their accounts and accessing U.S. and international markets. Existing clients living outside the U.S. can contact Fidelity to discuss tailored account solutions, ensuring continuity in their investment strategy. This flexibility makes Fidelity a solid all-around broker for U.S. citizens who need a mix of domestic and international trading capabilities, even if global investing isn’t their top priority.

Click on over to my entire Fidelity review to read more about what has earned the broker so many awards.

FAQs

How do I invest in foreign stocks?

There are five choices available to U.S. investors who want to increase their international stock exposure.

U.S. multinational stocks

Many blue-chip domestic companies get most of their revenue outside the U.S. It’s usually easy to find that info in a company’s financial reports. Two advantages to choosing U.S. multinationals are, first, you don’t have to exchange dollars for foreign currency, and, second, U.S. markets are tightly regulated, meaning there’s less opportunity for fraud.

American Depository Receipts

If you want to invest in a foreign company, look to see if there’s an American Depository Receipt (ADR) available for that company. ADRs are receipts for foreign shares that can be traded in the United States. They’re also dollar denominated like U.S. stocks. Some examples of ADRs are AstraZeneca (AZN), Nokia (NOK), and Toyota (TM).

Buy cross-listed shares of a foreign company

Cross-listed stocks are simply shares of the same company listed on multiple exchanges, often in different countries. Companies cross-list to increase demand for their stocks. Cross-listed stocks include Carnival Cruise Lines (United Kingdom) and Barrick Gold (Canada).

Buy an international or global fund

If you don’t want to pick stocks yourself, you can buy an international or global stock fund. “Global” funds usually include U.S. stocks along with international stocks. “International” funds usually exclude or minimize investing in U.S. stocks. There are international index funds and ETFs that can be less expensive than actively managed international funds.

Buy international stock on a foreign exchange

Investing directly in foreign stock is a bit more complicated than buying a fund and letting a portfolio manager do all the work, but you’ll also have many more choices. Keep in mind that your total return will also depend on how the foreign currency trades against the U.S. dollar. If the foreign currency falls compared to the U.S. dollar, you could have a loss even if the stock went up in its own currency.

euro Forex trading

Are you interested in trading foreign exchange instead of stock? Doing so could also be a useful hedge if you do purchase foreign stocks in the local currency. Check out our sister site, ForexBrokers.com.

What is an international broker?

Any brokerage firm that accepts clients from more than one country and offers trading access to global stock exchanges is considered an international broker.

How do you open an international trading account?

To open an international trading account, you need to find a broker that:

- Will accept clients from your country.

- Can trade in the countries you want to trade in.

- Is able to execute orders in the instruments you prefer to trade in.

- Has the features you want.

Then, follow the steps specified by the broker to open the account.

How do I buy stocks internationally?

To buy foreign stocks, you must first open a brokerage account with a broker that can trade in the country where you want to invest. Then, after funding your account, you may need to request access (including price data) for the exchange you want to trade.

Alternatively, simply search for the specific symbol to see if it is available to trade from within your account. A symbol that works for one broker may not work for another.

Example: A trader who wants to buy British Petroleum PLC (LSE: BP) would enter the symbol BP on the trading platform. If you enter this on the Interactive Brokers platform, BP will yield a few results, but the correct one if you want to buy it on the London Stock Exchange (LSE) is “BP PLC – LSE.”

Companies can have multiple results because one company may have several securities and/or symbols. A foreign stock may be dually listed or trade as an American Deposit Receipt (ADR). There may also be derivatives such as contracts for difference (CFD) or options. Bottom line: you should know the exchange and symbol to buy an international stock.

Can a citizen of another country open an account with a U.S. broker?

If you reside outside of the United States and are not a U.S. citizen, you may still be able to open a U.S. brokerage account. As long as the online broker accepts applications from your country of residence, you may proceed.

Can a non-citizen resident open a U.S. broker account?

In many cases, if you are a legal resident in the U.S. but not a U.S. citizen, then proper identification may be enough to open a U.S. brokerage account. Expect the broker to ask for a Social Security number. When in doubt, call the broker.

Can a non-U.S. resident invest in U.S. stocks?

Yes, you can, and you may not need to open an account with a U.S. broker if you are living in a foreign country. Brokers in many countries are able to trade U.S. stocks. For example, while testing brokers in Canada, Australia and in the U.K., we found U.S. markets to be easily accessible.

Which broker is best for international trading?

Interactive Brokers is the best U.S.-based international stockbroker because it provides you access to the most exchanges and supports clients from the widest variety of countries. Its Global Trader mobile app makes international investing easy for beginners, but its Trader Workstation is sophisticated enough to be an international trading platform for institutional investors.

StockBrokers.com Review Methodology

Why you should trust us

Sam Levine, CFA, CMT, formerly a lead writer for StockBrokers.com, has over 30 years of investing experience and actively trades stocks, ETFs, options, futures, and options on futures. He's held roles as a portfolio manager, financial consultant, investment strategist and journalist. He holds the Chartered Financial Analyst (CFA) and the Chartered Market Technician (CMT) designations and served on the board of directors of the CMT Association.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points for each broker.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.