Best Free Stock Chart Websites for 2026

close

Blain Reinkensmeyer

Blain Reinkensmeyer

Blain Reinkensmeyer heads research for all U.S.-based brokerages on StockBrokers.com. He has 20 years of trading experience and has been featured in the New York Times, Wall Street Journal, and Forbes, among other media outlets.

Why you can trust us

Why you can trust us

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

There’s simply no way around it: It's hard to do great analysis with lousy charts, which is why finding the best free stock charts is essential for spotting trends and executing your strategy. Whether you are a seasoned stock trader or a casual investor, my list of the top stock charting websites for 2026 will help you identify the right tools for your specific needs.

In my extensive testing of the market's leading free charting software, I focused heavily on design, ease of use, technical tools, and customizability. I wanted to see which platforms offered institutional-grade features without the institutional price tag. While every service reviewed here offers premium subscriptions, I ensured their free tiers are robust enough to stand on their own.

If you find you aren't satisfied with the standalone choices below, keep in mind that many modern online brokers provide comprehensive stock charts and analysis tools with no minimum deposit or monthly fee.

However, for pure analysis and pattern recognition, these five picks stood out from the pack. Here are the best free stock chart websites for 2026.

Best Free Stock Charts Websites

While top online brokers offer powerful built-in tools, there is a distinct advantage to using dedicated free charting software. Standalone websites provide unmatched agility and community features, allowing you to analyze markets from any browser without logging into a brokerage account, which is perfect for quick technical checks and idea generation.

To select the best stock charts for 2026, I prioritized platforms with comprehensive free tiers, responsive and modern designs, and reliable real-time data. Whether you need advanced technical indicators or visualized fundamental data, the websites below represent the best available standalone platforms for stock charting.

Broker

Overall

"Best for"

Bullet Points

Best free stock chart website

- Free version: Yes

- Monthly Pricing: $14.95/mo

- Annual Pricing: $155.40/yr

Review

TradingView offers the ultimate clean and flexible experience for looking at stock charts. It’s no wonder many brokers license TradingView charts and widgets for their own sites. There's also a great mobile app on offer.

Pros

- Charting powerhouse: 400+ indicators, 110+ drawing tools

- Easy signup; under a minute

- Active social network for ideas and user strategies

Cons

- Free plan has ads and limits multi-chart/advanced indicators

- Frequent upgrade prompts on free plan

- Education exists, but little in-platform guidance

Best for technical analysis education

- Free version: Yes

- Monthly Pricing: $19.95/mo

- Annual Pricing: $239.40/yr info

Review

StockCharts.com, one of the original internet charting websites, impresses with its Advanced Charting Platform (ACP), which offers terrific customization. Many features, however, are locked behind a paywall.

Pros

- ACP is powerful, intuitive, and attractive.

- Great articles and video content with technical analysis

Cons

- Real-time data, along with many other features, requires a subscription

- Free version: Yes

- Monthly Pricing: $9.95/mo

- Annual Pricing: $95.40/yr

Review

Yahoo Finance offers clean HTML5 charts that are clear, easy to use, and ideal for everyday investors, and it's now beta testing a rich charting experience with great tools as well.

Pros

- Yahoo’s screener is easy to use and includes streaming quotes and ESG filters

- Simple screening option for investors who want to learn stock trading

Cons

- There aren’t many criteria available for screening

- Lots of Yahoo's features are locked behind a paywall

- The screener isn’t available on the Yahoo Finance app

Best for free fundamental analysis

- Free version: Yes

- Monthly Pricing: Starts at $7.99/mo

- Annual Pricing: Starts at $79.99/yr

Review

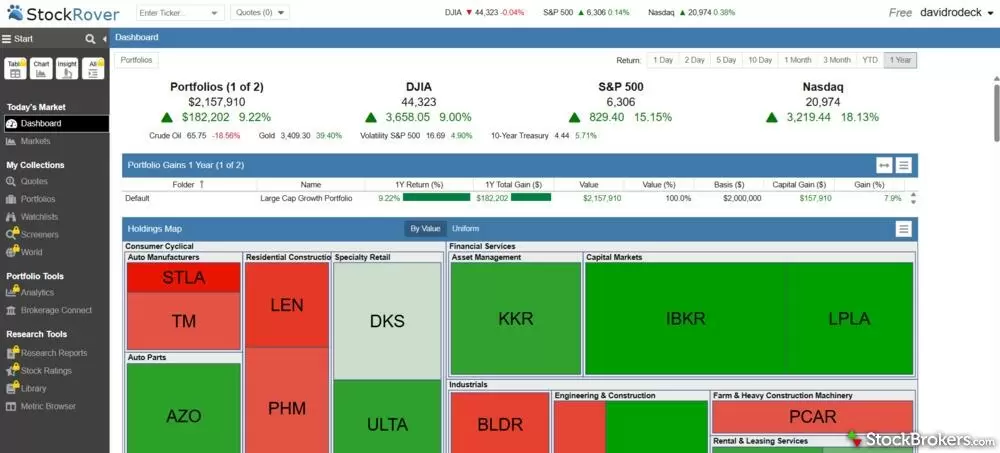

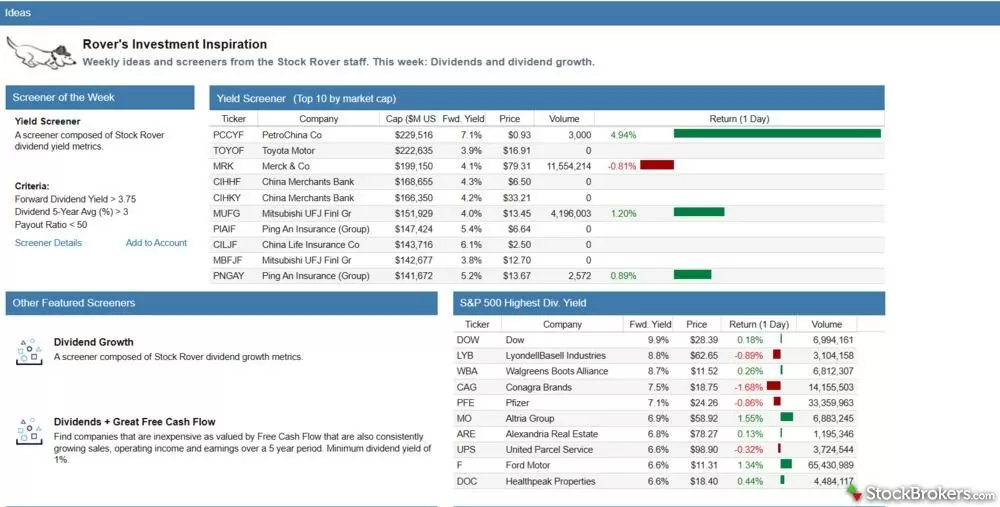

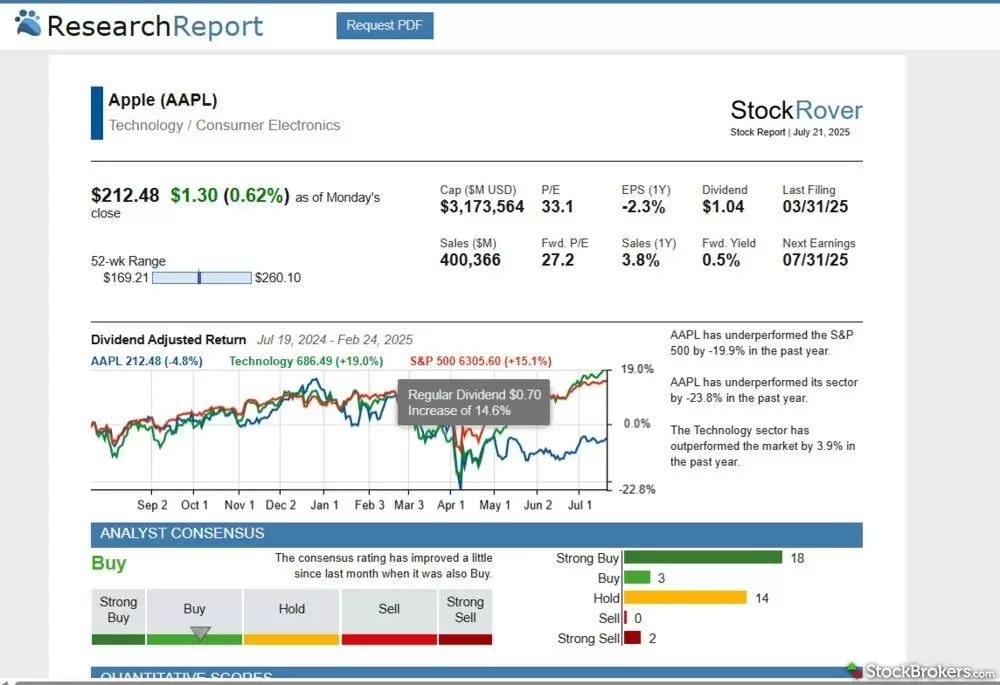

StockRover offers great analyst ratings, clear charts and solid presentation of fundamental data, though its best assets are tied to subscription accounts.

Pros

- Screener with 700+ criteria for stocks, ETFs, funds

- 14-day trial on all paid plans

- Weekly screener ideas and ratings

Cons

- Steep learning curve

- No international markets or crypto

- Research reports cost extra ($49.99–$99.99/yr)

- Free version: Yes

- Monthly Pricing: $39.50/mo

- Annual Pricing: $299.50/yr

Review

Finviz delivers fast, no-login access to charts alongside one of the best free stock screeners online. While its charts are basic and limited without a paid plan, the platform excels at presenting stock data in a clean, visual format.

Pros

- Top-tier stock screener, powerful yet simple

- Visual news, charts, and financials

- Intuitive and fun once learned

Cons

- Limited education; no chatbot

- Can feel overwhelming at first

- Free plan has ads and delayed data

Winners Summary

1. TradingView - The best stock chart website

| Company |

Overall |

Free version |

Monthly Pricing |

TradingView TradingView

|

|

Yes |

$14.95/mo |

TradingView delivers a clean, flexible experience for analyzing stock charts and sets the benchmark for what modern, cloud-based technical analysis should look like. It is no surprise that the platform now supports over 100 million investors and is licensed by many top brokers for their own charting engines. In 2025, the Supercharts platform remains the gold standard, combining cutting-edge user experience with institutional-grade analytical depth.

The charts are exquisitely detailed, offering over 400 pre-built indicators and a massive library of over 100,000 community-built scripts via the Pine Script programming language. There are thoughtful user touches throughout the site that streamline your workflow. For instance, the command search lets you locate any tool instantly, while the ticker box remembers your symbol history, often making it faster than building a formal watchlist.

Beyond pure analysis, TradingView hosts an extremely active community sharing trade ideas, scripts, and market forecasts in real-time. Sophisticated traders will appreciate the unique "Bar Replay" feature to backtest strategies on historical data, while novices can learn by observing the "Ideas" stream. You can even execute trades directly from the charts by connecting your brokerage account via the Trading Panel; supported brokers include TradeStation, Interactive Brokers, and tastytrade.

For a comprehensive look at its features and pricing, visit our in-depth TradingView review.

Free vs. Paid

- Free: Access to the main charting tool with global market data. However, it is ad-supported (including video commercials) and restricted to one chart per tab and two indicators per chart.

- Essential ($14.95/mo): Removes ads and increases limits to 5 indicators per chart and 2 charts per tab. Note that alerts on this tier expire after two months.

- Plus ($29.95/mo) & Premium ($59.95/mo): Unlocks advanced features like intraday spread charts, up to 8 charts in a single layout, and non-expiring alerts (Premium only), which are crucial for long-term trend following.

Blain's take

"The Bar Replay feature is a hidden gem for practicing technical analysis. It lets you rewind the market and watch price action unfold candle by candle, making it an excellent way to sharpen your skills without risking capital."

Blain Reinkensmeyer

Pros: Most flexible stock charts, massive library of community-built indicators (Pine Script), seamless broker integration for trading, and excellent mobile app synchronization.

Cons: The free version is ad-supported with frequent upgrade prompts and video ads; the limit of two indicators per chart on the free plan can be restrictive for advanced analysis.

TradingView gallery

2. StockCharts.com - Best for technical analysis education

| Company |

Overall |

StockCharts.com StockCharts.com

|

|

StockCharts.com is a titan in the industry, maintaining a loyal following among technical purists and Chartered Market Technicians (CMTs). While the interface feels less modern than TradingView, it excels in reliability and educational value. The platform offers two primary charting engines: the classic "SharpCharts" and the newer, more interactive "StockChartsACP" (Advanced Charting Platform). While ACP offers a smoother, drag-and-drop experience similar to modern competitors, SharpCharts remains the go-to for creating publication-quality static charts that are easy to annotate and share.

Where StockCharts truly separates itself is its educational ecosystem. ChartSchool is arguably the internet's most comprehensive library of technical analysis knowledge, and the site features commentary from industry legends like John Murphy and Martin Pring. The "PerfCharts" tool is another standout, allowing you to visualize the relative performance of different sectors or asset classes on a single dynamic timeline, which is a fantastic way to spot sector rotation in real-time.

Free vs. Paid

- Free: Access to creating SharpCharts and ACP charts with daily and weekly data (no intraday). You are limited to 3 technical indicators per chart and cannot save charts or create custom watchlists.

- Basic ($19.95/mo): Adds intraday data, allows you to save up to 1,000 charts, increases the indicator limit to 25 per chart, and unlocks 1 custom scan.

- Extra ($29.95/mo) & Pro ($49.95/mo): Adds official real-time data options, deeper historical data (back to 1900 on Pro), and advanced scanning capabilities (up to 500 scans on Pro).

Pros: Industry-leading educational resources (ChartSchool), excellent "PerfCharts" for relative strength analysis, and highly respected expert commentary.

Cons: The interface can feel dated compared to HTML5 competitors; free users are restricted to daily data (no intraday) and cannot save their work.

StockCharts.com gallery

3. Yahoo Finance - Best for ease of use

| Company |

Overall |

Free version |

Monthly Pricing |

Yahoo Finance Yahoo Finance

|

|

Yes |

$9.95/mo |

Yahoo Finance remains the internet's homepage for investing, and for good reason: it is the most accessible entry point for millions of investors. If you need to quickly check a quote, see a basic chart, or read the latest headlines without logging into a complex platform, this is the destination. While the interface has evolved, it retains a familiar logic that allows users to toggle seamlessly between charts, financials, and analyst ratings.

I was impressed by the depth hidden behind the "Full Screen" button. Don't settle for the basic line chart on the summary page. The advanced charting suite offers a surprising range of technical indicators, from Bollinger Bands to Guppy Multiple Moving Averages, along with automated pattern recognition that highlights key setups like head-and-shoulders or wedges. This feature is particularly valuable for newer traders learning to spot technical formations in real-time. Additionally, the integration of fundamental data means you can overlay events like dividends and splits directly onto the price action, providing context that pure technical charts often miss.

Free vs. Paid

- Free: Includes real-time stock quotes, interactive charts with over 100 indicators, unlimited watchlists, and basic portfolio tracking. The experience is supported by display and video ads.

- Bronze ($9.95/mo): Removes ads from the experience and unlocks advanced portfolio analytics, such as risk analysis and performance attribution.

- Silver ($24.95/mo) & Gold ($49.95/mo): Adds premium research reports from Morningstar and Argus, along with enhanced charting features like automated technical event overlays and the ability to download 40 years of historical data.

Pros: Comprehensive choice of indicators, automated pattern recognition on free charts, and seamless integration of news and fundamental data.

Cons: The free version is heavily ad-supported, which can clutter the workspace; advanced features like historical data downloads and premium research reports are locked behind a paywall.

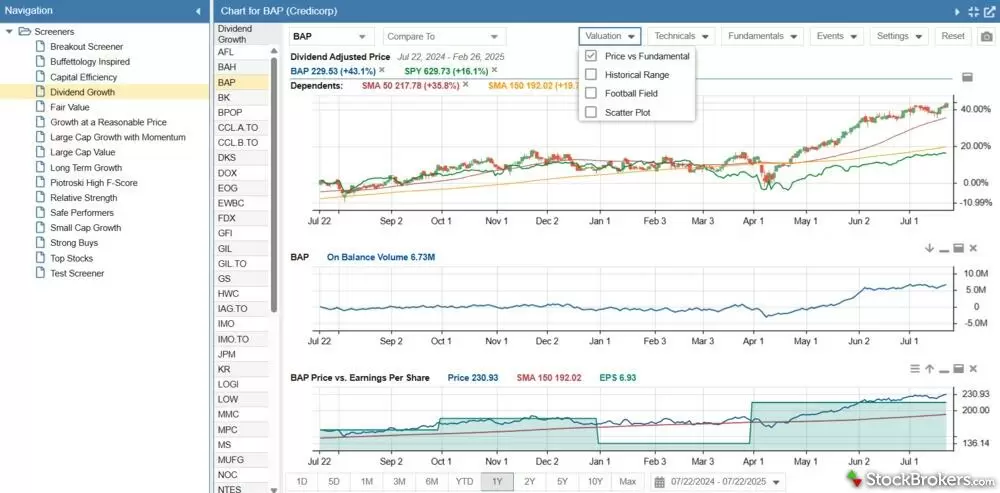

4. Stock Rover - Best for free fundamental analysis

| Company |

Overall |

Free version |

Monthly Pricing |

Stock Rover Stock Rover

|

|

Yes |

Starts at $7.99/mo |

Stock Rover is a unique platform in the charting software landscape, prioritizing financial health over price action. While it may feel clunky to technical purists used to the fluidity of TradingView, it is an indispensable tool for value investors. The platform’s real strength lies in its ability to layer rich fundamental data, such as P/E ratios, earnings per share (EPS), and dividends, directly onto price charts. This visualization helps you instantly spot divergences where a stock's price may have disconnected from its underlying value.

Beyond charting, Stock Rover functions as a comprehensive research workstation. Even the free tier allows you to sync your brokerage account for portfolio tracking, view analyst ratings, and access market news. It is less about drawing trendlines and more about determining if a company is fundamentally sound before you buy. To explore all features and pricing in depth, read our complete Stock Rover review.

Free vs. Paid

- Free: Includes daily market data, basic charting, portfolio syncing, and news. It is ad-supported and does not include the advanced screener.

- Essentials ($7.99/mo): Unlocks the stock screener with 275+ metrics, 5 years of historical data, and customizable chart comparisons.

- Premium ($17.99/mo) & Premium Plus ($27.99/mo): Adds 10+ years of data, over 700 screening metrics, correlation analysis, and advanced ratio charts.

Pros: Unmatched ability to visualize fundamental data alongside price, powerful portfolio analysis tools included in the free version, and deep analyst ratings.

Cons: The interface has a steep learning curve; charting features feel secondary to the screener; the free plan is supported by ads.

5. Finviz - Best for stock screening

| Company |

Overall |

Free version |

Monthly Pricing |

Finviz Finviz

|

|

Yes |

$39.50/mo |

Finviz isn’t known for flashy charts, but what it lacks in visual depth it makes up for with powerful screening. Most traders find Finviz through its stock screener as it's one of the most comprehensive free tools online. You can filter thousands of stocks using dozens of technical and fundamental data points, all without creating an account.

Charting, however, is where Finviz comes up short. Free users can view static charts with volume and moving averages, but even basic features like intraday timeframes and fullscreen mode are locked behind the $39.50/month Elite subscription. During testing, nearly every chart interaction triggered an upgrade prompt. And while the Elite version does enable real-time data and more flexible chart access, it still doesn’t compare to platforms like TradingView or StockCharts ACP in terms of technical tools, overlays, or customization.

That said, I appreciated how integrated Finviz's charts are within its screener and portfolio tools. With one click, you can jump from a filtered stock list to its chart, then save it to a portfolio or download the data. For investors who prioritize screening and market scanning, this tight workflow is efficient even if the charting itself feels like a secondary feature. For a detailed breakdown of features and pricing, see our full Finviz review.

Free vs. Paid

- Free: Access to the elite screener, heatmaps, and news. Charts are static images, and market data is delayed (3-5 minutes for maps, 15-20 minutes for quotes).

- Finviz*Elite ($39.50/mo): Unlocks real-time data, advanced interactive charting, backtesting strategies, email alerts, and an ad-free experience.

- Pros: Best-in-class market heatmap, incredibly fast technical screener, and automated pattern recognition on charts.

- Cons: Free data is delayed; charts are static images rather than interactive on the free tier; the interface can feel dense for beginners.

Best free stock charts features comparison

| Website |

Base Cost |

Premium Version |

Best Feature |

Rating |

| TradingView.com |

Free |

$14.95/mo+ |

Clean, comprehensive charting |

4.5 Stars |

| StockCharts.com |

Free |

$18.42/mo+ |

Education and commentary |

4.5 Stars |

| Yahoo Finance |

Free |

$9.95/mo+ |

Powerful advanced charting |

4.5 Stars |

| Stock Rover |

Free |

$7.99/mo+ |

Charting fundamentals |

4 Stars |

| FINVIZ.com |

Free |

$39.50/mo |

Automated analysis |

4.5 Stars |

FAQs

Where can I chart stocks for free?

The best free stock charts are on TradingView. Other free charting websites include StockCharts.com, Finviz, Stock Rover and Yahoo Finance. Traders can also open an account at many of the best stock brokers for free and chart stocks, even with a zero balance.

What is the best free stock chart?

TradingView has the best free stock charts. They are crisp, easy to use, highly customizable and update with real-time quotes. For pure stock charts, Yahoo Finance’s real-time ChartIQ-powered charts are hard to beat.

What stock broker offers the best charting tools?

In my extensive testing, Charles Schwab's thinkorswim (TOS) stands out as the best. It's incredibly hard to top the depth of customization available; you can essentially build your own trading environment. My favorite feature is the "Chart Describer," which automatically identifies technical patterns and explains them in plain English, which is perfect for learning while you trade. Additionally, TOS integrates economic data like interest rates directly onto your stock charts, adding a valuable macro layer to your technical analysis.

Our testing

Why you should trust us

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points for each broker.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Popular Trading Content

Popular Guides

About the Editorial Team

Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. He heads research for all U.S.-based brokerages on StockBrokers.com and is respected by executives as the leading expert covering the online broker industry. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets.

Jeff Anberg is a Senior Editor at StockBrokers.com. Along with years of experience in media distribution at a global newsroom, Jeff has a versatile knowledge base encompassing the technology and financial markets. He is a long-time active investor and engages in research on emerging markets like cryptocurrency. Jeff holds a Bachelor’s Degree in English Literature with a minor in Philosophy from San Francisco State University.

Steven Hatzakis is the Global Director of Research for ForexBrokers.com. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative.

TradingView

TradingView

StockCharts.com

StockCharts.com

Yahoo Finance

Yahoo Finance

Stock Rover

Stock Rover

Finviz

Finviz