Tradervue pros and cons

thumb_up_off_alt Pros

- Offers powerful analytical tools to go with the journal

- Well-designed platform, with helpful chatbot support

- Active community of users sharing insights

thumb_down_off_alt Cons

- Relatively pricey for a stock trading journal

- Dashboard can initially feel a little overwhelming and cluttered

- Offers a free version, but it’s very limited

Overall summary

|

Feature |

Tradervue Tradervue

|

|

Overall

info

|

|

|

Features

info

|

|

|

Ease of Use

info

|

|

|

Cost

info

|

|

|

Free version

info

|

Yes

|

|

Monthly Pricing

info

|

$29.95/month

|

|

Annual Pricing

info

|

$323.46/year

|

Cost and plans

Tradervue has two paid subscription options: Silver and Gold. Both allow you to record and analyze unlimited trades through the platform. However, Gold has more analytical tools.

Silver costs $29.95 per month, $323.46 if paid annually for a 10% discount. Gold costs $49.95 per month, $479.52 if paid annually for a 20% discount. You can sign up for a free seven-day trial, but you must provide a credit card. Tradervue also has a free version with restricted functionality.

Overall, the Tradervue pricing seemed fair to me based on what you get. It’s expensive for a trade journal, especially for Gold, but you get far more capabilities than most competitors.

Free version

Tradervue’s free version gives you basic access to the trading journal. However, you can only record 30 trades per month, and there’s little analysis beyond your own notes. If you’re a frequent trader, the 30-trade monthly limit will get annoying fast. However, the free plan could work out if you only want to track the occasional major investment decision.

Silver version

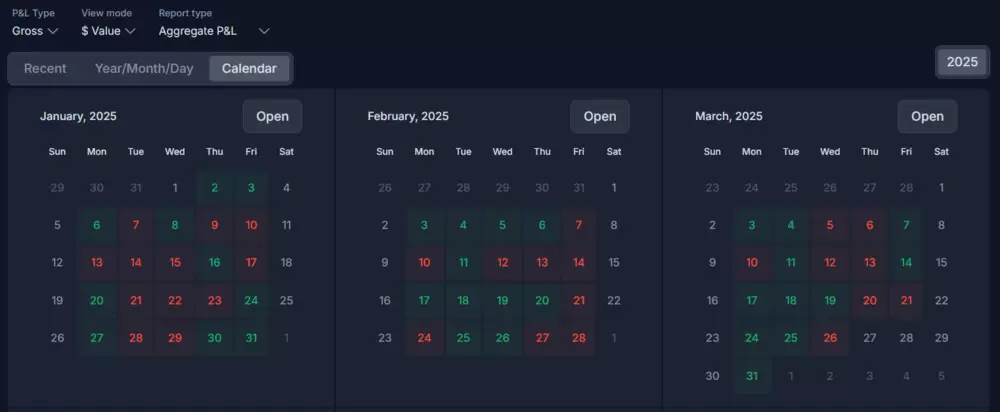

The Silver version opens far more capabilities. First, there is no limit to the number of trades you can record, track, and analyze. I uploaded several thousand at once, and it was seamless. With one click, the platform uploaded all the data from my spreadsheet almost instantaneously. It then organized everything automatically in my journal and calendar so I could easily sort through months of trades.

The real value of the Silver version is that it generates a wide range of reports, charts, and statistics to help you understand your trading history. Tradervue generated this information within a minute of my initial upload, letting me dive in without delay. Finally, you gain access to Tradervue’s mentorship program, which allows you to share your journal with other investors and coaches on the platform (more on that later).

Silver seems like a solid deal at nearly half the price of Gold. Side by side, the feature list is comparable, and you’re only missing a few of the most advanced analysis tools like liquidity reports, risk tracking and reporting, and exit analysis on trades.

Gold version

Tradervue’s most expensive Gold version gives you access to all its features, such as exit analysis on trades, advanced filters, and additional reports for liquidity, risk tracking, and commissions & fees.

I found these extra features interesting and helped add perspective to some past trades, such as an exit I was unsure about. Tradervue’s exit analysis tool considers the efficiency of a trade based on your actual P&L versus what you theoretically could have earned if your timing had been different. The closer you are to 100%, the closer you are to the best theoretical P&L performance within your target parameters. At 72.9%, I did ok but could have done better according to this metric.

It costs an additional $20 a month, but serious investors looking for every insight about past trades would likely benefit from the upgrade. For what it’s worth, Tradervue says Gold is the most popular subscription option.

Features

Tradervue is a trading journal, but it offers far more than a place to take notes and track past decisions. I was impressed by the wide range of analysis features and the social aspect of the platform.

Tradervue only operates as a web program. You cannot download it to your desktop, and there’s no Tradervue app. Here are the top features you get with a paid Tradervue subscription through the online platform.

Trading journal

Tradervue’s journal lets you track stocks, options, futures, and forex trades. To start, you must upload your trading history into the platform. Tradervue syncs with over 80 brokers, including Interactive Brokers, Charles Schwab, and Fidelity. Alternatively, you can simply enter your trades manually.

Some brokers connect to the platform automatically. For others, you must download the trading data in a spreadsheet and then upload it. I had to do so when syncing my Robinhood account, which was a little annoying. However, I did appreciate how Tradervue gave customized step-by-step instructions for each broker.

After the upload, Tradervue will organize all your trades in the journal, with data and charts showing your performance. You can also add your notes and examine the trades using a built-in charting tool.

Overall, the Tradervue journal is well-organized and helped me understand my trading history. I appreciated the color scheme and found it called attention to important data and trends. The calendar tool also helped me easily see patterns in my trading over the past few months.

Dashboard stats and analysis

The real power of Tradervue comes from all the analysis it provides for your trades. As soon as you upload trade data, your dashboard goes from a blank screen to a wall full of charts and data.

Some of the data included Cumulative P&L, performance by time, performance by price, performance by trade size, and daily volume. The dashboard is also customizable. You can add and remove widgets depending on what data you want to have front and center.

I found some of these extra insights intriguing, like the average hold time of winning trades versus losers. I was surprised to see how much better I did with short-term trades versus positions I held for days, showing I should perhaps cut my losses sooner.

At first glance, the dashboard felt a little overwhelming. All this data poured in without my asking for it. It may have been better to split up by category so I could search through piece by piece. However, cleaning things up and creating the dashboard I wanted was easy. If you need a do-over, it only takes one click to return to the original layout.

Advanced reports

You can dive even deeper into your trading history with Tradervue’s advanced reports. Some of the ones available include Liquidity, Market Behavior, and Win/Loss/Expectation. The advanced reports cover more information than you have on the dashboard, with extra graphics and stats in tables.

I thought these advanced reports were useful. For example, I enjoyed the detailed information about win vs. loss days, such as the probability of whether these streaks were due to luck. Keep in mind that you must have a Gold account to access all the advanced reports.

Community and mentors

Travervue has an active community message board with thousands of posts. You can share your charts and trading history for feedback from other active investors.

Tradervue also allows a mentorship program. You can provide read-only access to your journal and trading history to other paid Tradervue users. This could be someone you enjoy chatting with on the forums or a professional investment coach. They can then review your trading history as it comes in to give feedback.

I thought this community aspect was a fun, unique addition, especially as trading can get quite lonely.

Ease of use

I ran into a few minor issues while using the Tradervue platform, but mostly found it user-friendly. When you first log in, they make it clear where to go to get started. It’s hard to miss the bright-green Import Trades button popping up everywhere.

Uploading my broker data took a little more work than I hoped, as I had to figure out how to download an Excel spreadsheet from my broker, Robinhood. I suspect that might be a connection issue with Robinhood rather than a problem with Tradervue, as I had to go through extra steps with other trading journals I’ve reviewed, like TraderSync.

Some processes were not intuitive. I tried deleting some trade data by clicking the garbage can icon, but nothing happened. I had to work through the chatbot and realized they use another system to delete multiple data entries simultaneously.

That stumble led to a silver lining, though, as I found the help chatbot extremely useful. Every question I asked led to a detailed help page, often with videos. I could submit questions if I needed more support, and a human rep would handle them within a few hours.

Since Tradervue packs in more than your typical trading journal, expect a bit of a learning curve. However, users should get the hang of it quickly.

Final thoughts

Overall, I feel that Tradervue delivers a solid package for the cost. My Tradervue review found that the platform is visually impressive, offers far more insights and tools than the typical trading journal, and has a thriving community of other investors you can chat with.

Like any subscription, you need to balance cost with capabilities. Tradervue strikes the Goldilocks approach for both. Other options are better at the extremes.

Alternatives to Tradervue

If you want as much analysis as possible, consider TraderSync. It offers even more detailed reports, including the option to use AI to ask questions and find insights about your trading history. It also syncs with 250 brokers, versus around 80 at Tradervue. However, it’s quite a bit more expensive: $79.95 per month for the highest-cost option versus $49.95 at Tradervue.

On the other hand, if you’re fine with something more low-frills, Edgewonk gives you a solid trading journal at a much lower cost, just $169 per year to track unlimited trades. You won’t get the same level of analysis, but it’s a more affordable step up from the free Tradervue version.

That said, I think Tradervue strikes the right balance for what you’re paying. There’s a reason it’s so popular.

Our mission at StockBrokers.com is simple: provide thorough and unbiased reviews of online brokers, based on an extraordinary level of hands-on testing and data collection. Our ratings and awards are based on this data and our in-house experts’ deep authority in the field; brokers cannot pay for preferential treatment. Here’s more about trustworthiness at StockBrokers.com.

Our research team conducts thorough testing on a wide range of features, products, services, and tools for U.S. investors, collecting and validating thousands of data points in the process; this makes StockBrokers.com home to the largest independent database on the web covering the online broker industry. We test all available trading platforms for each broker and evaluate them based on a host of data-driven variables.

As part of our process, all brokers had the annual opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy. Brokers also were offered the opportunity to provide executive time for an annual update meeting.

Our rigorous data validation process yields an error rate of less than .001% each year, providing site visitors quality data they can trust. Learn more about how we test or about StockBrokers.com.