Penny stocks — typically stocks priced under $5 — often trade on over-the-counter (OTC) markets rather than traditional exchanges. In these markets, transparency is low, liquidity thin, and risks high. Unlike listed securities, OTC stocks aren’t held to the same financial disclosure or listing requirements, making it hard to know what you’re really buying. That’s why they’re so often linked to price manipulation, pump-and-dump schemes, and outright fraud.

I don’t advocate for penny stock trading, but if you're going to venture into this space, you should do it with your eyes wide open and the best tools at your disposal. Many brokers restrict OTC access or tack on extra fees, so choosing the right platform makes a real difference. I evaluated 16 brokerage firms to find the ones that offer the most access, transparency, and control for penny stock traders. Below are my top picks, along with key insights to help you navigate one of the riskiest corners of the market.

Based on my hands-on testing of 16 brokers, these are the best platforms for trading penny stocks — including those that offer OTC access, low fees, and the tools needed to trade microcap stocks effectively.

Top picks for penny stock brokers

The best broker for penny stocks - Fidelity

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Fidelity Fidelity

|

|

$0.00 |

$0.00 |

$0.65 |

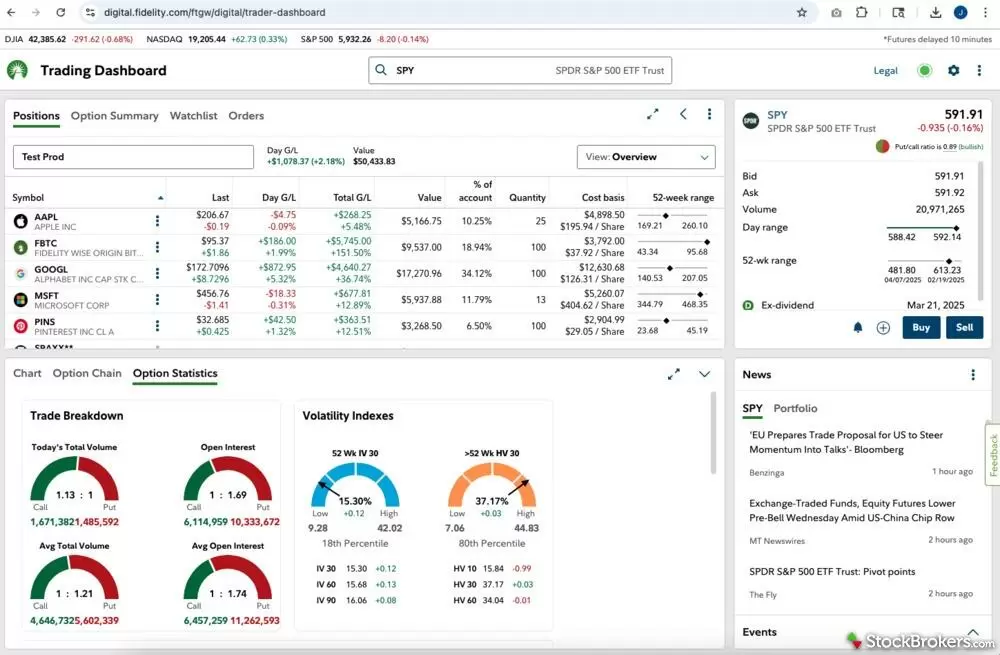

Why Fidelity is best for penny stocks: Fidelity is my pick for the best broker for trading penny stocks because it offers zero additional fees and industry-leading order execution. Many brokers either charge extra for low-priced stocks or restrict trading altogether, but Fidelity allows you to trade them commission-free, with no hidden costs. More importantly, Fidelity does not accept payment for order flow (PFOF), meaning its execution quality prioritizes price improvement for customers. In a volatile market like penny stocks, every fraction of a cent matters, and Fidelity consistently delivers better trade fills that can make a big difference over time.

Powerful research tools: Beyond execution, Fidelity gives penny stock traders access to powerful research tools that many brokers lack. Its platform includes advanced charting, third-party analyst reports, and one of the best economic calendars available. Whether you’re identifying trends, screening for new opportunities, or using sector comparisons to evaluate market sentiment, Fidelity’s research suite provides the depth needed to navigate the speculative nature of penny stocks. Even though some features are tucked away within the platform, the sheer amount of data at your fingertips makes it a top-tier choice for traders who rely on research to make informed decisions.

Platforms & tools: For traders who need flexibility, Fidelity’s mobile app and trading platforms offer seamless access to the market. The flagship Fidelity app provides a smooth, intuitive trading experience, while Active Trader Pro gives more advanced traders direct access to customizable layouts, real-time analytics, and trade automation. While Active Trader Pro isn’t as modern as some competitors, it still packs in the critical features penny stock traders need. With low costs, top-tier execution, and research tools that outshine most brokers, Fidelity is my top pick for trading penny stocks.

Visit my Fidelity review to learn more about its full offering and cost structure.

Best for zero-commission pricing - Firstrade

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Firstrade Firstrade

|

|

$0.00 |

$0.00 |

$0.00 |

Why Firstrade is best for zero-commission pricing: Firstrade is hands-down the best broker for zero-commission penny stock trading. Unlike many brokers that waive commissions but sneak in per-contract fees, Firstrade eliminates them entirely. I’ve tested plenty of platforms, and it’s rare to find a broker that charges $0 not just on stocks and ETFs but also on options, including no contract, exercise, or assignment fees. For penny stock traders who execute high-volume trades, this means serious cost savings that add up over time.

Ease of use: What really sets Firstrade apart is its accessibility. There’s no account minimum, so traders can start small without committing a large upfront deposit. The mobile app is straightforward, making it easy to search for penny stocks, analyze charts, and execute trades on the go. While the platform isn’t as feature-rich as Charles Schwab's thinkorswim or Interactive Brokers' Trader Workstation, I found it to be a solid choice for cost-conscious traders who want a simple, effective way to trade microcap stocks. If you're a beginner wondering how to trade penny stocks without paying extra fees, Firstrade is a solid place to start. Its free OTC stock trading and user-friendly app make it one of the best brokers with no fees for penny stock traders.

Research tools: Firstrade also adds surprising value with its research tools, a rarity among deep-discount brokers. Its integration with Morningstar and Recognia enhances stock analysis, offering fundamental insights and automated technical pattern recognition which is useful for evaluating speculative OTC stocks. FirstradeGPT, its beta AI tool, is another promising addition, hinting at future innovations in market analysis. While not as advanced as top-tier platforms, these tools show Firstrade is more than just a budget broker — it’s evolving. And for Chinese-speaking investors, its fully translated platform is a unique and valuable perk.

Check out my review of Firstrade to discover more about its platform and offerings.

Best trading platform for penny stocks - Charles Schwab

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Charles Schwab Charles Schwab

|

|

$0.00 |

$0.00 |

$0.65 |

Why Charles Schwab is the best trading platform for penny stocks: Charles Schwab is the best trading platform for penny stocks because it gives traders access to thinkorswim, one of the most advanced trading suites available. With over 350 technical indicators, customizable watchlists, and real-time data, it provides everything needed to track fast-moving, low-priced stocks. The platform’s ladder trading and pattern recognition tools help identify breakout opportunities, while advanced order types make trade execution precise. Schwab’s $6.95 OTC trade fee is higher than some competitors, but for traders who rely on professional-grade tools, the cost may be worth it.

Detailed research: Schwab also offers some of the most detailed research available for penny stock traders. Analyst reports, valuation metrics, and economic data help investors assess risk before committing capital. Schwab’s research doesn’t just list price targets; it includes earnings overlays and sentiment indicators that provide deeper context. For those learning the ropes, Schwab’s educational content, from live webinars to interactive courses, helps traders build a foundation and refine their approach over time.

Advanced web and mobile apps: Schwab’s mobile and web platforms ensure traders can act quickly, whether at their desk or on their phone. The Schwab Mobile app integrates research, real-time quotes, and CNBC live streams, while thinkorswim Mobile gives active traders access to sophisticated charting and order types. Between its professional trading tools, institutional-quality research, and investor education, Schwab delivers everything serious penny stock traders need to make informed decisions.

Visit my full review of Charles Schwab to read more about the thinkorswim platform and its various offerings.

Penny stock fees comparison

FAQs

What are penny stocks?

I think of penny stocks as microcap companies with prices under $5 that only trade over the counter. That said, definitions of penny stocks vary. According to the U.S. Securities and Exchange Commission, or SEC, "penny stock" generally refers to a security issued by a very small company (i.e., micro-cap) that trades at less than $5 per share. Many trade for pennies per share (less than $1).

What’s the difference between penny stocks and OTC (over-the-counter) stocks?

There isn’t a universally accepted definition for penny stocks, but a popular definition is an over-the-counter stock that trades for $5 or less per share. Penny stocks are considered riskier than higher-priced OTC stocks because they are most likely cheap for good reasons, including failed business models, distressed financials or simply falling out of favor in the stock market.

Over-the-counter stocks trade between stock dealers instead of a stock exchange. OTC Markets Group has three tiers that each have different listing requirements, with OTCQX stocks meeting the most stringent requirements. OTCQB stocks are subject to less demanding standards and OTC Pink (named from the printed pink sheets the quotes used to be printed on) has the most lax standards.

What are the pros and cons of trading penny stocks?

One of the key advantages of trading penny stocks is the potential for finding undervalued opportunities. Since small companies are rarely followed by major analysts or institutional investors, astute individual traders can identify stocks that may be overlooked. I’ve seen cases where the illiquidity of these stocks means they trade at a discount to their true value, giving savvy investors a chance to capitalize on price inefficiencies. For those willing to research and take on some risk, penny stocks offer the allure of high returns from small investments.

However, penny stocks come with significant risks. They’re often targeted by fraudulent schemes, such as pump-and-dump scams, which can result in substantial losses for unsuspecting investors. In my experience, the wide bid-ask spreads typical of penny stocks make exiting a position more expensive, cutting into potential profits. Additionally, these companies usually provide limited financial disclosure and face less regulatory oversight, which means traders often lack the reliable information needed to make informed decisions.

How much does it cost to trade penny stocks?

The cost of trading penny stocks depends on the online broker you use. If you use a broker that offers flat-fee trades instead of per-share rates, trading penny stocks is not expensive; some brokers even extend their free stock trading policy to include penny stocks. We also recommend avoiding brokers that charge a monthly platform fee, data fees, or monthly minimums, as those costs quickly add up.

Example 1 (flat-fee): Charles Schwab charges a flat-rate $6.95 per OTC trade, while Fidelity charges $0 (no charge). Thus, your cost to buy OTC shares is just $6.95 and $0, respectively.

Example 2 (per share): Interactive Brokers charges $.0035 per share with a max cost of 0.5% of the trade value. You buy 20,000 shares of penny stock XYZ at a price of $.13 per share ($2,600). 20,000 shares x $.0035 per share is $70, while $2,600 x .5% is $13. Thus, your cost to buy the shares is $13 (0.5% of trade value).

How do you buy penny stocks?

For beginners who want to buy penny stocks, the following checklist can help improve your experience buying and trading.

- Choose a reputable broker: Pick a trustworthy firm to open an online brokerage account.

- Analyze details: Research the penny stocks you are considering as much as possible, which will probably be difficult given the lack of reporting required by OTC exchanges.

- Don’t get scammed: Avoid penny stocks that are susceptible to market manipulation such as those targeted by "pump-and-dump" schemes, or that you may have heard about on online forums and in chat groups.

Who is the best penny stock broker?

The best penny stock broker is Fidelity due to its zero-commission OTC trades and exceptional order execution. Unlike many brokers that charge additional fees for penny stocks, Fidelity allows you to trade these low-priced shares without hidden costs, which is crucial for minimizing expenses in the volatile penny stock market. I’ve found that Fidelity also offers some of the best price improvement in the industry, often securing better fills for your trades, a significant advantage when every cent counts in penny stock trading. With its first-rate research tools and technical analysis capabilities, Fidelity is my top choice for traders looking to succeed in penny stocks.

Can you make money with penny stocks?

Yes, you can make money on penny stocks, just as you can with any stock. Penny stocks carry more risk because they are less liquid and often the target of investing scams. However, as in many markets in the financial world, high risk can sometimes offer high rewards. Do careful research before investing in a penny stock. And, before you day trade penny stocks, read our take on why most investors may wish to avoid day trading.

Before jumping in, make sure you’re using a broker that allows OTC stock trading with transparent fees. The best brokers for penny stocks are those that combine low commissions with solid tools and research. These qualities give you the best chance to make smart decisions in a high-risk market.

Our testing

Why you should trust us

Jessica Inskip is Director of Investor Research at StockBrokers.com, bringing 15 years of experience in brokerage and trading strategy. A former FINRA-licensed rep, she held Series 7, 63, 66, and 4 licenses. Jessica focuses on investor education and brokerage industry research, appears regularly on CNBC, Bloomberg, The Schwab Network, Fox Business, and Yahoo! Finance, and hosts the Market MakeHer podcast.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Trading platforms tested

We tested 14 online trading platforms for this guide:

Fidelity

Fidelity

Firstrade

Firstrade

Charles Schwab

Charles Schwab

E*TRADE

E*TRADE

TradeStation

TradeStation