Why you can trust us

Why you can trust us

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

Trading journals are among the most underutilized tools by beginner stock traders. A good journal goes beyond imported trades and simple profit/loss tracking, providing the data necessary to expose costly habits, prove which strategies work, and ensure focused execution. The best trading journals provide powerful tools for identifying and exploiting market opportunities.

In this guide, I review the best trading journal software available today for analyzing stocks, options, futures, forex, and cryptocurrency trades. I'll also detail the essential information you need to turn your journal into a system for optimizing your results.

A top-tier stock trading journal should offer seamless trade import from your broker, customizable performance reports, and allow you to easily tag emotional or strategic notes. Whether you are a dedicated professional trading multiple asset classes or a focused beginner looking to build profitable habits, the platforms below offer a blend of power, usability, and data security.

I’ve evaluated these trading journal platforms based on their auto-import capabilities, depth of performance metrics, visualization tools, pricing structures, and overall user experience.

Top picks for trading journals

Best trading journal - Tradervue

| Company |

Overall |

Free version |

Monthly Pricing |

Tradervue Tradervue

|

|

Yes |

$29.95/month |

Tradervue is one of the most popular trading journals around, and it’s no surprise why. I found it offered the most well-rounded package, balancing cost with features. While Tradervue provides a very basic free version, you need to pay to unlock its full capabilities.

- Supports: Stocks, options, futures, forex

- Free version: Yes

- Pricing: Free (30 stock trades/month), Silver ($29.95/mo), Gold ($49.95/mo)

- Mobile apps: No

Well-designed platform. I was impressed by how easy it was to get started. I uploaded thousands of trades from a spreadsheet, and it was seamless. Tradervue uploaded everything to my journal and began generating insights. Tradervue also syncs with over 80 brokers, including Interactive Brokers, Charles Schwab, and Fidelity. After syncing, current and future trades are automatically uploaded to the journal.

Extensive analysis. Once I uploaded my trades into the Tradervue platform, it immediately generated a wide range of charts, stats, and insights to help guide my future performance.

David's take:

"I appreciated its exit analysis tool, which showed the efficiency of my trades compared to what I theoretically could have gotten with better exit timing (the closer to 100%, the better). Initially, I found all this data a little overwhelming, but I quickly got the hang of the platform."

David Rodeck

Active community. Tradervue runs an active message board where its users share ideas, questions, and results. You can also invite people to mentor you, so they can see your trade history and give feedback. This social network was another valuable feature for an overall excellent trading journal.

The Tradervue community let's you see interactions and gather insights with other traders.

Best for high-powered analysis - TraderSync

| Company |

Overall |

Free version |

Monthly Pricing |

TraderSync TraderSync

|

|

No |

$29.95/mo |

TraderSync was by far the most expensive trading journal in this roundup, but like everything, you often get what you pay for. I found that TraderSync delivered the deepest analysis and guidance out of the top trading journals, especially through its AI assistant.

- Supports: Stocks, options, futures, forex, cryptocurrency

- Free version: No

- Pricing: Pro ($29.95/mo), Premium ($49.95/mo), Elite ($79.95/mo). Paid tiers are 13% off if you pay for a year up-front.

- Mobile apps: iOS, Android

Easy to get started. Despite its power, TraderSync is another trading journal that’s easy to dive into. I liked how simple it was to join as a new user. I didn’t need to put down a credit card for a 7-day trial. However, it should be noted there is no free version after the trial ends. From there, you can sync up with over 900 brokers or upload an Excel sheet of your trades to start tracking, taking notes, and generating insights from the platform.

In-depth reports and insights. I was amazed by the amount of analysis I got from TraderSync. It went beyond the usual stats found with every trading journal, like win % and profit factor. It also generated in-depth reports based on time, sector, trading volume, and entry price. The reports showed clear, actionable data to help my performance, such as that I was significantly more profitable trading in the morning than in the afternoon.

AI assistant. TraderSync provides an AI assistant along with its trading journal. You can ask questions about past trades and for new strategies. With a Premium subscription, you get AI insights automatically without asking. At $79.95 per month, it’s pricey, but worth the cost for serious investors.

The TraderSync AI Insights tool automatically generates commentary about specific trades.

Best for community insights - TradeZella

| Company |

Overall |

Free version |

Monthly Pricing |

TradeZella TradeZella

|

|

No |

Starts at $29.00 |

If you’re looking for help and insights from others about your trading strategy, TradeZella is well worth considering.

- Supports: Stocks, options, forex, futures, cryptocurrency

- Free version: No

- Pricing: Basic ($29/mo), Pro ($49/mo)

- Mobile apps: No

Fun interface and platform. TradeZella feels more fun and upbeat than the typical trading journal. When I first joined, the onboarding process asked me to rate my knowledge using categories like “Ninja” and “Monk Mode.” It was quick to upload my trades, and I really enjoyed the bright color scheme. It presented my data and insights in a visually friendly way. For example, giving my portfolio a “Zella Score” with areas for improvement. TradeZella also offers extensive educational resources.

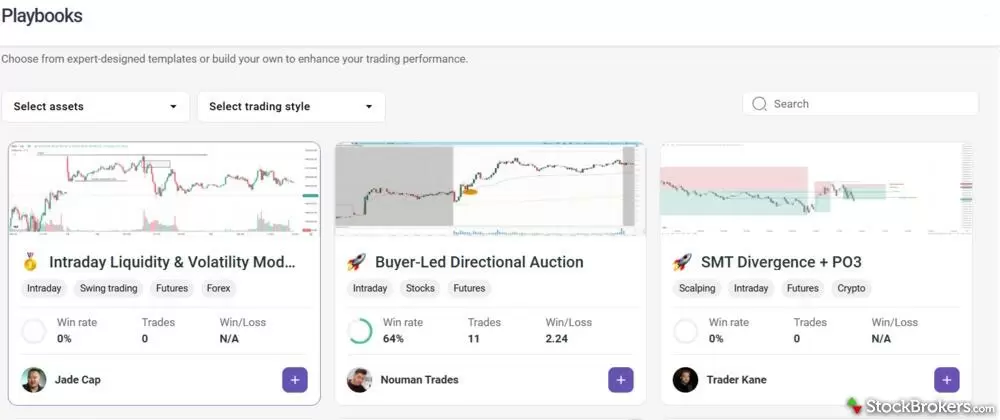

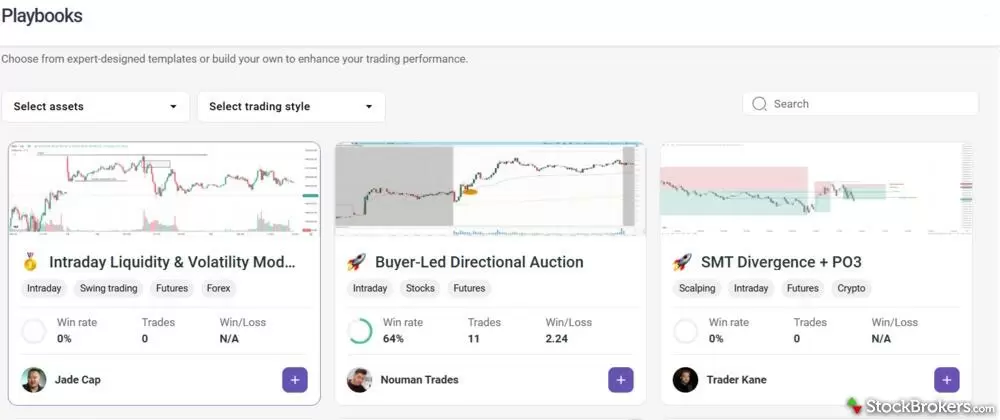

Shared community strategies. TradeZella has an active community of investors who share ideas and strategies through its Discord channel. You can also grant others, including mentors, access to your trading journal and results. If you’re looking for strategies, users share Playbooks, which set rules and guidelines for futures trading sessions, along with their performance to show how the strategy performed.

TradeZella's playbooks allow you to view other traders' strategies and see their success rates.

Trade replay and backtesting. Out of the TradeZella trading journal tools, I was most impressed by their trade replay and backtesting. You can slowly review and analyze your past trades on a chart, making notes about mistakes and ideas along the way. You can also create hypothetical strategies to backtest how they would have performed under historical market conditions. It’s a nice additional level of analysis not found in other trading journals.

Overall, I really liked TradeZella, but it’s just a shame you can’t try it without paying upfront. There is no free version or trial.

Best free trading journal - Stonk Journal

| Company |

Overall |

Free version |

Monthly Pricing |

Stonk Journal Stonk Journal

|

|

Yes |

Free |

Stonk Journal is a completely free trading journal. They are powered solely by user donations and don’t offer paid subscriptions. For a free tool, I was pleasantly surprised at what was offered. It took 15 seconds to register with my name and email.

- Supports: Stocks, options, forex, futures, crypto

- Free version: Yes

- Pricing: Donation-supported

- Mobile apps: No

User experience. When I logged in, I was impressed by Stonk Journal’s clean, sleek interface. While some other free trade journals are little more than an Excel spreadsheet, Stonk Journal offers a nice design and some actual analysis. I was able to quickly jot down notes about trading sessions and keep them organized.

Basic trade analysis. As soon as I uploaded my trades, the Stonk Journal platform provided some instant analysis about my performance. For example, it showed my average win hold time versus average loss hold time, and that I tended to exit my winners sooner than my losers. I might have been holding on to unprofitable trades too long, trying to make my money back.

Now, you don’t get a ton of insight. It’s not like the top-paid trading journals, which go much deeper into your performance, including some that offer AI-generated insights. But for Stonk Journal’s free price tag, I thought it was fair.

Slow trade uploads. I did find it very frustrating that I had to upload my trades one at a time. There was no way to upload a spreadsheet of past trades, and there was definitely no option to auto-sync with a brokerage account. That could be a real hassle if you want to log many trades from your daily sessions.

Best for affordability and user-friendly design - Trademetria

| Company |

Overall |

Free version |

Monthly Pricing |

Trademetria Trademetria

|

|

Yes |

$29.95/mo |

Trademetria is a little more low-frills than some of the other trading journals, but it makes up for it in terms of affordability and ease of use.

- Supports: Stocks, options, forex, futures, cryptocurrency, and CFDs (contracts for difference)

- Free version: Yes

- Pricing: Free, Basic ($19.95/mo), Pro ($29.95/mo)

- Mobile apps: No

User-friendly platform. Trademetria’s design is clean and presents data efficiently. While the default view starts off basic, I found it easy to customize my dashboard with reports and widgets, such as an economic calendar and a scrolling ticker. From there, I could quickly start seeing data and insights about my past trades.

Affordable. Trademetria stood out as a decent trading journal for those who want more analysis and functionality than a completely free Stonk Journal, but didn’t want to pay the higher prices of the other top options.

Trademetria’s most expensive Pro plan was about what you’d pay for the cheapest plans at other top options like TraderSync and TradeZella, while the Basic plan offered a decent list of tools at an even lower price. Just note that with a Basic plan, you’ll have to manually upload all your trades. Only Trademetria’s Pro plan offers auto-sync.

Reasonable analysis. I found that at its bargain price point, Trademetria still offered decent analysis for a trading journal. It even included a basic AI analytics tool, though not nearly as powerful as TraderSync.

Bonus pick: Build your own trading journal using Excel

Online trading journals are convenient because they have most of the features traders could ever want. But, if you’re comfortable with Excel, you can easily create a trading journal of your own.

To get you started, here’s a free trading journal excel spreadsheet template to use, which includes all of the basics alongside a handful of advanced data points. Check out our full guide to using this Excel stock journal template to help get you started.

- Supports: Anything and everything

- Free version: Yes

- Pricing: Free, minus the cost of Microsoft Excel

FAQs

What is a trading journal?

A trading journal is a running log that notes what you traded, when you traded, why you traded, and how much money you made or lost on each trade. Over time, a journal will reveal your trading strengths and weaknesses. Online journal apps aren’t mandatory, but they can automate most of the process and provide unique insights you might not come up with on your own.

Why use trading journals for post-trade analysis?

Trading journals provide you with an easy way to figure out what went right and what went wrong, and look back at your trade history. There is simply no better way to improve over time. Technical analysts have been using stock trading journals for decades.

Reviewing the film is a critical part of professional sports, and investing is no different. Taking a screenshot of the stock chart after the trade is completed, plotting buy and sell points, writing down your notes recapping the trade, and tweaking trade rules thereafter all fall under the post-trade analysis.

How do you keep a stock trading journal?

If you take the time to conduct post-trade analysis, you can improve your success rate and ultimately make more money from your investing. To do so, I suggest following these steps:

- Log the trade details - This includes the ticker symbol, trade date, buy price $, total shares, sell price $, return $, return % (at a minimum). Other great data points to track include stop price, risk, and commission spend, if you’re paying commissions.

- Download a stock chart and mark it up - Mark it up with your buy and sell points alongside any trendlines, support, resistance, etc. Then, mark this chart with the trade info and archive it. Some trading journals allow you to save screenshots with your trade. That’s great if you take the time to do it.

- Write your trade notes - Either on the chart itself, in your Excel journal, or on paper, write down what you did right and wrong and recap the reasoning behind the trade.

- Reflect back on trade data, chart, notes - This is the true "reviewing the film" exercise; identify potential bad habits, make rule tweaks, identify areas for improvement, and overall set the focus for the next trade.

- Archive for later use - Once you have reviewed the trade from start to finish and gone through the motions of a proper recap, save your trading journal entry.

Recommended variables

What variables do successful traders use when logging trades in their trading journal? Here are 11 to always include:

- Stop Price $ - The Stop Loss price ($) which can be a physical stop loss order or a mental stop. Cutting your losses short is one of many crucial keys to successful investing.

- Strategy - Always tag each trade with the strategy used.

- Risk $ - This is the amount of capital being risked on the trade. So, if you buy 100 shares at $100, and your Stop is at $99, then you are effectively risking $100 on the trade. Risk can also be expressed as an "R" multiple (Van Tharp principle), and is a concept that has truly changed the way I approach trading.

- Risk % - The percent of capital risked on the trade. Referencing the previous example, the total risk would be 1% ($10,000 invested / $100 being risked).

- Target Price $ - Back to our example of buying long at $100, if we set our target price at $110, that means our goal is to hold the stock until it reaches at least $110. Once we reach our initial target price, we can check back in and consider trimming our position to take some profits, sell the entire position, or hold the position and set a new, higher price target.

- Return $ - The number everyone loves to see, which hopefully is a profit and not a loss. If our 100 shares of stock we bought at $100 reaches our $110 target price and we sell our full position to lock in profits, then we would realize a return of +$1,000 ($10 per share x 100 shares).

- Return % - The dollar return converted into a percentage. Sticking with our example, selling at $110 would yield a +10% return ($1,000 / $10,000).

- Return "R" - Applying R multiples, we convert the Return $ into "R". Using this same example, if we had risked $100 (1R), and made $1,000, then our return would be +10R.

- Mistake? - Did you make a mistake or break a rule with this trade? If yes, then you mark the trade as a mistake. Mistake tracking is one of the more underused, yet very powerful variables. By logging mistakes, you force yourself to replay the trade in your mind and reflect back on what went right and/or wrong.

- Notes - Not necessarily a variable, but writing notes when reflecting on the trade is important to help you learn from each trade. What went right, what didn't, what you were thinking when buying, selling, and so on are all examples of what can be journaled.

- Risk/Reward Ratio - The risk-reward ratio measures how much your potential reward is for each dollar you risk on the trade. Using the same long 100 shares at $100 trade example, with $99 as our stop and $110 as our target, our risk/reward ratio would be 1:10. As long as the trade works out at least once every 10 tries, we will still make money (excluding trade costs).

Should you tag all of your trades?

Yes, by tagging each trade you can assess performance over time and identify whether or not the strategy you are using is successful. Tagging your trades means marking the strategy you used to make the trade.

Any good trading journal will allow you to filter performance by tag to view your biggest winners and losers. By looking back every so often, you can identify areas of improvement and tweak your trade rules for that strategy.

How do you use your trading journal to build strategies?

Here are a few tips for success that I’ve learned over the years when building a trading strategy:

- Have clear rules for each strategy - Consider having preset profit targets, objectives and position management rules, and make sure to tag each trade!

- Use numerical identifiers - Start your seed strategy with "1.0" and refresh the tags each time you adjust your rules so you can accurately track performance. You can progress to "1.1" or "2.0", etc. You'll be amazed when you compare the trades and performance of each iteration.

- Challenge yourself to improve across the board - Don't just analyze the net return of each strategy iteration. Look also at mistake %, time committed overall, trade frequency, and your overall emotions to assess true success. For example, day trading requires far more trades, time, and stress than buying and holding long.

In his book Trade Your Way to Financial Freedom, Van Tharp advocates finding the right strategy for you. The more you test different strategies and learn about yourself, the more successful you will be over time. I learned that, for me, day trading just isn't the right fit.

What trading journal is best based on what assets I trade?

Here are my recommendations for the best trading journals based on how you trade:

Best trading journal for day trading: TraderSync

If you’re an active day trader who logs dozens of trades a day across multiple accounts or brokers, TraderSync’s sleek dashboard and deep import functionality (700+ brokers) is worth the premium. It also includes a paper trading simulator to stress test strategies in fast-moving markets.

Best trading journal for options trading: TradesViz

TradesViz lets you visualize complex multi-leg options positions with precise entry/exit charting and detailed P&L breakdowns by leg. It’s one of the few journals where options traders can analyze strategy-level outcomes at scale.

Best trading journal for stock trading: Chartlog

Chartlog’s clean interface and quick broker sync make it perfect for active equity traders. You can run strategy-based filters and visualize equity curves, which makes it easy to assess your progress over time.

Best trading journal for forex trading: Edgewonk

Edgewonk has deep support for MetaTrader 4 and international brokers, plus multi-currency performance tracking. Its return forecaster and mistake tagging are especially useful for forex traders managing high-frequency trades across pairs.

Best trading journal for futures trading: TradesViz

For futures, TradesViz strikes the right balance between automation and analysis. It supports futures, options on futures, and overlays powerful custom charting tools to dissect each trade.

What is the best free trading journal?

Stonk Journal is hands-down the best free trading journal right now. While most free trading journals are nothing more than an Excel spreadsheet, Stonk Journal offers an actual platform to track your trades, visualize your performance, and receive insights. It’s far more visually impressive and helpful.

Stonk Journal doesn’t support trade imports, but you can log your trades manually with full customization, including entry notes, confidence levels, and screenshots. It’s donation-based, so if you like it, consider supporting the creator. I donated $15 because it was worth it for what it offers. Great pick for beginners and casual traders who don’t need automation.

What is the best trading journal app?

TraderSync is the best trading journal app, partly because it's one of the few major trading journals that offers an app. You can download the TraderSync app on both Android and Apple devices. The TraderSync app also gives you access to many of the same functions that make TraderSync such a high-quality trading journal: detailed information about past trades, performance reports, and access to the AI assistant.

While most other top trading journals are only available on a desktop computer, TraderSync has taken the step to meet its mobile users where they are.

StockBrokers.com Review Methodology

Why you should trust us

David Rodeck, a contributing writer for StockBrokers.com, has over a decade of writing experience specializing in investing, trading, and retirement planning. Before becoming a full-time writer, David was a financial advisor and passed the Series 6 and CFP exams. He has written for AARP, Kiplinger Magazine, Forbes Advisor, and Investopedia.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used paid trading tool accounts for testing.

- We collected dozens of data points across the tools we review.

- We tested each tool’s website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; trading tools cannot pay for a higher rating.

Our researchers thoroughly test a wide range of popular trading tools' features, such as trading journals and screeners, charting providers, and educational resources. We also evaluate the overall design of each tool’s mobile experience and look for a fluid user experience moving between mobile and desktop tools.

At StockBrokers.com, our reviewers use a variety of devices to evaluate trading tools. Our reviews and data collection are conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each trading tool was evaluated and scored across three key categories: Ease of Use, Features, and Cost. Learn more about how we test.

Trading tools tested in 2025

We tested 9 trading tools and service providers for stock traders in 2025:

Tradervue

Tradervue

TraderSync

TraderSync

TradeZella

TradeZella

Stonk Journal

Stonk Journal

Trademetria

Trademetria