Best MetaTrader broker for trading stocks - Admirals

| Company |

Overall |

MetaTrader 4 (MT4) |

MetaTrader 5 (MT5) |

Minimum Deposit |

Admirals Admirals

|

|

Yes |

Yes |

$100 |

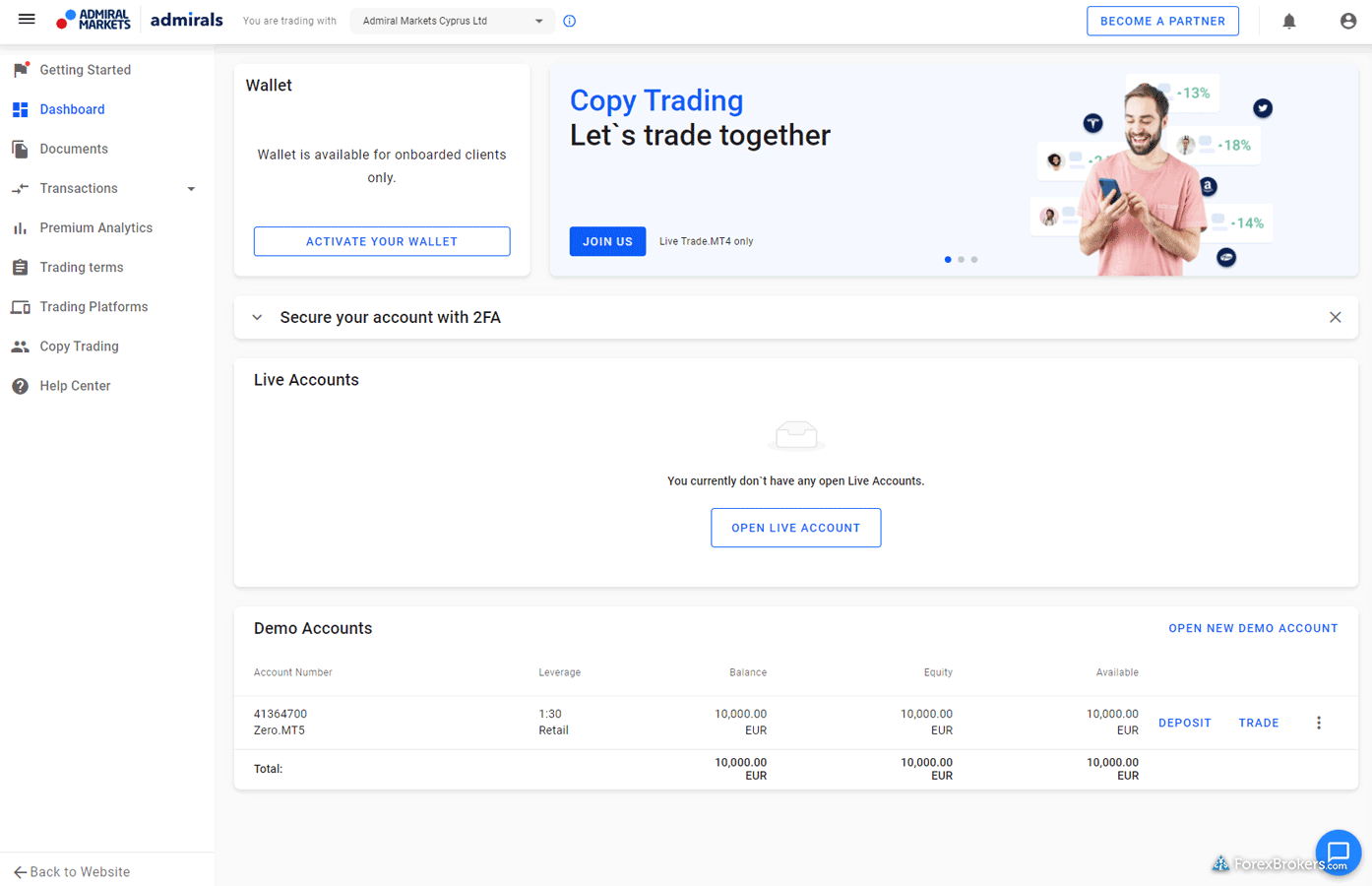

Admirals (previously known as Admiral Markets) offers the full MetaTrader platform suite, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), alongside nearly 5,000 stocks. Admirals’ stock offering consists of cash equities (non-CFD) including fractional shares and fractional ETFs, with low account minimums.

Admirals supports stock trading on its MT5 platform, which also comes with free platform add-ons such as StereoTrader, Supreme Edition, and more. For CFDs (not available to U.S. investors) Admirals offers over 200 stocks on MT4, and well over 3,000 on MT5. Simply put, Admirals is my top choice if you want to trade both stocks and forex from within the MetaTrader platform. To learn more about Admirals, check out my Admirals review on ForexBrokers.com.

Best broker for MetaTrader across all assets (shares available via FinClear) - IC Markets

| Company |

Overall |

MetaTrader 4 (MT4) |

MetaTrader 5 (MT5) |

Minimum Deposit |

IC Markets IC Markets

|

|

Yes |

Yes |

$200 |

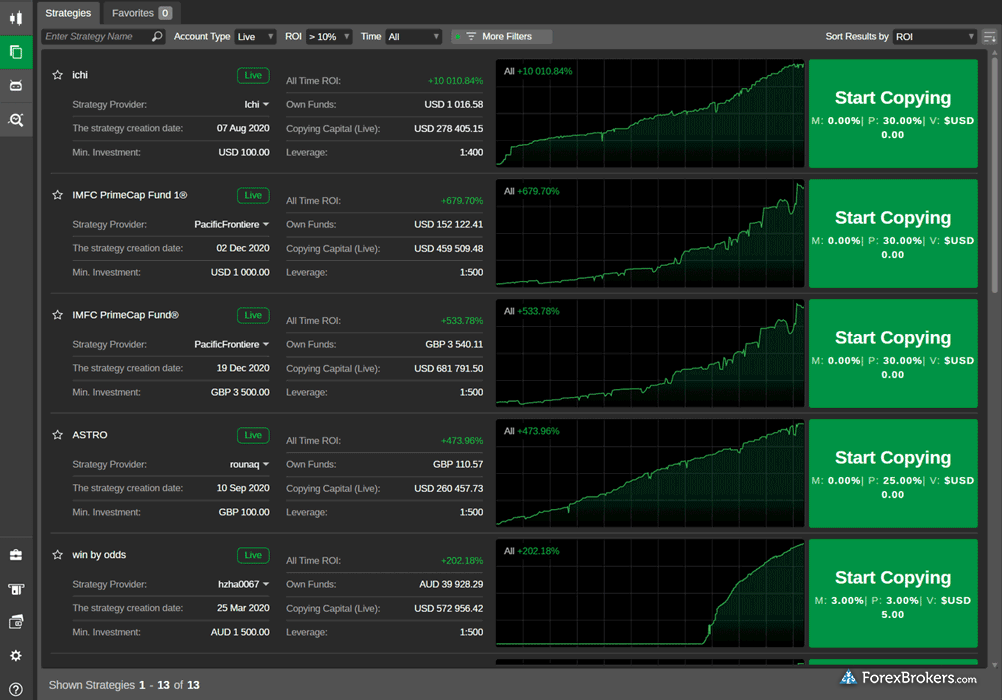

IC Markets would have taken first place were it not for the fact that its stock offering is segmented away on a different platform – FinClear (available via the broker’s IC Shares product). That said, IC Markets’ MetaTrader 4 and MetaTrader 5 are still formidable opions for manual and algorithmic trading, including for scalping, and come packed with add-ons and plugins to enhance the default MetaTrader setup.

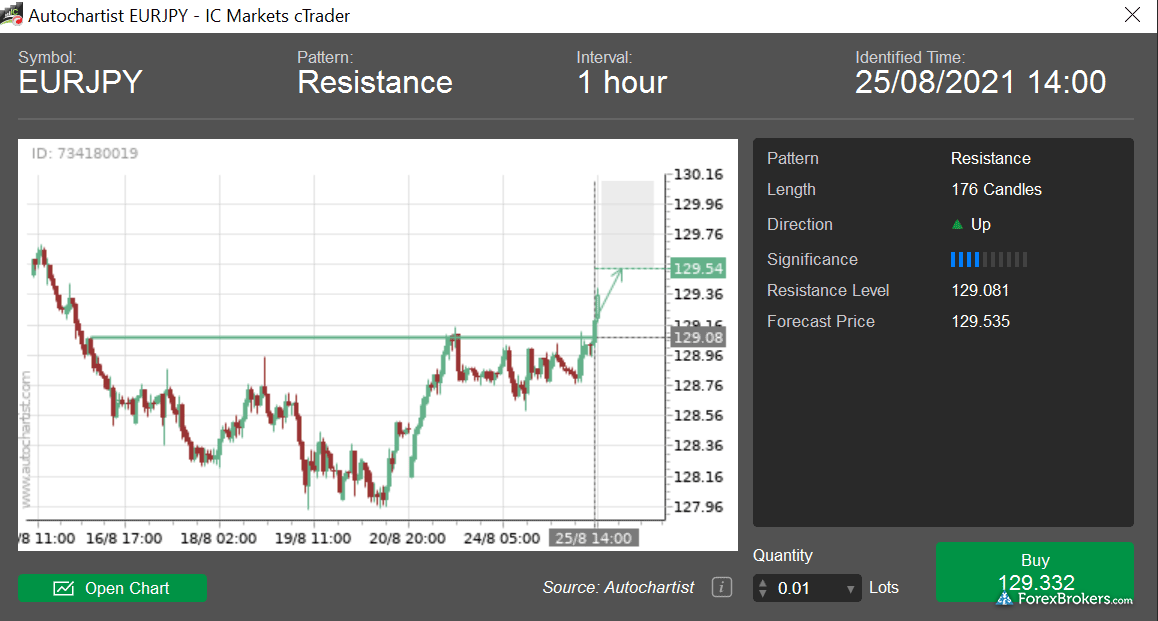

MetaTrader users at IC Markets gain access to the Advanced Trading Tools package – a suite of platform add-ons developed by FX Blue. IC Markets also provides installable third-party plugins from Trading Central and Autochartist. It's also worth noting that in the ForexBrokers.com Annual Awards, IC Markets has won the top spot for MetaTrader for four years straight. Learn more by reading my IC Markets review over at ForexBrokers.com.

Excellent pricing and spreads on MT4 - CMC Markets

| Company |

Overall |

MetaTrader 4 (MT4) |

MetaTrader 5 (MT5) |

Minimum Deposit |

CMC Markets CMC Markets

|

|

Yes |

No |

$0 |

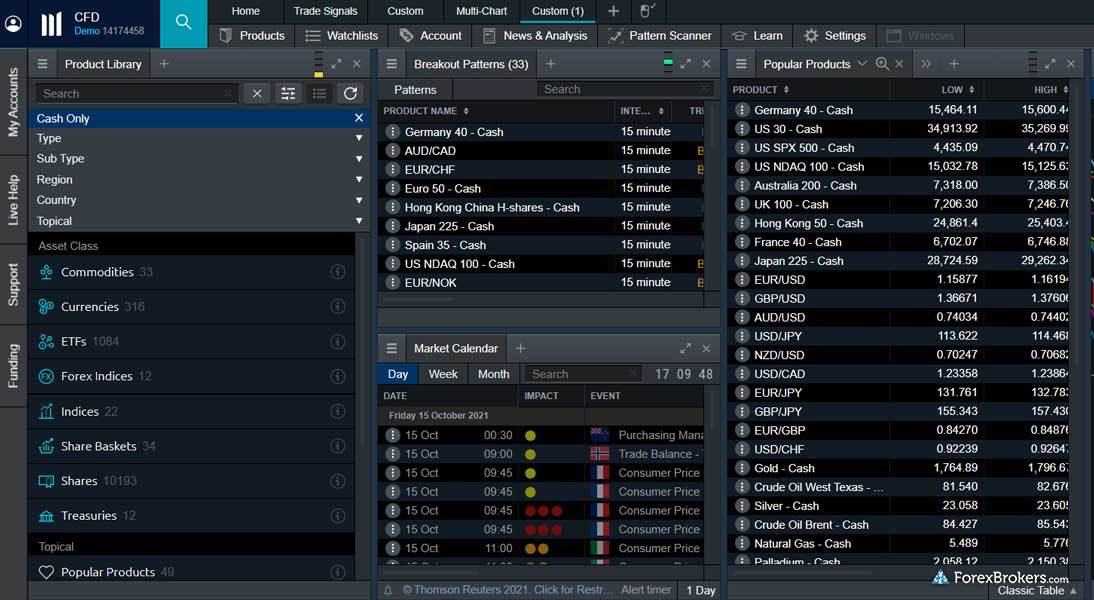

CMC Markets is our top choice for MetaTrader brokers that offer cash equities or the ability to trade actual shares (not CFDs). While CMC Markets does offer CFDs on its MT4 platform to non-US investors, shares are available on its CMC Invest platform (depending on your country of residence and the applicable CMC Markets entity that holds your account). Despite the fact that MT5 is not yet available at CMC Markets, the broker remains a great choice for MetaTrader enthusiasts due to its excellent pricing, lack of restrictions on scalping strategies, and the multiple add-ons powered by FX Blue.

CMC Markets is a highly trusted, publicly traded (LSE: CMCX) broker regulated across multiple Tier-1 jurisdictions. Traders who are interested in dabbling in the forex market will find a wide selection of tradable symbols; CMC Markets has nabbed the ForexBrokers.com Annual Award for #1 Most Currency Pairs three years in a row. Check out my CMC Markets review on ForexBrokers.com.

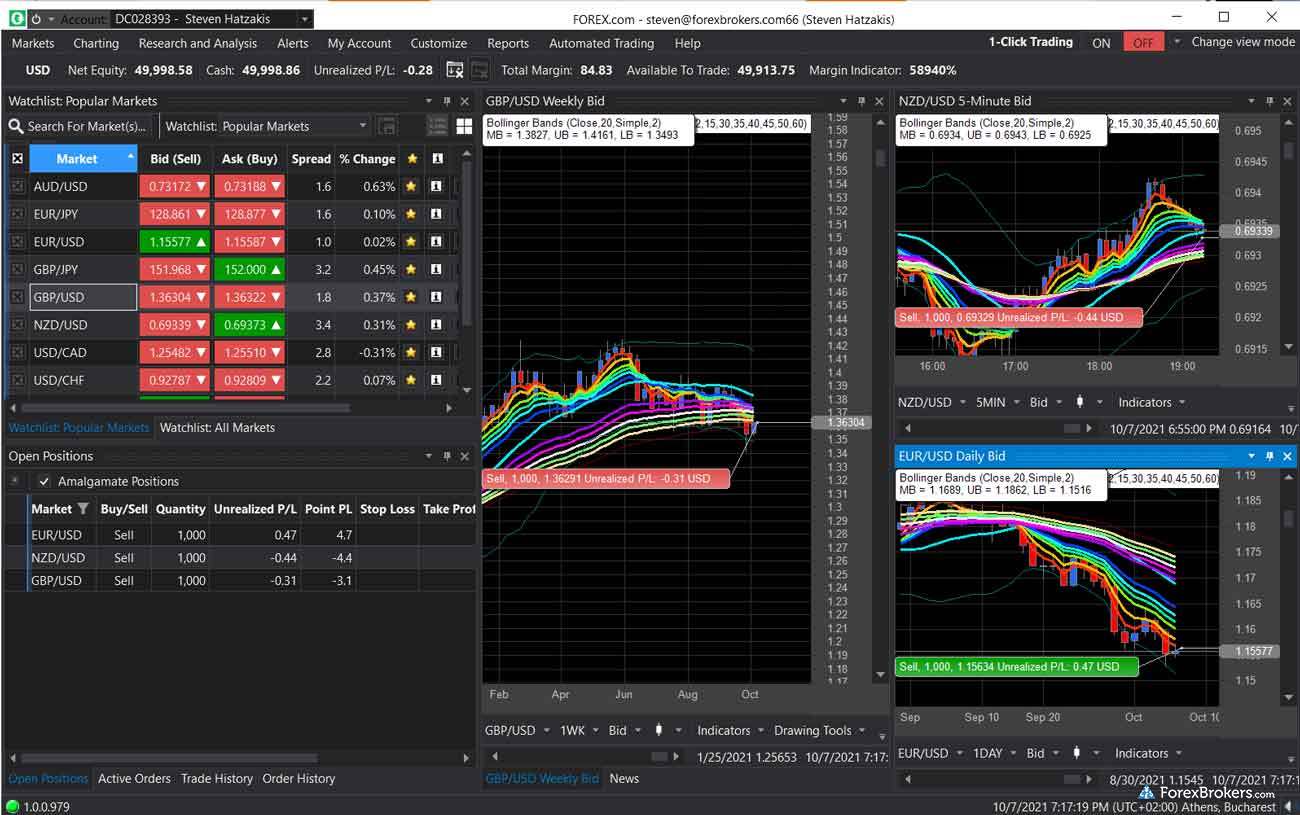

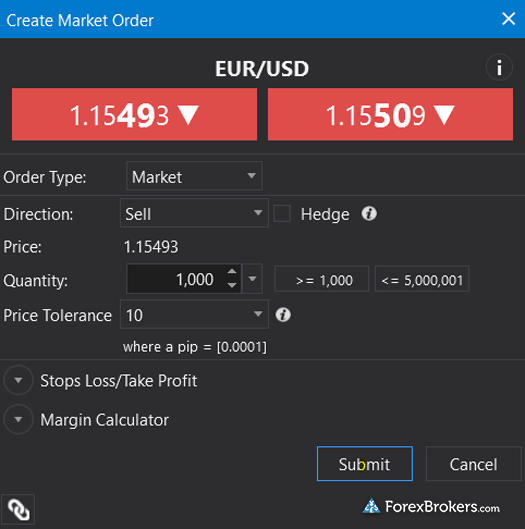

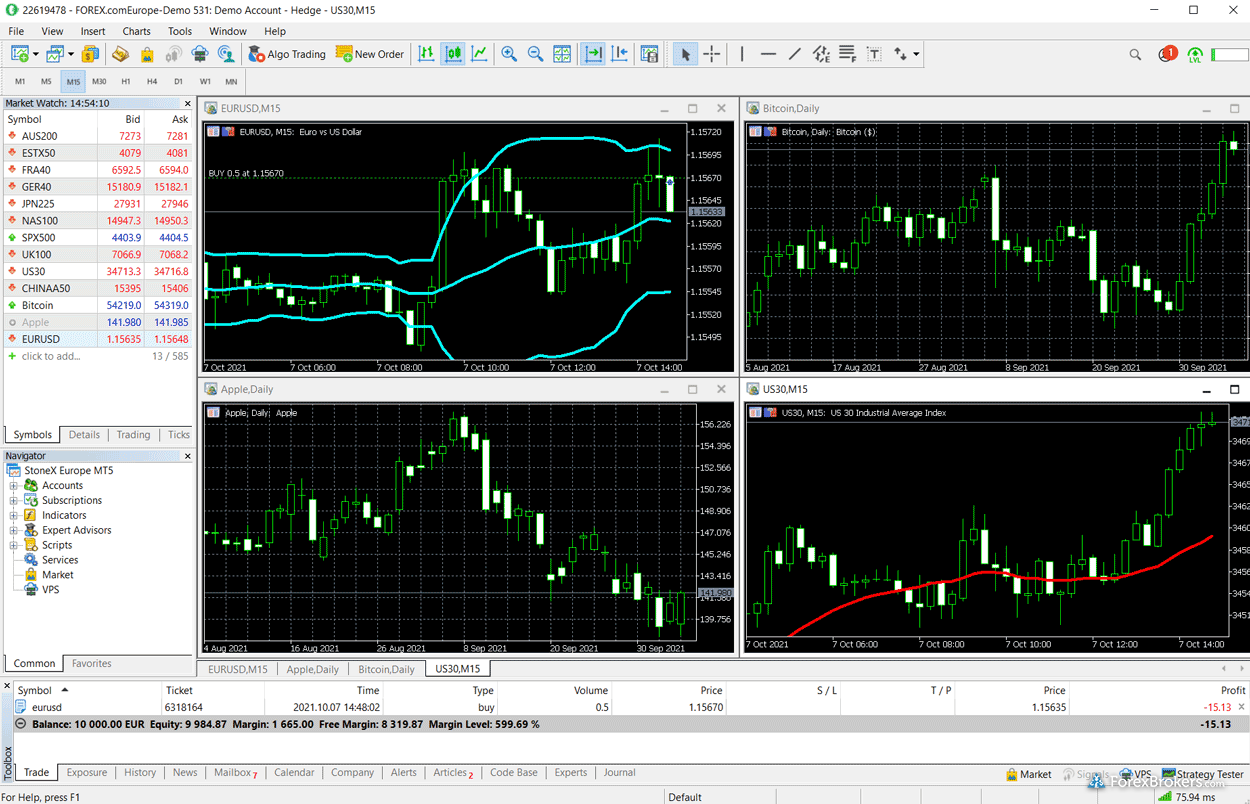

Great choice for MT5 – FOREX.com

| Company |

Overall |

MetaTrader 4 (MT4) |

MetaTrader 5 (MT5) |

Minimum Deposit |

FOREX.com FOREX.com

|

|

Yes |

Yes |

$100 |

FOREX.com, part of StoneX (NASDAQ: SNEX), is a highly trusted, top-ranking forex broker that offers the full MetaTrader suite (both MT4 and MT5). FOREX.com also offers a proprietary platform suite, and multiple account types depending on your trading needs, including MetaTrader in the U.S. and globally. Traders at FOREX.com gain access to third-party platforms like Trading Central and MetaTrader add-ons from FX Blue including Expert Advisors (EAs), which give a boost to the brokers' overall MetaTrader offering.

FOREX.com’s high-quality educational content helped it win the ForexBrokers.com 2024 Annual Award for #1 Interactive Educational Experience. Clients also benefit from FOREX.com’s in-house Performance Analytics, which combines behavioral finance and quantitative analysis of your trading history to deliver feedback on a per-trade and post-trade basis. Find out more by reading my FOREX.com review.

FAQs

Can you use MetaTrader to trade stocks?

Yes, MetaTrader 5 (MT5) supports stock trading and is offered by a growing number of the best international stock brokers. Whether you can trade stock CFDs or cash equities (exchange-traded securities and funds) will depend on your broker and country of residence. Though MT5 supports the ability to trade stocks, MT4 does not. The range of markets available to you will depend entirely on your broker.

Note: Many brokers that offer stock trading on MT5 do not accept U.S. clients, and some brokers may only offer stocks on MT5 as CFDs.

Does MetaTrader 4 (MT4) support stock trading?

Generally speaking, MT4 supports only a handful of stocks, indices and derivatives, because the range of symbols that can be added is limited to just over 1,200, and its technology infrastructure is not compatible for integration with stock exchanges. MetaTrader 5 (MT5) supports thousands of symbols and is the de facto choice for brokers when integrating stocks into their MetaTrader platforms.

Can I use MetaTrader in the US?

Yes, the MetaTrader platform suite is available in the U.S. from the following U.S.-regulated brokers in 2025:

- tastyfx (powered by IG): Offers MetaTrader 4 (MT4)

- FOREX.com (part of StoneX Group): Offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

- OANDA: Offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

- Trading.com: Only offers the MetaTrader 5 (MT5) platform.

It’s worth noting that most forex brokers offering stock trading on MT5 are international and offer them as contract for differences (CFDs), which are not available to U.S. residents. This means that while you can use MT5 in the U.S., the range of products that you can trade will generally be limited to forex and metals.

Can I trade US30 on MetaTrader 5?

Yes, in most cases (depending on the broker you choose) indices are typically available from regulated MT5 brokers alongside their forex and stock offering. The US30 aims to track the underlying price of the futures index for the Dow Jones Industrial Average (DJIA) based on the 30 stocks that comprises the index. Brokers try to replicate the index and offer it as a CFD or futures product.

Our Research

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on StockBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust.

How we tested

In order to assess the best brokers for traders looking to use the MetaTrader 5 platform, we researched and tested each individual broker’s MetaTrader offering.

We examine a wide range of features and evaluate forex brokers based on our own data-driven variables. We determine whether the broker offers the MetaTrader 4 and/or MetaTrader 5 software developed by MetaQuotes Software Corp, and we look for a number of supplementary features that can distinguish MetaTrader offerings. Features that our researchers look for include custom Expert Advisors (Experts or EAs), the availability of the signals market, the ability to use VPN, the number of account types and execution methods, among a host of other data-driven variables.