Public.com Review

Public.com is built for investors who care as much about experience as they do about access. From the moment you open the app, it’s clear the platform prioritizes clean design, simple navigation, and an investing experience that feels approachable rather than overwhelming.

That focus on ease doesn’t mean Public lacks ambition. The firm is experimenting with new ways to help investors explore ideas and put cash to work, especially in areas like thematic investing and fixed income. Still, Public isn’t aiming to compete with full-scale trading platforms. Its strengths lie in simplicity and innovation, while depth, advanced tools, and account flexibility take a back seat. For the right investor, that tradeoff works. For others, Public is best viewed as a complement, not a cornerstone.

-

Minimum Deposit:

$20.00 -

Stock Trades:

$0.00 -

Options (Per Contract):

$0.00

| Range of Investments | |

| Mobile Trading Apps | |

| Advanced Trading | |

| Research | |

| Education | |

| Ease of Use | |

| Customer Service | N/A |

Check out StockBrokers.com's picks for the best stock brokers in 2026.

| #1 AI Tool | Winner |

| #1 Crypto Trading | Winner |

| 2026 | #12 |

| 2025 | #13 |

| 2024 | #17 |

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

- Sleek, minimalist platform that's easy to navigate.

- Creative AI idea generation with “Generated Assets.”

- High-Yield Cash Account offers up to $5 million in FDIC insurance.

- Low borrowing costs (4.90% for balances under $50,000).

- Access to stocks, ETFs, crypto, and bonds.

Cons

- Essential market data locked behind a paywall.

- Weak options tools lack critical data like bid/ask spreads and Greeks.

- No streaming quotes.

- No support for custodial, trust, SEP IRA, or business accounts.

- Basic tasks, like adding a beneficiary, require manual emailed forms.

My top takeaways for Public.com in 2026:

- Polished design, paid data: Public delivers one of the most modern brokerage experiences available, but many standard tools sit behind a Premium paywall that other brokers include by default.

- Creative ideas, missing fundamentals: Features like Generated Assets and simplified Treasury investing show real innovation, yet gaps in options data and account availability hold the platform back.

- Strong companion, weak centerpiece: Public shines as a place for cash, Treasuries, crypto, or passive investing, but it lacks the depth and flexibility to replace a primary brokerage.

Range of investments

Public.com offers a modern mix of investments, but its range only goes so far once you start thinking about long-term wealth structure. For investors using a simple individual or joint account, the lineup is appealing. For anyone managing family assets or more complex financial needs, the limitations show up quickly.

Automated investments: On the investment side, Public checks a lot of boxes. You get access to stocks, ETFs, options, and fractional shares, along with a large selection of cryptocurrencies. Fixed income is another asset, with Treasuries and bonds presented in a way that feels far more approachable than at most brokers. Automated investment plans make it easy to invest around themes or build a diversified portfolio with minimal effort, though fees can apply depending on your subscription.

Limited accounts: Where Public falls short is in account flexibility. The platform supports individual and joint taxable accounts plus Traditional and Roth IRAs, but that’s where the list ends. There are no custodial accounts, trusts, SEP IRAs, or business accounts, which makes it difficult to use Public if you’re a parent saving for your children or income tied to a business.

Even basic account maintenance feels more manual than it should. Adding a beneficiary requires emailing support and completing a physical form, a surprising friction point for a platform that otherwise leans so heavily into modern design. You can trade cutting-edge assets, but handling the fundamentals of long-term ownership still feels stuck in the past.

| Feature |

Public.com Public.com

|

|---|---|

| Stock Trading | Yes |

| Account Feature - Margin Trading | Yes |

| Fractional Shares (Stocks) | Yes |

| OTC Stocks | Yes |

| Options Trading | Yes |

| Complex Options Max Legs | 4 |

| Fixed Income (Treasurys) | Yes |

| Futures Trading | No |

| Forex Trading | No |

| Crypto Trading | Yes |

| Crypto Trading - Total Coins | 40 |

| Traditional IRAs | Yes |

| Roth IRAs | Yes |

| Advisor Services | No |

Public.com fees

Public.com’s pricing is a bit of a tradeoff. On one hand, trading costs are extremely low. On the other, many features investors expect to be standard sit behind a subscription. For casual investors, that balance can work. For more active traders, the paywall becomes harder to ignore.

The basics are strong. Stock and ETF trades are commission-free, and options trades cost $0 per contract, which still puts Public ahead of most competitors. Public also offers an Options Rebate Program that can pay rebates per contract if you enroll.

Margin fees: Margin pricing is a standout: 4.90% for balances up to $50,000 (rates tier down from there). For investors who use margin, that alone makes Public worth a look.

Subscription fees: The downside is the subscription model. Access to advanced portfolio data, Morningstar research, and extended-hours trading requires Public Premium unless your account exceeds $50,000. Smaller accounts end up paying for tools that are free at brokers like Fidelity and Schwab. Outgoing ACAT transfers cost $100. If you’re moving an IRA, confirm any additional custodian/termination fees before initiating the transfer.

| Feature |

Public.com Public.com

|

|---|---|

| Minimum Deposit | $20.00 |

| Stock Trades | $0.00 |

| Penny Stock Fees (OTC) | $2.99 |

| Options (Per Contract) | $0.00 |

| Options Exercise Fee | $0.00 |

| Options Assignment Fee | $0.00 |

| Futures (Per Contract) | (Not offered) |

| Mutual Fund Trade Fee | n/a |

| Broker Assisted Trade Fee | n/a |

Mobile trading apps

Public.com is clearly built with mobile in mind. The app is clean, intuitive, and one of the better-looking trading apps available. For passive investors who want to invest regularly or check in on their portfolio, the experience feels effortless.

Market data: The mobile app also does a better job than the web platform at presenting market context. The Markets tab includes earnings calendars, index performance, Treasuries, and even a yield curve view. I found this section especially useful for getting a quick snapshot of the day. Alpha AI summaries make it easy to skim market news and quickly understand the context behind major market moves.

Public.com’s Markets screen on mobile looks nice. It has a clean layout, is easy to scan, and shows the major indices and top movers. That said, it’s definitely on the basic side. The earnings calendar is pretty limited, and if you’re looking for deeper insight or tools, you might find yourself wanting more. Still, it’s a nice starting point for a quick market check.

Limited analysis: Where the app falls short is on the technical side. Mobile charts don’t support technical indicators, and quotes are real-time but not streaming, which limits their usefulness for timing trades. The options trading experience follows the same pattern. While placing trades is straightforward, the options chain omits key data like bid-ask spreads, Greeks, and liquidity, making it difficult to evaluate risk with confidence.

Overall, Public’s mobile app excels at simplicity and accessibility, but it’s not built for active or technically driven trading. I would feel comfortable using it for long-term, hands-off investing, but not for managing more complex or time-sensitive trades.

| Feature |

Public.com Public.com

|

|---|---|

| iPhone App | Yes |

| Android App | Yes |

| Apple Watch App | No |

| Stock Alerts | No |

| Charting - After-Hours | No |

| Charting - Technical Studies | 0 |

| Charting - Study Customizations | No |

| Watchlist (Streaming) | No |

| Mobile Watchlists - Create & Manage | No |

| Mobile Watchlists - Column Customization | Yes |

Research

Public.com takes a very different approach to research than most traditional brokerages. Instead of dense reports and robust screeners, the platform leans into AI-driven tools and clean visual design. If you’re looking for deep fundamental analysis or technical precision, you’ll likely come up short. If your goal is idea generation and an easier way to explore fixed income, Public offers something more approachable.

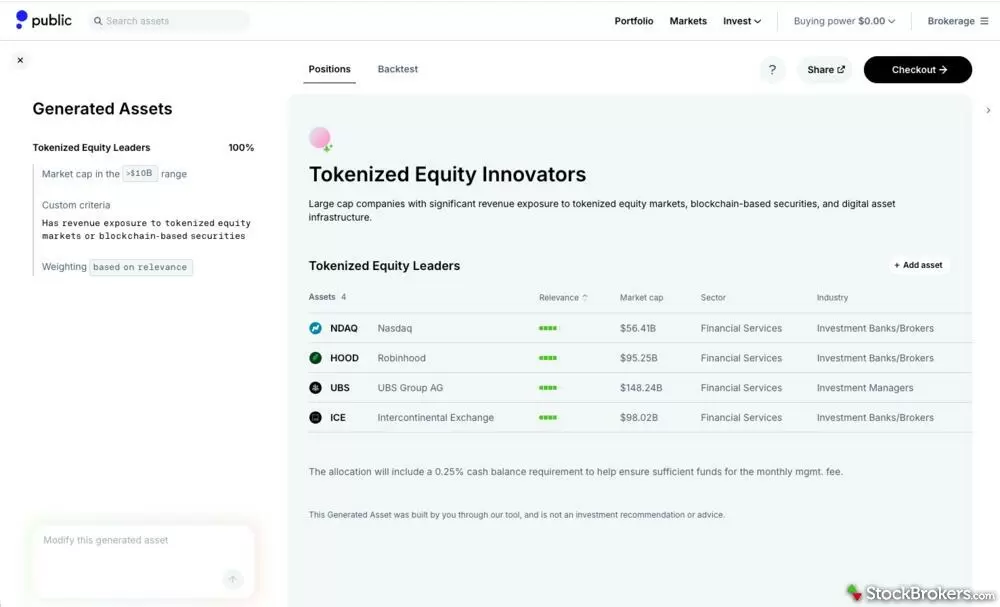

Research innovation: The clear standout is the Generated Assets tool, which earned Public our top industry award for AI innovation. It allows investors to turn plain-language prompts into themed, investable indexes, backtest them against the S&P 500, and allocate capital directly to the Generated Asset they create. I found it especially useful for brainstorming and exploring themes, though it’s better suited for comparing growth performance than evaluating total return, since dividends aren’t fully reflected.

An example of Public.com’s innovative screening tool, used to identify large-cap stocks with revenue exposure to tokenization and tokenized securities based on user-defined criteria.

Visual tools: Public makes finding and evaluating bonds far less intimidating than at most brokers. Visual tools help illustrate the relationship between price and yield, and the liquidity score adds helpful context for newer investors. The Treasury Account builds on this strength, offering a streamlined way to create a treasury ladder without the usual complexity.

Limited analysis tools: Beyond those areas, the research experience thins out quickly. Advanced charting and Morningstar ratings are locked behind the Premium subscription, and key tools like an economic calendar are missing altogether. Options research is the weakest area. The Options Hub emphasizes percent-to-breakeven while leaving out essential data like bid-ask spreads and leg-level pricing, making it difficult to assess risk. For a platform that supports options trading, these omissions are hard to overlook.

Public.com’s options chain looks clean, but it’s missing a lot of the critical info needed to actually make informed trading decisions. There’s no bid-ask spread, no implied volatility, and no real sense of liquidity, just the bare bones. It’s a nice-looking interface, but for serious options traders, it falls short where it counts.

Public has also expanded its platform with tools aimed at more advanced investors. The firm now offers Direct Indexing with a relatively low $1,000 minimum investment, making personalized index-based investing far more accessible than many competitors that require six-figure minimums. In addition, Public provides a commission-free Trading API with full read and write access, allowing investors and developers to programmatically access data and execute trades. These features signal a clear push toward supporting more sophisticated workflows, even if they exist alongside a platform that still prioritizes simplicity in other areas.

Jessica's take:

"Public is doing some genuinely innovative things, especially with Generated Assets and fixed income. It’s exciting to see a broker rethink how investors generate ideas. That said, innovation doesn’t replace fundamentals. Across the platform, the lack of depth in data, account types, and tools makes it hard to rely on Public as a primary brokerage."

| Feature |

Public.com Public.com

|

|---|---|

| Research - Stocks | Yes |

| Stock Research - ESG | No |

| Stock Research - PDF Reports | 0 |

| Screener - Stocks | No |

| Research - ETFs | Yes |

| Screener - ETFs | No |

| Research - Mutual Funds | No |

| Screener - Mutual Funds | No |

| Research - Pink Sheets / OTCBB | Yes |

| Research - Fixed Income | No |

Education

Public.com has clearly invested in expanding its educational content, and the result is a large, visually polished library that covers a wide range of investing topics. At a glance, it’s impressive. In practice, the experience often feels more like skimming than studying.

Unclear navigation: Navigation is the biggest challenge. The learning center feels detached from the rest of the platform, and finding specific content isn’t always easy. There’s no dedicated search within the education hub, and I often had to rely on Google to locate articles hosted on Public’s own site. That separation carries into the trading experience as well. Educational content isn’t meaningfully integrated into charts, options chains, or research pages, so learning often requires stepping away from what you’re doing.

Public.com’s education center is truly the standout feature of the platform, comprehensive, easy to read, and impressively broad in scope. From investing fundamentals to more advanced topics, the content is thoughtfully written and approachable for all experience levels. It’s one of the most user-friendly educational hubs in the brokerage space.

Content quality: The quality of the content itself is uneven. Fixed income education stands out, with clear explanations that pair well with Public’s bond and Treasury offerings. Other areas don’t hold up as well. Technical analysis articles tend to be text-heavy and light on visuals, which makes learning chart-based concepts harder than it should be. Options education is particularly mixed, with high-level explanations that occasionally include imprecise or confusing language. It gives the impression that some content was created to check boxes rather than teach skills.

Public also misses an opportunity to support learning through practice. There’s no paper trading, no quizzes, and no progress tracking. Aside from a basic savings calculator, there are few tools to help investors apply what they’re reading. As a result, the education center works best as a reference for definitions and overviews, but I wouldn’t rely on it as a primary resource for learning how to trade or invest with confidence.

| Feature |

Public.com Public.com

|

|---|---|

| Education (Stocks) | Yes |

| Education (ETFs) | Yes |

| Education (Options) | Yes |

| Education (Mutual Funds) | No |

| Education (Fixed Income) | Yes |

| Education (Retirement) | Yes |

| Videos | Yes |

| Webinars | Yes |

| Progress Tracking | No |

| Interactive Learning - Quizzes | No |

Banking services

Public.com isn’t trying to be a full-service bank. There’s no checking account, debit card, or bill pay, so it’s not built for everyday spending. Where Public excels is cash management. The High-Yield Cash Account offers up to $5 million in FDIC insurance, well above industry norms, and the Treasury Account provides a tax-efficient way to earn yield on idle cash. Public’s banking features are designed with one goal in mind: putting unused cash to work, not replacing your bank.

| Feature |

Public.com Public.com

|

|---|---|

| Bank (Member FDIC) | No |

| Checking Accounts | No |

| Savings Accounts | No |

| Credit Cards | No |

| Debit Cards | No |

| Mortgage Loans | No |

Public.com IRA review

Public.com offers a clean, approachable way to start saving for retirement, but it lacks the administrative depth found at more established brokerages. For W-2 employees opening a Traditional or Roth IRA and setting up recurring contributions, the experience is smooth and intuitive. For self-employed investors or anyone with more complex retirement needs, the platform quickly feels restrictive.

Public supports only Traditional and Roth IRAs. The absence of SEP and SIMPLE IRAs is a meaningful gap, especially for freelancers and small business owners who rely on those account types. For eligible investors, though, the automation tools work well. Recurring investments into stocks, ETFs, or crypto make dollar-cost averaging straightforward and easy to maintain.

The biggest weakness is account administration. Assigning a beneficiary still requires emailing customer support and completing a physical form, a frustrating step for a platform that otherwise emphasizes digital convenience. While there is no annual IRA maintenance fee, the $150 termination fee stands out as unusually steep. Public makes it easy to open an IRA, but transferring one out comes at a cost.

Public.com crypto review

Public.com treats crypto as just another asset class rather than a standalone ecosystem. For investors who want exposure to Bitcoin (BTC), Ethereum (ETH), or Solana (SOL) without opening a separate crypto exchange account, the experience is simple and well integrated. For more crypto-native users who care about self-custody, staking, or on-chain activity, the platform will feel limiting.

Public offers access to more than 40 cryptocurrencies, covering the major names along with a handful of altcoins. Buying crypto is as easy as placing a stock trade, though it comes at a cost. Standard crypto transactions carry a fee of around 1.25%, which is meaningfully higher than the commission-free structure used for stocks and ETFs. While transfers are supported through a third-party custodian, the platform clearly encourages a buy-and-hold approach rather than active crypto management.

Where Public gets creative is in how it handles staking. Instead of offering native on-chain staking, the platform provides access to staking-focused ETFs that hold the underlying crypto and distribute staking rewards as dividends. I view this as a clever workaround that fits within traditional brokerage rails and regulatory constraints, even if it falls short for investors looking for true DeFi participation.

Final thoughts

Public.com stands out as one of the most visually polished brokerages available. The platform replaces the cluttered, spreadsheet-heavy feel of traditional finance with a clean, modern experience that lowers the barrier for beginner traders getting started. For investors focused on passive wealth building, like automated investing, earning yield on cash, or building a Treasury ladder, Public offers a smooth, easy to navigate environment. Its use of tools like Generated Assets and its approachable fixed-income research show real creativity in areas where many legacy brokers still lag.

That said, the platform’s limits become more obvious over time. Standard data behind a subscription, and the lack of basic account types like custodial or trust accounts, make it difficult to rely on Public as a long-term financial home. I often found myself impressed by the design while running into unnecessary steps on simple administrative tasks.

Public works best as a complement rather than a replacement. It’s a strong option for holding crypto, earning yield on cash, or exploring investment ideas, but until it expands its account offerings and back-office capabilities, it remains better suited as a “sidecar” than a primary brokerage.

Public.com Star Ratings

| Feature |

Public.com Public.com

|

|---|---|

| Overall |

|

| Range of Investments |

|

| Mobile Trading Apps |

|

| Advanced Trading |

|

| Research |

|

| Customer Service | N/A |

| Education |

|

| Ease of Use |

|

StockBrokers.com Review Methodology

Why you should trust us

Jessica Inskip is Director of Investor Research at StockBrokers.com, bringing 15 years of experience in brokerage and trading strategy. A former FINRA-licensed rep, she held Series 7, 63, 66, and 4 licenses. Jessica focuses on investor education and brokerage industry research, appears regularly on CNBC, Bloomberg, The Schwab Network, Fox Business, and Yahoo! Finance, and hosts the Market MakeHer podcast.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Trading platforms tested in 2026

We tested 14 online trading platforms in 2026:

Read next

Popular Guides

- Best Day Trading Platforms of 2026 for Beginners and Active Traders

- Best Futures Trading Platforms for 2026

- Best Brokers for Penny Stock Trading of 2026

- Best Options Trading Platforms for 2026

- Best Stock Trading Apps for 2026

- Best Stock Brokers for 2026

- Best Paper Trading Apps & Platforms for 2026

- Best Stock Trading Platforms for Beginners of 2026

More Guides

About Public.com

Public.com is the trade name for Open to the Public Investing, Inc., a brokerage firm headquartered in New York City. While the company was originally registered back in 2004, the Public brand as we know it today really took shape in 2019 with a mission to make investing more inclusive, transparent, and community-driven.