Top picks for futures brokers

Best for futures trading - tastytrade

| Company |

Minimum Deposit |

Futures (Per Contract) |

Options (Per Contract) |

tastytrade tastytrade

|

$0.00 |

$1.00 info |

$0.50 info |

It’s no surprise that tastytrade, long known for shaking up the options world, also delivers one of the best futures trading platforms for individual investors. After all, futures and options are derivatives cousins, and tastytrade teaches both with clarity and edge.

Education: I’ve spent years with their educational content, and it still sets the bar. Whether you’re new to futures or building on a solid base, tastytrade helps you understand the why behind the markets. The platform has a deep library of explainers, video tutorials, and a searchable help center that makes learning feel less like homework and more like leveling up.

Range of contracts: tastytrade offers a broad selection of cash-settled futures contracts, which is a good thing, unless you were planning to take physical delivery of a barrel of oil (you probably weren’t). You’ll find products across equities, energy, currencies, metals, rates, crypto, agriculture, and even livestock. Most are available in mini and micro sizes, which lowers the capital required and makes it easier to scale into trades or manage risk more precisely.

Platform experience: As a futures broker, tastytrade delivers a clean, intuitive platform that puts control in the hands of active traders. Orders are easy to place, market data updates in real time, and the interface doesn’t clutter what should be a fast decision-making process. Margin requirements are clearly stated, with helpful guidance on intraday versus overnight rules. For self-directed traders who want to understand their positions and risk at a glance, tastytrade makes that simple.

Best for professional futures trading - Interactive Brokers

| Company |

Minimum Deposit |

Futures (Per Contract) |

Options (Per Contract) |

Interactive Brokers Interactive Brokers

|

$0.00 |

$0.85 info |

$0.65 info |

If you’re trading futures with a strategy-first mindset, Interactive Brokers (IBKR) is the platform I recommend most. As a futures broker, IBKR offers institutional-grade access across global markets, paired with advanced tools, deep asset coverage, and precision execution.

Advanced platform: At the heart of the advanced trader experience is Trader Workstation (TWS), a powerful platform built for professional-grade futures trading. TWS offers access to over 90 order types and trading algorithms, along with tools like ComboTrader for multi-leg trades and the Index Arbitrage Meter, which helps visualize pricing disparities between futures contracts and their corresponding spot markets. These features are essential for executing advanced strategies like spreads, pairs trades, and arbitrage.

Range of contracts: Interactive Brokers supports a massive range of futures contracts: equity indices, Micro E-minis, interest rates, crypto, metals, energy, agriculture, currencies, softs, and more. It’s a full-spectrum platform for traders who want exposure across multiple asset classes without bouncing between platforms.

Education: As a futures trading platform, IBKR is built to reward preparation. The broker’s educational library is second to none, with resources from both IBKR Campus and the CME Group. Courses range from beginner walkthroughs to advanced futures analysis, like how economic reports and global news flow into contract pricing.

Execution: What separates IBKR is execution precision. Order routing is fast, customizable, and global, giving experienced traders the confidence to scale, hedge, and refine their approach. If you’re looking for a platform that feels like it was built with quants, analysts, and market veterans in mind, this is it.

Best for active futures traders and API access - TradeStation

| Company |

Minimum Deposit |

Futures (Per Contract) |

Options (Per Contract) |

TradeStation TradeStation

|

$0.00 |

$1.50 |

$0.60 |

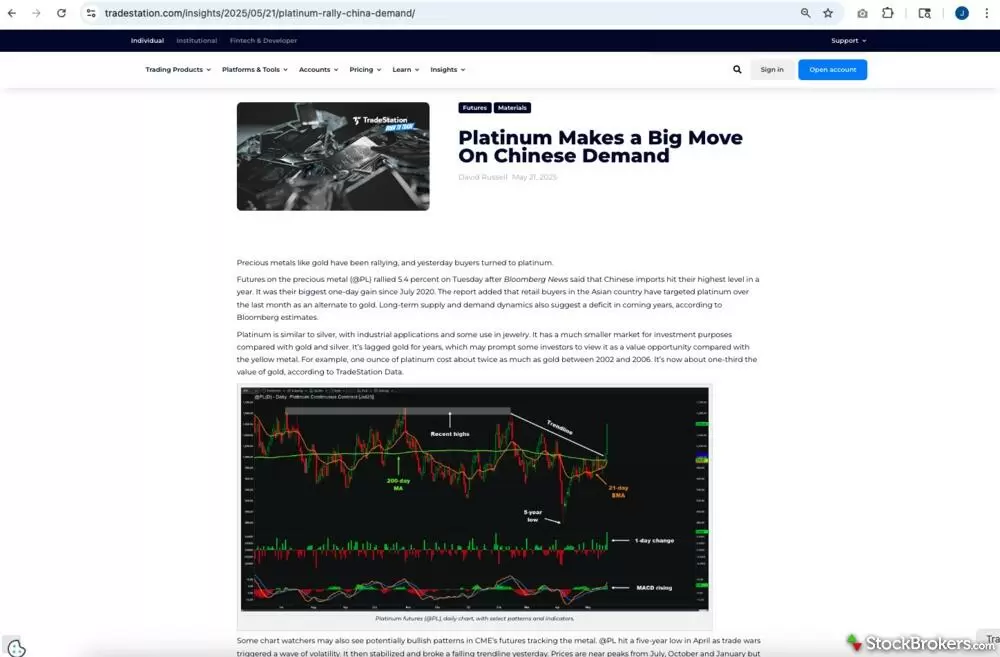

TradeStation is a top choice if you’re an active trader who thrives on customization and automation. As a futures trading platform, it stands out for its low intraday margin requirements, deep data coverage, and advanced developer tools that are perfect for building and testing trading systems.

Margin rates: One of the biggest strengths of TradeStation is flexibility. Intraday margin rates can go as low as 10% on select contracts, giving you the capital efficiency needed for short-term strategies. Just remember: overnight margin requirements will be higher and vary by product. Still, this kind of leverage can be a powerful edge when used responsibly.

Research: TradeStation also gives you access to historical data that spans years of market activity across U.S. and Eurex contracts. This makes it easy to backtest strategies and fine-tune performance.

API access & scripting tools: For developers and algo traders, the broker offers multiple APIs and scripting tools, supporting automation across futures, equities, and options. You can integrate with custom indicators, create alerts, or build entire trade execution systems from scratch.

Range of contracts & pricing: TradeStation supports trading in nearly every contract category: stock indices, crypto, rates, metals, energy, ags, softs, and even meats. Pricing is competitive, especially for high-volume traders. Market data fees are waived if you generate at least $40 in monthly commissions. New accounts get a 90-day grace period, so you can test the platform without paying extra for Level 1 or Market Depth feeds. After that, if commission thresholds aren’t met, traders will be charged $20 per package, totaling $40 per month.

TradeStation isn’t a futures broker for everyone, but if you want precision, control, and the ability to program your trades down to the millisecond, it’s one of the most capable platforms available.

Best for futures market research – Charles Schwab

| Company |

Minimum Deposit |

Futures (Per Contract) |

Options (Per Contract) |

Charles Schwab Charles Schwab

|

$0.00 |

$2.25 |

$0.65 |

Charles Schwab is one of the best futures brokers for traders who want to blend market research with hands-on strategy. With its research-driven approach, solid educational tools, and integration with the thinkorswim platform, Schwab caters to investors who are serious about learning and leveling up.

Research: One of my favorite features from Schwab is the “Looking to the Futures” newsletter. It drops before the U.S. market opens and offers a blend of macroeconomic context, technical analysis, and futures positioning. I read it daily and it’s a fast way to understand how futures are setting the tone for the day ahead.

Range of contracts: Schwab’s product lineup includes over 75 futures contracts across micro indices, metals, energy, crypto, currencies, interest rates, agriculture, and softs. Both cash-settled and physically settled contracts are available. And no, physically settled doesn’t mean a truck full of soybeans pulling up to your house. It just means you’d take a position in the underlying at expiration. Most traders close out before then, but it’s important to know the mechanics.

Platform experience: As a futures trading platform, thinkorswim delivers. It combines visual order tools like the bid/ask ladder and one-click entries with customizable charting, advanced order types, and built-in risk tools. It also includes paperMoney, Schwab’s paper trading mode, which lets you practice futures strategies in a real-time environment without risking capital.

For stock and options traders looking to expand into futures, Schwab offers a smooth on-ramp. The interface feels familiar, the tools are deep, and the research is unmatched.

Best trading futures app – E*TRADE from Morgan Stanley

| Company |

Minimum Deposit |

Futures (Per Contract) |

Options (Per Contract) |

E*TRADE E*TRADE

|

$0.00 |

$1.50 |

$0.65 |

If you're just getting started with futures, E*TRADE is one of the most approachable platforms out there. It brings futures into the same place you already manage your stocks and options which means no separate accounts, no extra logins, and no surprise margin transfers. Everything is built to keep you trading confidently, even if you’re still learning the ropes.

Platform experience: Power E*TRADE, the broker’s active trading platform, is available on both desktop and mobile and supports full 24/6 access to the futures markets. The mobile app includes a clean ladder view and real-time quote tracking, giving you tools to manage positions on the go without feeling overwhelmed.

Automatic fund transfers: One feature I especially like is the automatic money movement between your margin account and your futures account. This setup allows transfers to happen automatically to cover margin calls or mark-to-market requirements, helping you stay in compliance without scrambling to fund positions manually. For a new futures trader, it removes a lot of stress.

Research: While E*TRADE may not offer the most advanced analytical tools for futures traders, it does feature a solid Futures Research Center, powered by the CME Group. You’ll find market outlooks, charting tools, and short-form video explainers that help you build a foundation in how futures work. It’s a great way to sharpen your understanding of futures basics, even if it’s not a deep research hub.

For an approachable futures trading platform with a well-designed app that fits seamlessly into your existing investing routine, E*TRADE is hard to beat.

Best for community-driven futures trading - Webull

| Company |

Minimum Deposit |

Futures (Per Contract) |

Options (Per Contract) |

Webull Webull

|

$0.00 |

$1.25 info |

$0.00 |

Webull brings something to the futures space that most platforms don’t: a built-in trader community. For traders who like to learn from others, follow sentiment, or crowdsource trade ideas, it’s the most interactive futures trading platform available today.

Trader Community: You can chat with other traders, follow popular contracts, and watch how market sentiment evolves throughout the day. It’s one of the few platforms where education happens by observation, where you can watch others trade, read community posts, and see how people react to macro news in real time.

Range of contracts: Webull’s product offering is expanding. You’ll find contracts across major asset classes, including index futures, crypto, energy, metals, currencies, interest rates, and agriculture. Their margin rates are highly competitive, making it an attractive choice for cost-conscious traders looking to stay active in the market.

Mobile app: The mobile app is clean and fast, with a simplified order ticket that even shows your margin requirements before you place a trade. It’s a small feature, but one that makes trading with margin more transparent, which is especially important if you’re just starting out.

Platform experience: As a futures broker, Webull keeps the platform approachable. It doesn’t overwhelm you with complex tools or data overload. While advanced analytics and automation features are limited, the streamlined design makes it easy to stay engaged, track positions, and learn by doing.

If you’re looking for a mobile-first futures trading experience with a strong sense of community, Webull is worth exploring, especially for newer traders who value simplicity, clarity, and connection.

How to get started in futures trading

Understand what a futures contract is

Trading futures isn't just about predicting where the market is heading. It's about understanding how contracts, leverage, and margin work together. In simple terms, a futures contract is a standardized agreement to buy or sell an asset at a set price on a specific future date. These contracts cover everything from stock indices and crude oil to gold, wheat, and interest rates.

Futures can be used for speculation, hedging, or market analysis, but they come with risk especially because they're leveraged products. That leverage magnifies both gains and losses, so having a firm grasp of how futures work is essential before placing a trade.

Open and fund a futures trading account

To trade futures, you'll need to open a futures trading account with a broker that supports margin trading. Unlike using borrowed money to buy stocks, futures margin isn’t a loan. It's more like a performance bond or security deposit that helps cover potential losses.

The initial margin is set by the exchange, but brokers may add extra requirements depending on your account size, trading activity, and the contracts you're working with. Once approved, fund your account so you're ready to enter a position.

Start with beginner-friendly contracts

Most new traders begin with micro or mini futures contracts, which are smaller versions of standard contracts. These allow you to trade with lower capital at risk while still participating in the same markets.

Once your account is funded, you'll be able to trade on a broker's desktop or mobile platform. Tools like ladder trading, customizable charts, and real-time quotes make it easier to analyze and execute trades. Some platforms also offer paper trading accounts, which let you practice in live markets without risking real money.

Build your knowledge and trading strategy

Education is essential. Most brokers offer built-in resources like articles, tutorials, and webinars to help you learn how to trade futures effectively. Many also publish regular market insights and commentary, which can help you make better-informed decisions.

To improve your results, start small, monitor your margin usage, review your trades, and stay up to date on contract expirations, rollover dates, and key economic news. Building a strategy you can stick to is the difference between guessing and trading.

FAQs

What is the best site to learn futures trading?

If you're just starting out, the CME Group's education hub is one of the best places to learn about futures trading. As the largest futures exchange in the U.S., CME offers free, high-quality content that covers everything from contract basics to advanced topics like spreads and fundamental analysis.

For platform-specific learning, tastytrade is the best option. Its real-world trading examples and built-in tutorials make it easier to understand how futures work in practice, not just in theory.

I also recommend checking out our guide on how to trade futures, which walks through the process from account setup to risk management.

Do you need $25K to day trade futures?

No, the $25,000 Pattern Day Trader (PDT) rule only applies to stocks and options. Futures trading is regulated under the Commodity Futures Trading Commission (CFTC), not FINRA, which means there’s no minimum balance requirement to day trade. This is one of the biggest advantages to futures trading.

You can trade futures with much less capital, as long as you meet your broker’s margin requirements. Some brokers allow intraday trading with margins as low as 5% to 10% of the contract value. Just remember, leverage works both ways and small price moves can lead to big gains or steep losses.

Can you practice trading futures?

Yes, and it’s one of the smartest ways to learn. Paper trading lets you place simulated futures trades using virtual money in live market conditions. It’s ideal for learning how leverage, contract sizing, and margin work, all without risking real capital.

Charles Schwab offers one of the best paper trading platforms through thinkorswim’s paperMoney, where you can test strategies using the full suite of futures tools, including ladder trading, charts, and order types.

Practicing before going live is valuable for both new and experienced traders. It helps you refine your approach and reduce the chance of emotional or margin-related mistakes.

Which trading platform is best for beginners?

For new futures traders, the best platform for beginners is one that teaches as you go. That’s why tastytrade is my top pick. Its clear tutorials, product explainers, and built-in education help you understand every step of the process.

Charles Schwab is another strong option, especially if you’re already trading stocks or options. The thinkorswim platform includes paperMoney, so you can practice trading futures risk-free. Their “Looking to the Futures” newsletter is also great for learning how futures respond to market shifts.

Webull appeals to mobile-first traders who like learning from community discussions, but it lacks the educational depth of more structured platforms.

Start with a platform that gives you the tools to grow, manage risk, and build confidence over time.

What is contango?

Contango is when a futures contract is priced higher than the current spot price of the underlying asset. It’s common in markets like oil or natural gas, where storage, insurance, and time add cost to future delivery. For example, if oil trades at $70 today but the three-month futures contract is priced at $73, that market is in contango.

This setup usually reflects the market's expectation that prices will rise over time. Most futures markets, especially commodities, spend more time in contango than not.

For traders, contango matters because it can erode returns in futures-based ETFs or long-term positions. As contracts roll forward, you're often selling lower and buying higher, which creates negative carry.

Backwardation is the opposite. It occurs when futures are priced below the current spot price. A good example is the VIX (Volatility Index), where spot prices spike in volatility events, but futures trade lower as markets expect calm to return. The VIX spot price might be 45 today, while next-month futures trade closer to 21 or 20. In backwardation, rolling contracts can actually benefit long positions by capturing that positive price difference.

What is mark to market?

Mark to market is a daily accounting method used in futures trading to reflect the current value of open positions. At the end of each trading day, your futures account is adjusted based on the day’s price movement. If your position gained value, your account balance increases. If it lost value, the loss is subtracted from your balance.

This process helps ensure that gains and losses are recognized in real time, and it also determines whether your account meets the margin requirements set by your broker. If your balance falls below the required maintenance margin, you may receive a margin call and need to deposit additional funds.

Mark-to-market accounting is one of the key differences between trading futures and other types of securities like stocks, where gains and losses are usually only realized when a position is closed.

What are the hours for futures trading?

Futures trade nearly around the clock, but hours vary by exchange and product. For most contracts on the CME Group, trading opens at 6 p.m. Eastern Time on Sunday (the “open”) and continues through 5 p.m. Friday (the “close”), with a short daily pause between sessions.

That means you can trade futures overnight or in pre-market hours, making them useful for reacting to global events and macro news. I recommend bookmarking the CME’s trading calendar, which includes holiday schedules and contract-specific trading times.

Beyond futures, many brokers are now offering after hours or overnight trading on stocks and ETFs on alternative exchanges. To learn more about this new era of trading, check out our complete guide to after hours trading.

How much does it cost to trade futures?

Costs vary by broker, but you'll typically pay a per-contract commission, which can range from $0.25 to $2.50 per side. You’ll also pay exchange and clearing fees, which are passed through from the futures exchange.

Some brokers offer bundled pricing that includes all fees in one number, while others break them out separately. Market data subscriptions are often an additional monthly cost, unless waived for meeting trading minimums.

Don’t forget margin — it’s not a fee, but it does represent the capital needed to hold a position. Intraday margin requirements can be as low as 5% to 10% of the contract’s notional value, while overnight requirements are higher.

What is the best mobile app for futures trading?

Power E*TRADE Mobile is one of the most feature-rich mobile apps for trading futures. It supports ladder trading, custom charting with over 100 indicators, and advanced tools like bracket orders, which are all designed for active traders who want full control from their phone.

The app also includes predefined screeners for volatility and unusual activity, making it easier to spot trading opportunities in real time. Whether you're monitoring multiple contracts or executing trades on the go, Power E*TRADE combines functionality with intuitive design.

Can you trade futures with Fidelity?

No, Fidelity does not currently offer futures trading. The platform supports stocks, ETFs, options, bonds, mutual funds, and crypto. But futures and forex are not available.

If you're looking for a broker that supports futures, check out our full list of recommended platforms above.