Range of investments

Bottom line: J.P. Morgan Self-Directed Investing and Public.com both cover the basics—stocks, options, margin, fractional shares, and OTC (over-the-counter) stocks—while skipping forex and futures. The key difference is focus: J.P. Morgan adds mutual funds and access to advisor services, whereas Public.com brings crypto trading (40 coins) but no mutual funds or advice. For Range of Investments, both earn 3.5 out of 5 stars, with StockBrokers.com ranking Public.com slightly higher (#12 of 14) than J.P. Morgan (#13 of 14).

What you can trade: J.P. Morgan Self-Directed Investing supports stocks, options, margin, fractional shares, OTC stocks, and mutual funds; it does not offer crypto, forex, or futures, and it provides advisor services if you want guidance. Public.com supports stocks, options, margin, fractional shares, OTC stocks, and crypto (40 coins); it does not offer mutual funds, forex, or futures, and it does not provide advisor services.

Account types: Both brokers offer Traditional and Roth IRAs, so retirement savers can use either. Choose J.P. Morgan if mutual funds and professional advice matter most; pick Public.com if crypto access is a priority alongside stock and options trading.

|

Feature |

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

Public.com Public.com

|

|

Stock Trading

info

|

Yes

|

Yes

|

|

Account Feature - Margin Trading

info

|

Yes

info |

Yes

|

|

Fractional Shares (Stocks)

info

|

Yes

|

Yes

|

|

OTC Stocks

info

|

Yes

|

Yes

|

|

Mutual Funds

info

|

Yes

|

No

|

|

Options Trading

info

|

Yes

|

Yes

|

|

Futures Trading

info

|

No

|

No

|

|

Crypto Trading

info

|

No

|

Yes

|

|

Crypto Trading - Total Coins

info

|

0

|

40

|

|

Range of Investments

|

|

|

Dive deeper: Best Options Trading Platforms for 2026, Best Futures Trading Platforms for 2026

Trading platforms and tools

Bottom line: If you need more capable charting and richer watchlists, J.P. Morgan Self-Directed Investing edges out Public.com. Both are web-only with very basic toolsets, but J.P. Morgan includes 36 technical indicators, 10 drawing tools, and corporate events on charts, plus larger watchlists. Public.com is simpler with none of those charting features and minimal watchlist fields. StockBrokers.com rates both platforms 1 out of 5 stars, ranking J.P. Morgan 13th of 14 and Public.com 14th of 14 for trading platforms and tools.

Platform access is similar: neither broker offers a downloadable desktop platform for Windows or Mac, and both rely on a browser-based experience. Paper trading and trading journals are not available, and you can’t adjust open orders directly from charts on either platform. Watchlists are where they diverge—J.P. Morgan supports up to 20 columns (fields), while Public.com limits you to 3.

For charting, J.P. Morgan provides 36 indicators and 10 drawing tools, and you can display corporate events like earnings, splits, and dividends. Public.com offers 0 indicators and 0 drawing tools, and it doesn’t show corporate events on charts. On both brokers, you can’t add notes to charts, show your historical trades, set custom date ranges, run automated pattern recognition, save multiple chart layouts, or create custom studies. Editing a simple SMA study is also more flexible with J.P. Morgan (3 fields) versus Public.com (0 fields).

|

Feature |

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

Public.com Public.com

|

|

Web Trading Platform

info

|

Yes

|

Yes

|

|

Desktop Trading Platform

info

|

No

|

No

|

|

Desktop Platform (Mac)

info

|

No

|

No

|

|

Paper Trading

info

|

No

|

No

|

|

Watchlists - Total Fields

info

|

20

|

3

|

|

Charting - Indicators / Studies

info

|

36

|

0

|

|

Charting - Drawing Tools

info

|

10

|

0

|

|

Advanced Trading

|

|

|

Dive deeper: Best Stock Brokers for 2026, Best Paper Trading Apps & Platforms for 2026

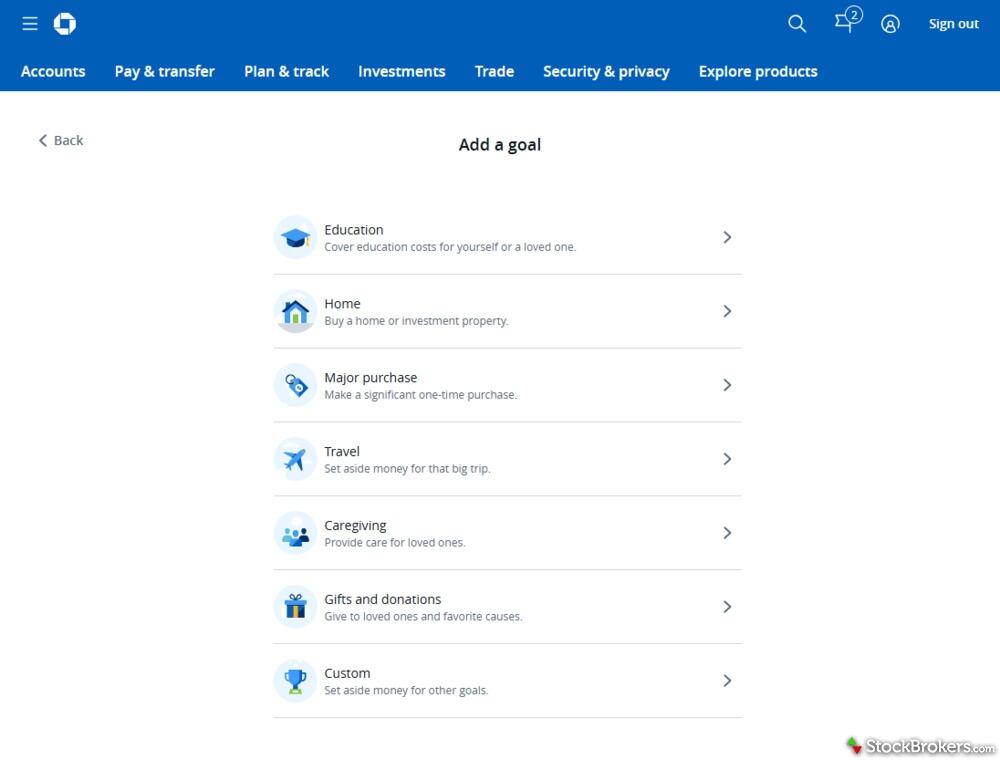

A full-featured account for investing

Get up to $1K on new brokerage account*

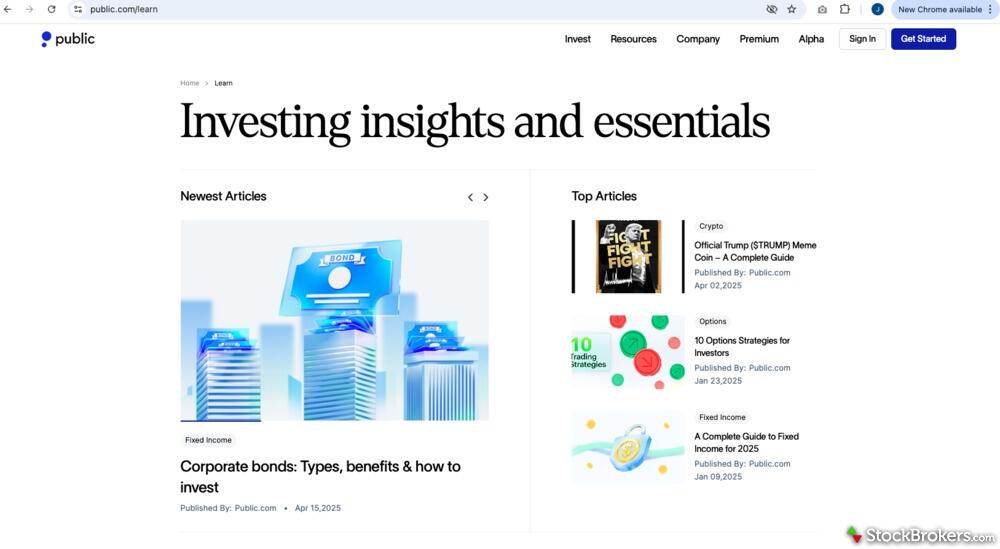

Beginners and education

J.P. Morgan Self-Directed Investing and Public.com both cater to beginners with clear lessons on stocks, ETFs, options, and bonds. Each offers educational videos and webinars to help you build core investing knowledge. J.P. Morgan adds coverage of mutual funds, which Public.com does not. Neither platform offers paper trading, educational quizzes, or tools to track your learning progress.

For education quality, StockBrokers.com rates J.P. Morgan Self-Directed Investing 4 out of 5 stars and ranks it 4th out of 14 brokers, while Public.com earns 3.5 out of 5 stars and ranks 8th. If mutual fund guidance or a higher education score matters to you, J.P. Morgan has the edge; if you want solid coverage of stocks, ETFs, options, and bonds with videos and webinars, both platforms deliver.

|

Feature |

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

Public.com Public.com

|

|

Education (Stocks)

info

|

Yes

|

Yes

|

|

Education (ETFs)

info

|

Yes

|

Yes

|

|

Education (Options)

info

|

Yes

|

Yes

|

|

Education (Mutual Funds)

info

|

Yes

|

No

|

|

Education (Fixed Income)

info

|

Yes

|

Yes

|

|

Videos

info

|

Yes

|

Yes

|

|

Webinars

info

|

Yes

|

Yes

|

|

Education

|

|

|

Dive deeper: Best Stock Trading Platforms for Beginners of 2026

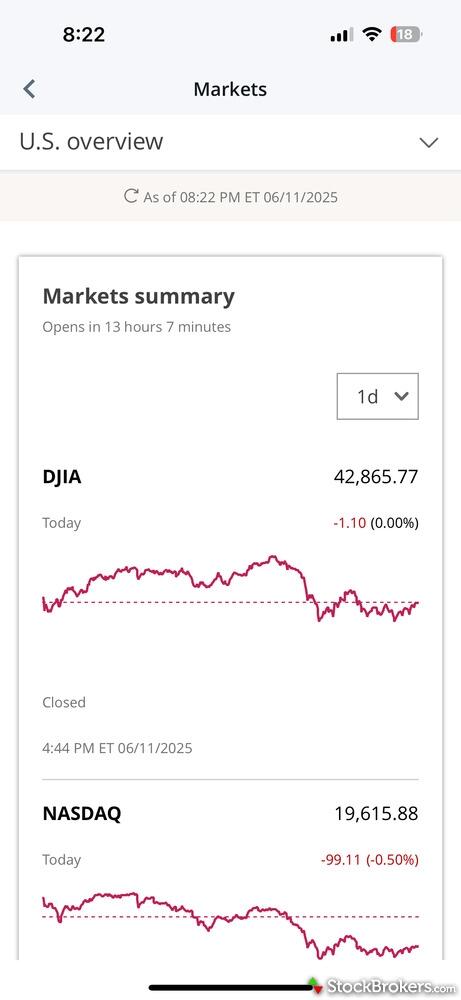

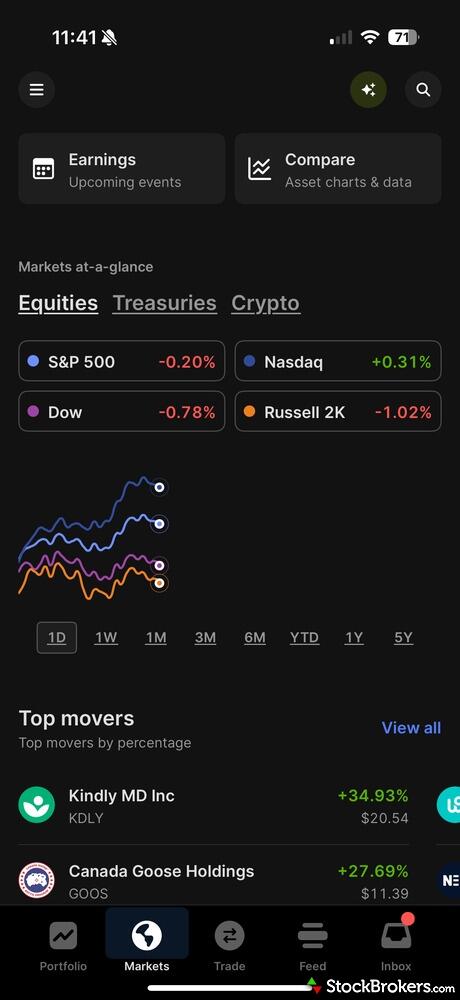

Stock trading apps

Bottom line: J.P. Morgan Self-Directed Investing generally offers a more capable mobile stock trading experience than Public.com. J.P. Morgan earned 4 stars and ranks #10 out of 14 brokers for stock trading apps, while Public.com earned 3 stars and ranks #13, according to StockBrokers.com. J.P. Morgan stands out for alerts, watch list tools, landscape charting, and 36 built-in technical studies, whereas Public.com trails on research depth but does let you compare stocks directly on a chart.

Both J.P. Morgan Self-Directed Investing and Public.com have iPhone and Android apps, and neither has an Apple Watch app. J.P. Morgan does not support after-hours trading on mobile; Public.com’s status for mobile after-hours trading was not specified. Both apps support mobile options trading. Neither app provides streaming quotes, streaming live TV, or videos on demand. J.P. Morgan offers stock alerts, while Public.com does not. J.P. Morgan lets you create custom watch lists; Public.com does not, though both let you customize watch list columns.

For charts, J.P. Morgan is better if you value technical analysis: it supports landscape view, multiple time frames, and 36 technical studies. Public.com also supports multiple time frames but lacks landscape mode and has no technical studies. If you like comparing symbols directly on a chart, Public.com includes that feature while J.P. Morgan does not. Neither app offers after-hours charting.

|

Feature |

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

Public.com Public.com

|

|

iPhone App

info

|

Yes

|

Yes

|

|

Android App

info

|

Yes

|

Yes

|

|

Apple Watch App

info

|

No

|

No

|

|

Stock Alerts

info

|

Yes

|

No

info |

|

Charting - After-Hours

info

|

No

|

No

|

|

Charting - Technical Studies

info

|

36

|

0

|

|

Mobile Trading Apps

|

|

|

Dive deeper: Best Stock Trading Apps for 2026

Fees

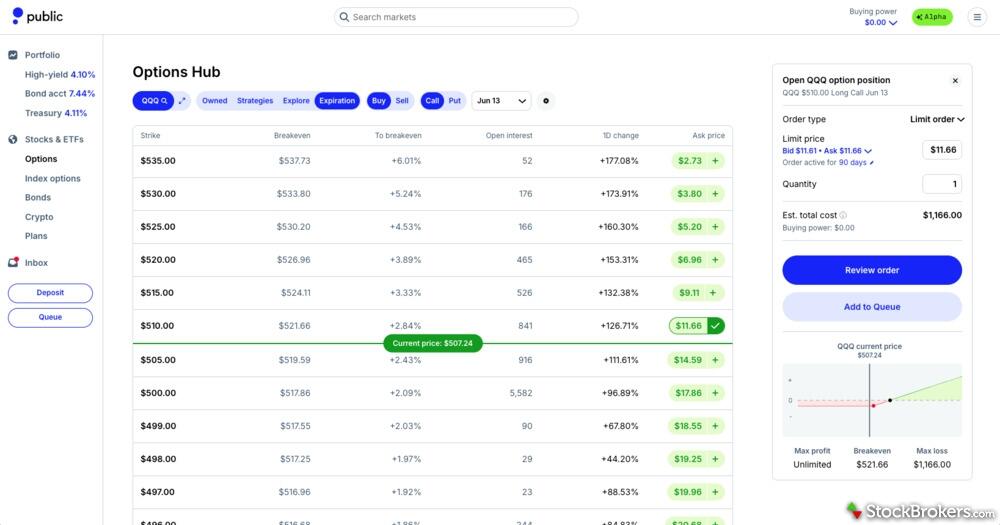

Bottom line: J.P. Morgan Self-Directed Investing vs Public.com comes down to what you value. Public.com is the cheaper pick for options and margin borrowing, while J.P. Morgan is lighter on certain account-level charges and has no minimum to open. Public.com charges $0 per options contract and offers lower margin rates (5.65% under $50,000; 5.50% for $50,000–$99,999), beating J.P. Morgan’s $0.65 per contract and higher margin rates (12.25% under $25,000; 12% for $25,000–$49,999; 11.5% for $50,000–$99,999). J.P. Morgan pushes back with a $0 minimum deposit, lower ACAT fees, and a cheaper IRA closure fee.

Trading costs are simple: both brokers charge $0 for stock trades. Options pricing differs—Public.com is $0 per contract while J.P. Morgan Self-Directed Investing is $0.65 per contract; both list $0 for option exercises and assignments. Margin is where Public.com stands out, with rates of 5.65% below $50,000 and 5.50% for $50,000–$99,999, compared with J.P. Morgan’s 12.25%, 12%, and 11.5% across the same tiers.

For account fees and other charges, J.P. Morgan Self-Directed Investing has a $0 minimum deposit, whereas Public.com requires $20. Both have $0 IRA annual fees, but closing an IRA costs $75 at J.P. Morgan and $150 at Public.com. Transfer fees also favor J.P. Morgan: ACAT partial is $0 and full is $75, versus Public.com’s $100 for partial and $100 for full transfers.

|

Feature |

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

Public.com Public.com

|

|

Minimum Deposit

info

|

$0.00

|

$20.00

|

|

Stock Trades

info

|

$0.00

|

$0.00

info |

|

Options (Per Contract)

info

|

$0.65

|

$0.00

info |

|

Options Exercise Fee

info

|

$0.00

|

$0.00

|

|

Options Assignment Fee

info

|

$0.00

|

$0.00

|

|

IRA Annual Fee

info

|

$0.00

|

$0.00

|

|

IRA Closure Fee

info

|

$75.00

|

$150.00

|

Dive deeper: Best Free Trading Platforms for 2026

Day Trading

When comparing J.P. Morgan Self-Directed Investing to Public.com for day trading capabilities, neither platform offers features typically desired by active traders. Both J.P. Morgan Self-Directed Investing and Public.com lack streaming time and sales for stocks, direct market routing, and the option to use trading hotkeys for faster trade entry. They also do not provide Level 2 quotes, which are essential for gaining deeper insight into market activities.

Furthermore, neither platform supports advanced trading tools such as ladder trading and strategy backtesting, whether basic or advanced. The absence of order liquidity rebates and a short locator tool, which helps traders identify available shares to short, further highlights the limitations of both platforms for day trading. These similarities indicate that individuals seeking a platform with comprehensive day trading features might need to explore alternatives beyond J.P. Morgan Self-Directed Investing and Public.com.

|

Feature |

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

Public.com Public.com

|

|

Streaming Time & Sales

info

|

No

|

No

|

|

Streaming TV

info

|

No

|

No

|

|

Direct Market Routing - Equities

info

|

No

|

No

|

|

Level 2 Quotes - Stocks

info

|

No

|

No

|

|

Trade Ideas - Backtesting

info

|

No

|

No

|

|

Trade Ideas - Backtesting Adv

info

|

No

|

No

|

|

Short Locator

info

|

No

|

No

|

Dive deeper: Best Day Trading Platforms of 2026 for Beginners and Active Traders

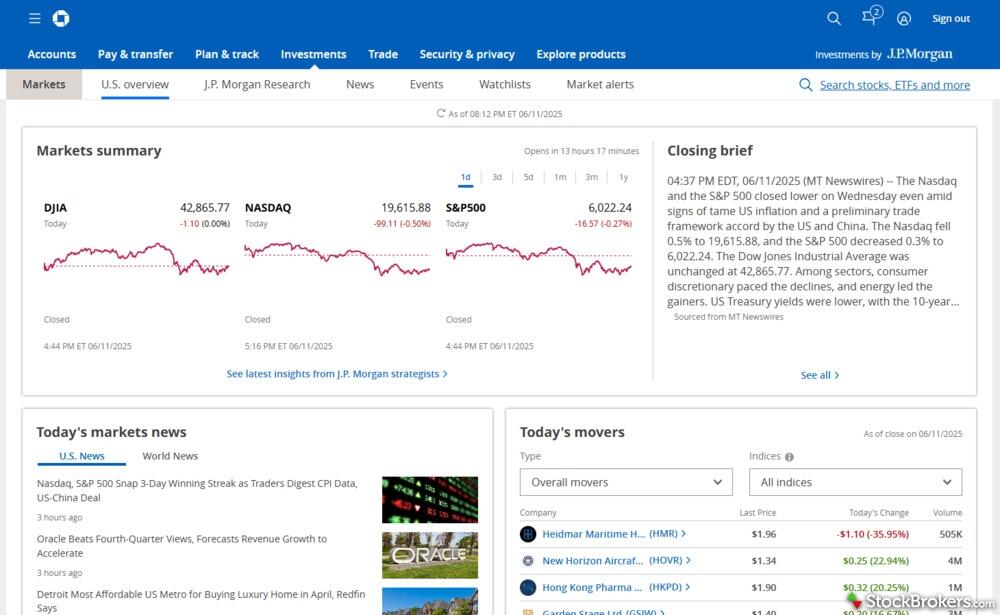

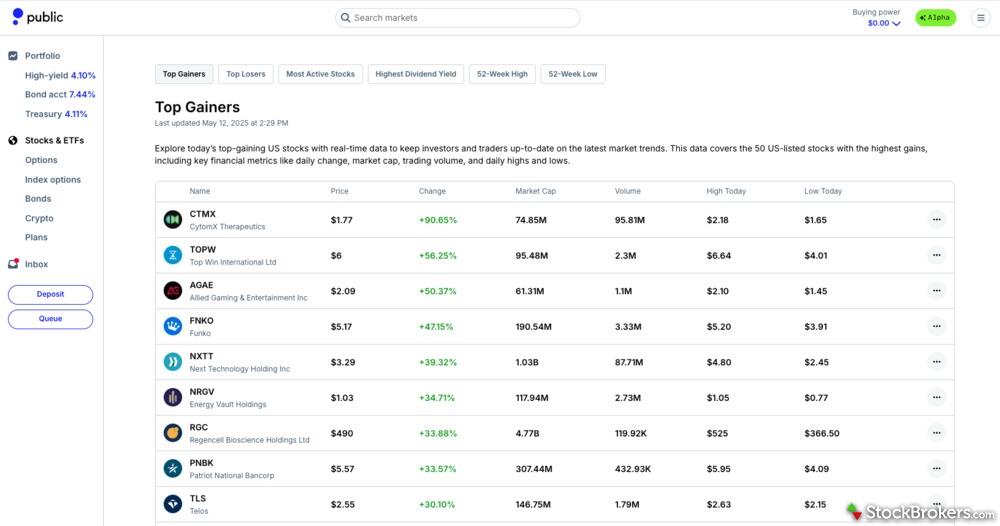

Market Research

For market research, J.P. Morgan Self-Directed Investing is the stronger pick. It covers more investment types, offers more tools, and earns higher marks: 4 stars and a #7 ranking out of 14 brokers from StockBrokers.com, compared with Public.com’s 2.5 stars and #12 ranking. If you want screeners, downloadable stock reports, and a clear view of how your portfolio is split by asset class, J.P. Morgan stands out. Public.com can work for basic stock and ETF research and Pink Sheets/OTC info, but it leaves notable gaps for deeper analysis.

Both brokers provide stock and ETF research, and both include Pink Sheets/OTC coverage. Neither platform offers ESG research, social media sentiment tools, or downloadable PDF reports for ETFs or mutual funds. J.P. Morgan adds two downloadable PDF research reports for individual stocks, while Public.com offers none. J.P. Morgan also supplies research on mutual funds and bonds, which Public.com does not.

Tools are another differentiator. J.P. Morgan includes screeners for stocks, ETFs, mutual funds, and bonds, plus a portfolio allocation view by asset class—features that are not available on Public.com. If your investing style benefits from screening ideas across markets and seeing how your holdings are distributed, J.P. Morgan provides a more complete toolkit.

|

Feature |

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

Public.com Public.com

|

|

Research - Stocks

info

|

Yes

|

Yes

|

|

Screener - Stocks

info

|

Yes

|

No

|

|

Research - ETFs

info

|

Yes

|

Yes

|

|

Screener - ETFs

info

|

Yes

|

No

|

|

Research - Mutual Funds

info

|

Yes

|

No

|

|

Screener - Mutual Funds

info

|

Yes

|

No

|

|

Research - Fixed Income

info

|

Yes

|

No

|

|

Screener - Fixed Income

info

|

Yes

|

No

|

|

Research

|

|

|

Banking

When it comes to banking capabilities, J.P. Morgan Self-Directed Investing offers a broader range of services compared to Public.com. J.P. Morgan provides checking and savings accounts, debit and credit cards, mortgage loans, and Certificates of Deposit (CDs), making it a versatile choice for those seeking comprehensive financial services. On the other hand, Public.com does not offer these banking features, focusing solely on investment opportunities without traditional banking services like accounts, cards, or loans. For individuals who prioritize having access to extensive banking options as part of their online brokerage experience, J.P. Morgan Self-Directed Investing may be the more suitable choice.

Dive deeper: Best Brokerage Checking Accounts for 2026

Winner

After opening live accounts and testing 14 of the best online brokers, our research and live account testing finds that J.P. Morgan Self-Directed Investing is better than Public.com. J.P. Morgan Self-Directed Investing finished with an overall score of 67.5%, while Public.com finished with a score of 56.0%.

J.P. Morgan Self-Directed Investing makes it easy for Chase Bank customers to invest and allows access to J.P. Morgan research. On the downside, the broker features are sparse compared to industry leaders.

FAQs

Can you trade cryptocurrency with J.P. Morgan Self-Directed Investing or Public.com?

Comparing J.P. Morgan Self-Directed Investing vs Public.com for crypto trading: J.P. Morgan Self-Directed Investing offers no cryptocurrency trading (0 coins), while Public.com supports crypto with 40 coins. Investors prioritizing crypto access will find Public.com more suitable than J.P. Morgan Self-Directed Investing.

Dive deeper: Best Online Brokers for Crypto Trading in 2026

Does J.P. Morgan Self-Directed Investing or Public.com offer IRAs?

J.P. Morgan Self-Directed Investing and Public.com both offer Traditional and Roth IRA accounts with $0 annual fees; however, J.P. Morgan Self-Directed Investing charges a $75 IRA closure fee versus $150 at Public.com, which can impact rollover or account transfer costs.

Dive deeper: Best IRA Accounts for 2026

Popular trading guides

More trading guides

Popular broker reviews

navigate_before

navigate_next

|

Broker Screenshots

|

J.P. Morgan Self-Directed Investing |

Public.com |

|

|

Broker Gallery (click to expand) |

|

|

|

|

Trading Fees

|

J.P. Morgan Self-Directed Investing |

Public.com |

|

|

Minimum Deposit info

|

$0.00

|

$20.00

|

|

|

Stock Trades info

|

$0.00

|

$0.00

info

|

|

|

Penny Stock Fees (OTC) info

|

$0.00

|

$2.99

|

|

|

Mutual Fund Trade Fee info

|

$0

|

n/a

|

|

|

Options (Per Contract) info

|

$0.65

|

$0.00

info

|

|

|

Futures (Per Contract) info

|

(Not offered)

|

(Not offered)

|

|

|

Broker Assisted Trade Fee info

|

Varies

|

n/a

|

|

|

Margin Rates

|

J.P. Morgan Self-Directed Investing |

Public.com |

|

|

Margin Rate Under $25,000 info

|

12.25%

|

5.65%

|

|

|

Margin Rate $25,000 to $49,999.99 info

|

12%

|

5.65%

|

|

|

Margin Rate $50,000 to $99,999.99 info

|

11.5%

|

5.50%

|

|

|

Margin Rate $100,000 to $249,999.99 info

|

11.25%

|

5.25%

|

|

|

Margin Rate $250,000 to $499,999.99 info

|

11.25%

|

5.25%

|

|

|

Margin Rate $500,000 to $999,999.99 info

|

10.5%

|

5.25%

|

|

|

Margin Rate Above $1,000,000 info

|

10%

info

|

5.05%

|

|

|

Account Fees

|

J.P. Morgan Self-Directed Investing |

Public.com |

|

|

IRA Annual Fee info

|

$0.00

|

$0.00

|

|

|

IRA Closure Fee info

|

$75.00

|

$150.00

|

|

|

Account Transfer Out (Partial) info

|

$0.00

|

$100.00

|

|

|

Account Transfer Out (Full) info

|

$75.00

|

$100.00

|

|

|

Options Exercise Fee info

|

$0.00

|

$0.00

|

|

|

Options Assignment Fee info

|

$0.00

|

$0.00

|

|

|

Investment Options

|

J.P. Morgan Self-Directed Investing |

Public.com |

|

|

Stock Trading info

|

Yes

|

Yes

|

|

|

Account Feature - Margin Trading info

|

Yes

info

|

Yes

|

|

|

Fractional Shares (Stocks) info

|

Yes

|

Yes

|

|

|

OTC Stocks info

|

Yes

|

Yes

|

|

|

Options Trading info

|

Yes

|

Yes

|

|

|

Complex Options Max Legs info

|

1

|

4

|

|

|

Futures Trading info

|

No

|

No

|

|

|

Forex Trading info

|

No

|

No

|

|

|

Crypto Trading info

|

No

|

Yes

|

|

|

Crypto Trading - Total Coins info

|

0

|

40

|

|

|

Fixed Income (Treasurys) info

|

Yes

|

Yes

|

|

|

Fixed Income (Corporate Bonds) info

|

Yes

|

Yes

|

|

|

Fixed Income (Municipal Bonds) info

|

Yes

|

No

|

|

|

Traditional IRAs info

|

Yes

|

Yes

|

|

|

Roth IRAs info

|

Yes

|

Yes

|

|

|

Advisor Services info

|

Yes

|

No

|

|

|

International Countries (Stocks) info

|

0

|

0

|

|

|

Order Types

|

J.P. Morgan Self-Directed Investing |

Public.com |

|

|

Order Type - Market info

|

Yes

|

Yes

|

|

|

Order Type - Limit info

|

Yes

|

Yes

|

|

|

Order Type - After Hours info

|

No

|

Yes

info

|

|

|

Order Type - Stop info

|

Yes

|

Yes

|

|

|

Order Type - Trailing Stop info

|

No

|

No

|

|

|

Order Type - OCO info

|

No

|

No

|

|

|

Order Type - OTO info

|

No

|

No

|

|

|

Order Type - Broker Assisted info

|

Yes

|

No

|

|

|

Beginners

|

J.P. Morgan Self-Directed Investing |

Public.com |

|

|

Education (Stocks) info

|

Yes

|

Yes

|

|

|

Education (ETFs) info

|

Yes

|

Yes

|

|

|

Education (Options) info

|

Yes

|

Yes

|

|

|

Education (Mutual Funds) info

|

Yes

|

No

|

|

|

Education (Fixed Income) info

|

Yes

|

Yes

|

|

|

Education (Retirement) info

|

Yes

|

Yes

|

|

|

Retirement Calculator info

|

Yes

|

No

|

|

|

Investor Dictionary info

|

No

|

Yes

|

|

|

Paper Trading info

|

No

|

No

|

|

|

Videos info

|

Yes

|

Yes

|

|

|

Webinars info

|

Yes

|

Yes

|

|

|

Progress Tracking info

|

No

|

No

|

|

|

Interactive Learning - Quizzes info

|

No

|

No

|

|

|

Stock Trading Apps

|

J.P. Morgan Self-Directed Investing |

Public.com |

|

|

iPhone App info

|

Yes

|

Yes

|

|

|

Android App info

|

Yes

|

Yes

|

|

|

Apple Watch App info

|

No

|

No

|

|

|

Trading - Stocks info

|

Yes

|

Yes

|

|

|

Trading - After-Hours info

|

No

|

Yes

|

|

|

Trading - Simple Options info

|

Yes

|

Yes

|

|

|

Trading - Complex Options info

|

No

|

No

|

|

|

Order Ticket RT Quotes info

|

Yes

|

Yes

|

|

|

Order Ticket SRT Quotes info

|

No

|

No

|

|

|

Stock App Features

|

J.P. Morgan Self-Directed Investing |

Public.com |

|

|

Mobile Research - Market Movers info

|

Yes

|

Yes

|

|

|

Stream Live TV info

|

No

|

No

|

|

|

Videos on Demand info

|

No

|

No

|

|

|

Stock Alerts info

|

Yes

|

No

info

|

|

|

Option Chains Viewable info

|

Yes

|

Yes

|

|

|

Watchlist (Real-time) info

|

Yes

|

Yes

|

|

|

Watchlist (Streaming) info

|

No

|

No

|

|

|

Mobile Watchlists - Create & Manage info

|

Yes

|

No

|

|

|

Mobile Watchlists - Column Customization info

|

Yes

|

Yes

|

|

|

Stock App Charting

|

J.P. Morgan Self-Directed Investing |

Public.com |

|

|

Charting - After-Hours info

|

No

|

No

|

|

|

Charting - Can Turn Horizontally info

|

Yes

|

No

|

|

|

Charting - Multiple Time Frames info

|

Yes

|

Yes

|

|

|

Charting - Technical Studies info

|

36

|

0

|

|

|

Charting - Study Customizations info

|

Yes

|

No

|

|

|

Charting - Stock Comparisons info

|

No

|

Yes

|

|

|

Trading Platforms

|

J.P. Morgan Self-Directed Investing |

Public.com |

|

|

Active Trading Platform info

|

No

|

n/a

|

|

|

Desktop Trading Platform info

|

No

|

No

|

|

|

Desktop Platform (Mac) info

|

No

|

No

|

|

|

Web Trading Platform info

|

Yes

|

Yes

|

|

|

Paper Trading info

|

No

|

No

|

|

|

Trade Journal info

|

No

|

No

|

|

|

Watchlists - Total Fields info

|

20

|

3

|

|

|

Stock Chart Features

|

J.P. Morgan Self-Directed Investing |

Public.com |

|

|

Charting - Adjust Trades on Chart info

|

No

|

No

|

|

|

Charting - Indicators / Studies info

|

36

|

0

|

|

|

Charting - Drawing Tools info

|

10

|

0

|

|

|

Charting - Notes info

|

No

|

No

|

|

|

Charting - Historical Trades info

|

No

|

No

|

|

|

Charting - Corporate Events info

|

Yes

|

No

|

|

|

Charting - Custom Date Range info

|

No

|

No

|

|

|

Charting - Custom Time Bars info

|

No

|

No

|

|

|

Charting - Automated Analysis info

|

No

|

No

|

|

|

Charting - Save Profiles info

|

No

|

No

|

|

|

Trade Ideas - Technical Analysis info

|

No

|

No

|

|

|

Charting - Study Customizations info

|

3

|

0

|

|

|

Charting - Custom Studies info

|

No

|

No

|

|

|

Day Trading

|

J.P. Morgan Self-Directed Investing |

Public.com |

|

|

Streaming Time & Sales info

|

No

|

No

|

|

|

Streaming TV info

|

No

|

No

|

|

|

Direct Market Routing - Equities info

|

No

|

No

|

|

|

Ladder Trading info

|

No

|

No

|

|

|

Trade Hot Keys info

|

No

|

No

|

|

|

Level 2 Quotes - Stocks info

|

No

|

No

|

|

|

Trade Ideas - Backtesting info

|

No

|

No

|

|

|

Trade Ideas - Backtesting Adv info

|

No

|

No

|

|

|

Short Locator info

|

No

|

No

|

|

|

Order Liquidity Rebates info

|

No

|

No

|

|

|

Research Overview

|

J.P. Morgan Self-Directed Investing |

Public.com |

|

|

Research - Stocks info

|

Yes

|

Yes

|

|

|

Research - ETFs info

|

Yes

|

Yes

|

|

|

Research - Mutual Funds info

|

Yes

|

No

|

|

|

Research - Pink Sheets / OTCBB info

|

Yes

|

Yes

|

|

|

Research - Fixed Income info

|

Yes

|

No

|

|

|

Screener - Stocks info

|

Yes

|

No

|

|

|

Screener - ETFs info

|

Yes

|

No

|

|

|

Screener - Mutual Funds info

|

Yes

|

No

|

|

|

Screener - Fixed Income info

|

Yes

|

No

|

|

|

Portfolio Asset Allocation info

|

Yes

|

No

info

|

|

|

Stock Research

|

J.P. Morgan Self-Directed Investing |

Public.com |

|

|

Stock Research - PDF Reports info

|

2

|

0

info

|

|

|

Stock Research - Earnings info

|

Yes

|

Yes

|

|

|

Stock Research - Insiders info

|

No

|

No

|

|

|

Stock Research - Social info

|

No

|

No

|

|

|

Stock Research - News info

|

Yes

|

Yes

|

|

|

Stock Research - ESG info

|

No

|

No

|

|

|

Stock Research - SEC Filings info

|

No

|

No

|

|

|

ETF Research

|

J.P. Morgan Self-Directed Investing |

Public.com |

|

|

ETFs - Investment Objective info

|

Yes

|

Yes

|

|

|

ETF Fund Facts - Inception Date info

|

Yes

|

Yes

|

|

|

ETF Fund Facts - Expense Ratio info

|

Yes

|

Yes

|

|

|

ETF Fund Facts - Total Assets info

|

Yes

|

Yes

|

|

|

ETF Fund Facts - Total Holdings info

|

Yes

|

Yes

|

|

|

ETFs - Top 10 Holdings info

|

Yes

|

Yes

|

|

|

ETFs - Sector Exposure info

|

Yes

|

No

|

|

|

ETFs - Risk Analysis info

|

No

|

No

|

|

|

ETFs - Ratings info

|

Yes

|

No

|

|

|

ETFs - Morningstar StyleMap info

|

Yes

|

No

|

|

|

ETFs - PDF Reports info

|

No

|

No

|

|

|

Mutual Fund Research

|

J.P. Morgan Self-Directed Investing |

Public.com |

|

|

Mutual Funds - Investment Objective info

|

Yes

|

No

|

|

|

Mutual Funds - Performance Chart info

|

Yes

|

No

|

|

|

Mutual Funds - Performance Analysis info

|

Yes

|

No

|

|

|

Mutual Funds - Prospectus info

|

No

|

No

|

|

|

Mutual Funds - 3rd Party Ratings info

|

Yes

|

No

|

|

|

Mutual Funds - Fees Breakdown info

|

Yes

|

No

|

|

|

Mutual Funds - Top 10 Holdings info

|

Yes

|

No

|

|

|

Mutual Funds - Asset Allocation info

|

Yes

|

No

|

|

|

Mutual Funds - Sector Allocation info

|

Yes

|

No

|

|

|

Mutual Funds - Country Allocation info

|

Yes

|

No

|

|

|

Mutual Funds - StyleMap info

|

Yes

|

No

|

|

|

Options Trading

|

J.P. Morgan Self-Directed Investing |

Public.com |

|

|

Option Chains - Total Greeks info

|

0

|

5

|

|

|

Option Analysis - P&L Charts info

|

No

|

Yes

|

|

|

Banking

|

J.P. Morgan Self-Directed Investing |

Public.com |

|

|

Bank (Member FDIC) info

|

Yes

|

No

|

|

|

Checking Accounts info

|

Yes

|

No

|

|

|

Savings Accounts info

|

Yes

|

No

|

|

|

Credit Cards info

|

Yes

|

No

|

|

|

Debit Cards info

|

Yes

|

No

|

|

|

Mortgage Loans info

|

Yes

|

No

|

|

|

Customer Service

|

J.P. Morgan Self-Directed Investing |

Public.com |

|

|

Phone Support (Prospective Customers) info

|

No

|

No

|

|

|

Phone Support (Current Customers) info

|

Yes

|

No

|

|

|

Email Support info

|

Yes

|

Yes

|

|

|

Live Chat (Prospective Customers) info

|

No

|

Yes

|

|

|

Live Chat (Current Customers) info

|

No

|

Yes

|

|

|

24/7 Support info

|

Yes

|

No

|

|

arrow_upward