Top 5 winners for education

Best broker for investor education - Charles Schwab

Charles Schwab stands out as the number one broker for investor education because it delivers breadth, quality, and variety. During my testing, I found Schwab’s courses to be incredibly useful. The Leading Economic Indicators course, part of an eight-course catalog, pulled me in for four straight hours with its depth, progress tracking, and assessment quizzes. Schwab’s education is methodically crafted to engage and empower investors, as I experienced firsthand when a single course pulled me in for hours—a true testament to the thoughtfulness of the platform.

Beyond courses, Schwab excels with live and on-demand webinars featuring interactive Q&A, and its intuitive bond education is second to none, clearly explaining everything from issuers to market mechanics. What sets Schwab apart is how seamlessly it integrates education into the platform itself. Whether you’re researching stocks or using tools, Schwab’s contextual education provides clear explanations that guide you as you trade. Schwab combines variety, accessibility, and real-world application, making it the ultimate platform for any investor serious about learning and succeeding.

Check out my Charles Schwab review to see why Schwab was my pick for #1 Overall Broker for 2025.

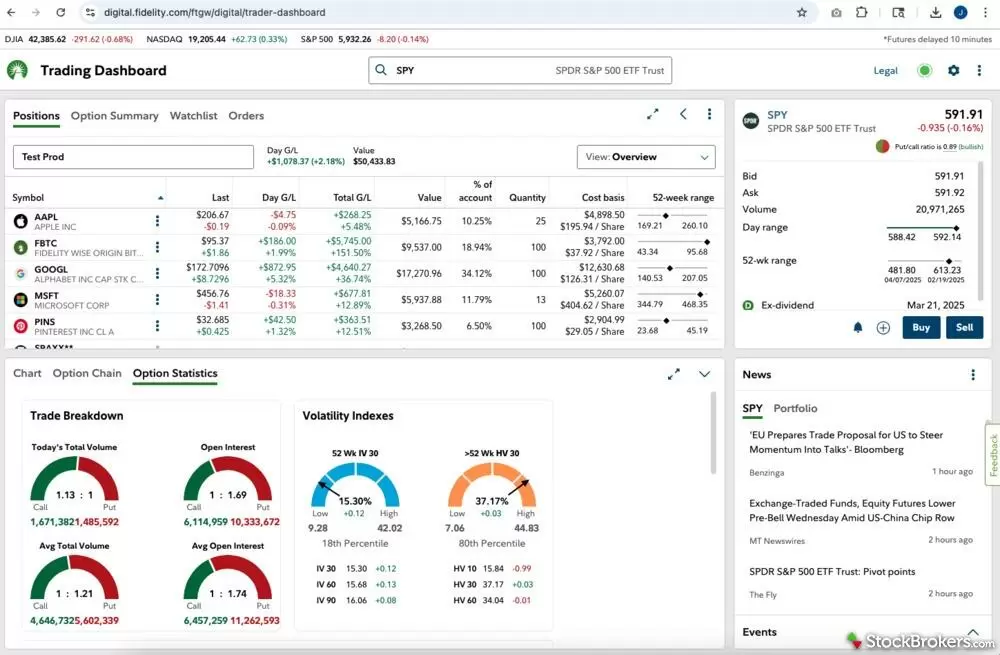

Best broker for live investor education - Fidelity

| Company |

Overall |

Minimum Deposit |

Education |

Fidelity Fidelity

|

|

$0.00 |

|

Fidelity earns second place for investor education, offering a thoughtfully curated platform with diverse ways to learn. During testing, I was impressed by its fund education, which dives into advanced topics like share creation, arbitrage, futures-based exchange-traded notes (ETNs), and even contango and backwardation. Its fixed-income education stood out for its timeliness, providing clear insights on navigating changing interest rate environments while helping investors understand products, strategies, and the impact of macro trends. Fidelity’s options strategy guide was another favorite, breaking down everything from single to complex four-legged strategies in an engaging and accessible way—no small feat for such a complex topic.

Fidelity also excels with its variety of learning formats. Live sessions led by their highly educated strategy desk, the Women Investing series, and webinars covering a range of topics ensure investors feel supported and informed. Its macroeconomic content is timely and actionable, explaining market movements, portfolio strategies, and key trends to watch. However, I found that Fidelity could better connect these advanced insights to foundational concepts, such as understanding indexes or economic data. Even so, Fidelity’s depth, live interaction opportunities, and timely resources make it a top choice for investors looking to expand their knowledge and confidently apply what they’ve learned.

Read my Fidelity review to learn more.

Best investor education learning center - Interactive Brokers

Often, brokerage firms miss the mark when it comes to covering the basics. In my view, these foundational concepts must be explained clearly and correctly because knowledge, much like investing, is compounding. Interactive Brokers (IBKR) gets this right. The Trader’s Academy excels at breaking down core concepts through its CFA-accredited courses, which build on one another to deepen understanding over time. The Introduction to the Stock Market course is a perfect example, starting with the fundamentals and layering in actionable steps, culminating in a platform tutorial that bridges theory with practice. By structuring education this way, IBKR ensures that investors of all levels can build a solid foundation and grow their expertise.

IBKR also goes beyond the basics with a wealth of resources, including webinars on diverse topics like market fundamentals, women in finance, and investing in AI. Its dedicated economics section dives into key global indicators, offering insights into how macroeconomic trends impact markets. Importantly, IBKR’s education platform is separate yet highly organized, making it easy to navigate and apply what you’ve learned. For investors looking to grow their knowledge, IBKR delivers an educational experience that compounds value with every resource.

Check out my Interactive Brokers review to learn more.

Comprehensive investor education content - E*TRADE from Morgan Stanley

| Company |

Overall |

Minimum Deposit |

Education |

E*TRADE E*TRADE

|

|

$0.00 |

|

E*TRADE’s educational offering stands out for its quality and depth, even though the organization could be improved—a common theme among brokers. The content is well-written, easy to understand, and commendable for its focus on important topics. Polished videos and thoughtful insights, like how market mechanics influence ETFs more than mutual funds, demonstrate the platform’s commitment to delivering valuable education – a topic many others overlook.

I particularly appreciated the comprehensive fixed-income education. E*TRADE provides a detailed breakdown of different products, why you might use them, how to trade them, and even key terminology. The integration of Morgan Stanley’s thought leadership is another strong point, with a dedicated section in the Knowledge Center covering current events alongside actionable educational insights to help you understand them. Contextual education is woven throughout the platform, and I especially liked the hover-over definitions, allowing me to stay on the page while learning. E*TRADE delivers a robust library of content, proving that quality education is its strongest asset.

Read my E*TRADE review to learn more.

Best tool integrated investor education - Merrill Edge Self-Directed

| Company |

Overall |

Minimum Deposit |

Education |

Merrill Edge Merrill Edge

|

|

$0.00 |

|

Merrill Edge excels at integrating education directly into the investing experience, making it easy to learn while you research, trade, and explore the platform. During testing, I found tools like the Options Strategy Assistant especially helpful—it guided me through understanding how options work, constructing trades, and analyzing strategies, seamlessly combining education with application. For life-stage planning, Merrill’s Guidance and Retirement Center offers standout resources like the Social Security Calculator, which breaks down collection strategies with clear, actionable insights tailored to your goals.

However, Merrill’s education platform could be more comprehensive. Macro education is limited, lacking foundational content on how the stock market works or key economic principles, which may leave beginners wanting more. While Morningstar courses and on-demand webinars are available, they feel static and would benefit from live Q&A sessions for added engagement. Topics like stocks, funds, and fixed income are covered, but only at a surface level—deeper, story-driven formats like Stock Story could add real value. Merrill Edge is a solid choice for investors who prioritize contextual education integrated into the platform.

Read my Merrill Edge Self-Directed review to learn more.

Our testing

Why you should trust us

Jessica Inskip is Director of Investor Research at StockBrokers.com, bringing 15 years of experience in brokerage and trading strategy. A former FINRA-licensed rep, she held Series 7, 63, 66, and 4 licenses. Jessica focuses on investor education and brokerage industry research, appears regularly on CNBC, Bloomberg, The Schwab Network, Fox Business, and Yahoo! Finance, and hosts the Market MakeHer podcast.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Trading platforms tested

We tested 14 online trading platforms for this guide: