Fidelity Review

While other brokers optimize for a specific type of user, Fidelity has constructed an ecosystem equipped to handle every stage of wealth building. It deftly bridges the gap between saving and institutional-grade trading, with a platform experience capable of handling a teenager's first Youth Account or complex options strategies for a high-net-worth portfolio.

This is matched by a client-first fee structure that is increasingly rare. By rejecting Payment for Order Flow (PFOF) and eliminating nuisance fees like transfer charges, Fidelity ensures your capital isn't slowly eroded by the invisible costs common at other firms.

Fidelity ranked #1 for Research, Education, and Retirement Accounts in 2026 because it treats these categories as essential infrastructure rather than add-ons. Whether you’re looking for a high-yield home for your cash, a tax-efficient way to trade options, or the best economic calendar in the business, Fidelity delivers a comprehensive, professional-grade experience that few can match.

-

Minimum Deposit:

$0.00 -

Stock Trades:

$0.00 -

Options (Per Contract):

$0.65

| Range of Investments | |

| Mobile Trading Apps | |

| Advanced Trading | |

| Research | |

| Education | |

| Ease of Use | |

| Customer Service |

Check out StockBrokers.com's picks for the best stock brokers in 2026.

| #1 Research | Winner |

| #1 Education | Winner |

| #1 Beginners | Winner |

| #1 Retirement Accounts | Winner |

| #1 Investor App | Winner |

| #1 Stock Trading Platform | Winner |

| #1 Bond Investing | Winner |

| #1 Youth Investors | Winner |

| #1 Small Business Owners | Winner |

| 2026 | #2 |

| 2025 | #3 |

| 2024 | #1 |

| 2023 | #1 |

| 2022 | #1 |

| 2021 | #2 |

| 2020 | #2 |

| 2019 | #2 |

| 2018 | #1 |

| 2017 | #2 |

| 2016 | #1 |

| 2015 | #2 |

| 2014 | #2 |

| 2013 | #5 |

| 2012 | #7 |

| 2011 | #8 |

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

- #1 for Research and Education in the StockBrokers.com 2026 Annual Awards.

- 25+ retirement account types, including the award-winning Fidelity Youth Account.

- $0 account transfers, $0 for options exercise/assignment, and global ATM fee reimbursements.

- Cash Management Account offers seamless bill pay and high-yield cash sweep options.

Cons

- No futures or forex trading.

- No paper trading.

- No backtesting and poor chart drawing tools.

My top takeaways for Fidelity in 2026:

- Your financial lifecycle partner: Fidelity isn’t just a place to trade stocks; it’s a platform designed to manage your entire financial life. With unique offerings like the Fidelity Youth Account and over 25 variations of retirement accounts, including crypto-enabled IRAs and solo 401(k)s, Fidelity offers a specific, high-quality solution for every stage of wealth building.

- Unrivaled market intelligence: Securing our 2026 Annual Awards for #1 Research and #1 Education in 2026, Fidelity provides a depth of resources that few competitors can match. From the proprietary Equity Summary Score to institutional-grade economic calendars and "Life Event" learning paths, Fidelity empowers you to make decisions with the same data available to professional desks.

- Client-first value: By rejecting Payment for Order Flow (PFOF) on stock and ETF trades, offering global ATM fee reimbursements, and eliminating nuisance fees like transfer charges, Fidelity consistently prioritizes the client's bottom line over hidden revenue streams.

Range of investments

Fidelity has constructed one of the most comprehensive investment ecosystems in the industry, offering a massive catalog of tradeable assets and account types that helped the broker snag second place (behind just Interactive Brokers) in our Range of Investments category for 2026. Whether you’re building a simple portfolio of ETFs or managing a complex estate with trusts and business accounts, Fidelity is capable of handling almost any financial scenario.

Range of assets: While you won’t find futures here, the depth available in traditional asset classes, including stocks, options, fixed income, commodities, and international markets, is exhaustive. Fidelity also provides access to international markets and handles currency conversion seamlessly for international trading (though dedicated forex traders may find the experience different from a specialized forex broker). On the digital asset front, the offering is intentionally narrow. You can trade three specific cryptocurrencies (Bitcoin, Ethereum, Litecoin), which serves investors looking for exposure rather than active crypto traders.

Retirement and custodian accounts: While most brokers offer a standard IRA, Fidelity provides over 25 retirement account variants. This includes everything from standard Roth and Traditional IRAs to more niche offerings like SEP IRAs, self-employed 401(k)s, and nuanced crypto-enabled accounts.

Youth accounts: I loved the Fidelity Youth Account so much that it ran away with our 2026 Annual Award for #1 Youth Investors. Unlike a standard custodial account, this account type is owned and managed by teens aged 13 to 17 (with parental oversight, of course), allowing them to manage their own debit card and learn saving and investing within a secure sandbox.

| Feature |

Fidelity Fidelity

|

|---|---|

| Stock Trading | Yes |

| Account Feature - Margin Trading | Yes |

| Fractional Shares (Stocks) | Yes |

| OTC Stocks | Yes |

| Options Trading | Yes |

| Complex Options Max Legs | 4 |

| Fixed Income (Treasurys) | Yes |

| Futures Trading | No |

| Forex Trading | Yes |

| Crypto Trading | Yes |

| Crypto Trading - Total Coins | 3 |

| Traditional IRAs | Yes |

| Roth IRAs | Yes |

| Advisor Services | Yes |

One of the best for high net worth

We analyzed online brokers' offerings for clients with over $1 million of liquid, investable assets. See our guide to the Best Brokerage Firms for High Net Worth Individuals.

Fidelity fees

In 2026, most brokers have joined in the race to $0 commissions on stock trades, but Fidelity extends those savings by ruthlessly eliminating the nuisance fees that quietly erode returns at other firms. It’s rare to find a broker that feels so confident in its service that it refuses to penalize you for leaving, but Fidelity does exactly that.

Commissions: Standard trading costs are what you’d expect from a top-tier firm: $0 for stocks and ETFs, and $0.65 per contract for options. Active options traders will appreciate that Fidelity charges $0 for exercise and assignment, a cost that can stack up elsewhere. Fidelity also offers a dime buyback program, allowing you to close out low-priced short options without incurring a contract fee.

Transfer fees: While the industry standard is to charge $75 to $100 to transfer your account out (ACAT), Fidelity charges $0. I view this as the ultimate flex; Fidelity is betting you won’t want to leave. Fidelity is also one of the few major brokers to charge $0 on OTC (penny stock) trades, a segment where competitors often slap on surcharges. Fixed income investors are also treated well, with $0 fees for Treasurys and a reasonable $1 per bond for secondary market trades.

Margin rates: The only area where the pricing feels average at Fidelity is in its margin rates. With rates hovering around 12.575% for balances under $25,000, borrowing costs are in line with major bank brokers but far higher than specialized discount firms.

| Feature |

Fidelity Fidelity

|

|---|---|

| Minimum Deposit | $0.00 |

| Stock Trades | $0.00 |

| Penny Stock Fees (OTC) | $0.00 |

| Options (Per Contract) | $0.65 |

| Options Exercise Fee | $0.00 |

| Options Assignment Fee | $0.00 |

| Futures (Per Contract) | (Not offered) |

| Mutual Fund Trade Fee | Varies |

| Broker Assisted Trade Fee | $32.95 |

Mobile trading apps

Fidelity offers a mobile app that feels sleek, intuitive, and surprisingly powerful. It balances the desire for deep market data with an interface that feels at home in the scrolling era.

Mobile trading: For stock and single-leg options traders, the workflow is seamless. The options chain is filterable and includes critical data like Greeks and implied volatility. I found the app to be a great choice for the everyday investor, but the active trader may find the workflow frustrating compared to Fidelity’s desktop experience. With complex strategies, for example, the app stumbles. I found trading multi-leg options to be tedious. When I attempted to build a spread, my pre-populated long leg disappeared and I lost visibility on the Greeks during the ticket creation.

Mobile charting: Charting on mobile is often an afterthought, but Fidelity impressed me here. With over 120 technical studies and the ability to easily layer moving averages and adjust time frames, Fidelity’s charting engine is robust enough for serious analysis – though I was a bit annoyed that I couldn’t draw directly on the charts. The watchlist is similarly capable, offering a detailed view with 11 customizable columns, though I was disappointed to see that key dates like ex-dividend and earnings were missing from the selection.

Discover: The standout feature for me is the "Discover" tab. Fidelity has embraced the way modern consumers absorb information, offering short-form, scrollable, social-media-style educational videos. This innovative approach helps make financial literacy digestible and engaging. You can also stream Bloomberg TV, view Treasury yields (though not a full curve), and track sector performance all from the palm of your hand.

Fidelity’s mobile app makes learning on the go super easy with its “On Our Radar” videos which are quick social media style clips that cover everything from market trends to investing basics. They're short, smart, and actually fun to watch, making it simple to stay informed without feeling overwhelmed. It’s a great way to pick up insights in just a few minutes.

| Feature |

Fidelity Fidelity

|

|---|---|

| iPhone App | Yes |

| Android App | Yes |

| Apple Watch App | Yes |

| Stock Alerts | Yes |

| Charting - After-Hours | Yes |

| Charting - Technical Studies | 128 |

| Charting - Study Customizations | Yes |

| Watchlist (Streaming) | Yes |

| Mobile Watchlists - Create & Manage | Yes |

| Mobile Watchlists - Column Customization | Yes |

Advanced trading platforms

Fidelity’s Active Trader Pro (ATP) platform offers an advanced trading experience that feels sharp, modern, and surprisingly agile.

Trading: It’s easy to place a trade on Active Trader Pro. Beyond the standard buy and sell buttons, you’ll find contextual calls to action for quick trades as well as functions to add to a watchlist, create an alert, view the chain, or access a stock screener. "Detailed Quotes" are packed with information, including the volume weighted average price (VWAP), share float, short percentage, sector classifications, block trades, dividend history, and more. I’ll note here that this data only displays in a fixed vertical format; I’d love to see a responsive, customizable layout. The platform also supports advanced order management, including a suite of conditional orders.

Charting: Fidelity’s modernized charting engine offers a visual upgrade and 129 configurable technical indicators. Setting up my charts was a simple process, though I did have to open each indicator one at a time to adjust the settings to my preferences. I couldn’t figure out a way to configure them in bulk. All that said, the charts were modern and otherwise easy to configure.

Once again, however, Fidelity’s drawing tools missed the mark. When I selected "Draw" to place a support line, I found that I couldn’t snap the line to a specific price. I tried this with the Fibonacci extensions with the same result. This could be a friction point for technical analysts or active traders, but if drawing on charts isn’t a priority for you, you’ll still love Fidelity’s charting tools.

Workspace customization: Active Trader Pro is easy to use and customize. Upon launching the platform, I was presented with a tutorial which helped alleviate any learning curve. You can create your own workspace that supports up to four monitors; everything is modular and drag-and-drop. There’s a menu where you can launch widgets based on your accounts, trading, market data, news, etc. I really enjoyed dragging and dropping widgets across my workspace.

Options trading: Testing the options chain was my favorite part of using ATP. Simply put, it has everything you need. You can customize the view with over 25 data columns, including all the Greeks. Clicking the bid or ask instantly prepopulates a trade ticket, and enabling "multi-select" allows you to construct complex multi-leg strategies. You can also define the number of strikes and expiration dates displayed by default.

Jessica's take

"Executing a standard single-leg trade is straightforward, but I prefer using the multi-leg tool even for single contracts. I simply enable 'multi-select' on the chain and click just one contract to build the ticket at the bottom of the screen.."

I love the multi-leg experience on this platform. Once "multi-select" is active, I can choose an ask for my long leg and a bid for my short leg; the strategy immediately constructs itself beneath the chain, displaying individual data points for each leg, including Net Greeks. It even displays the probability of profit. You can also expand a calculator to model your probability of profit by adjusting price targets, dates, and implied volatility.

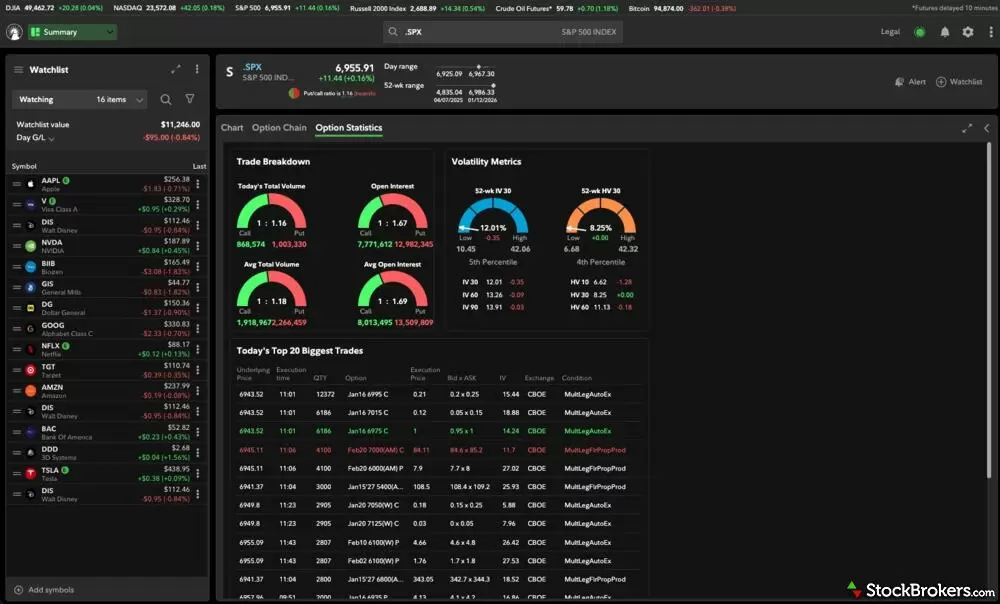

Fidelity’s trading dashboard brings everything together in one place. Here, I’ve linked SPY across all widgets for a seamless view. You can dive into options statistics, volatility indices, and my personal favorite: the trade breakdown activity, which gives great insight into how traders are positioning.

| Feature |

Fidelity Fidelity

|

|---|---|

| Active Trading Platform | Active Trader Pro |

| Desktop Trading Platform | Yes |

| Desktop Platform (Mac) | Yes |

| Web Trading Platform | Yes |

| Paper Trading | No |

| Trade Journal | Yes |

| Watchlists - Total Fields | 92 |

| Charting - Indicators / Studies | 129 |

| Charting - Drawing Tools | 38 |

| Charting - Study Customizations | 5 |

| Charting - Save Profiles | Yes |

| Trade Ideas - Technical Analysis | Yes |

| Streaming Time & Sales | Yes |

| Trade Ideas - Backtesting | Yes |

Research

Fidelity offers the gold standard for investment research in 2026. While many brokers provide data, Fidelity provides wisdom. Instead of just dumping numbers in front of you, the platform contextualizes them, bridging the gap between raw statistics and actionable strategy. Whether you’re a novice looking for a mutual fund or a pro analyzing yield curves, Fidelity’s research library is unmatched.

Fixed income: Fixed income investors will find themselves in a bond trader's paradise. Fidelity offers an institutional-grade experience where you can participate in primary Treasury auctions online for $0, or trade secondary bonds for a nominal $1 mark-up. The CD Ladder tool is also exceptional, guiding you through the maintenance of a laddered portfolio with ease.

Stock and ETF research: Fidelity’s Equity Summary Score consolidates opinions from up to seven independent research firms into a single, accuracy-weighted score, saving you the headache of cross-referencing conflicting analyst reports. I also liked the "Portfolio Fundamentals" widget, which allows you to view metrics like P/E ratios and cash flow growth for the fund itself, a level of granularity that’s often frustratingly absent elsewhere. I was also impressed by the portfolio risk tools found on the main website, which offer institutional-grade metrics like Sharpe ratio, Alpha, and Beta, data points that many competitors hide or omit entirely.

Fidelity’s economic calendar is hands-down one of the best out there. It's clean, easy to navigate, and packed with useful info. It clearly highlights market-moving events for the week, so you know exactly what to watch. Tap on any item to get more context, making it a great tool for staying ahead of and understanding key economic events.

Economic calendar: For me, the crown jewel of the entire research experience at Fidelity is its Economic Calendar. This calendar goes beyond just listing release dates for CPI or non-farm payrolls; it includes a consensus range, a chart of past data, and crucially, a "Why Investors Care" section that explains the economic implications of the event. This focus on macro-context extends to the sector research as well. I also loved the "Business Cycle" view, which classifies sectors not just by performance, but by their stage in the economic cycle (early, mid, late, or recession).

Jessica's take

"Fidelity’s economic calendar is the one I’ve personally bookmarked for daily use. I love the "Business Cycle" view, which classifies sectors by their stage in the economic cycle, allowing for a deeper level of strategic planning."

| Feature |

Fidelity Fidelity

|

|---|---|

| Research - Stocks | Yes |

| Stock Research - ESG | Yes |

| Stock Research - PDF Reports | 7 |

| Screener - Stocks | Yes |

| Research - ETFs | Yes |

| Screener - ETFs | Yes |

| Research - Mutual Funds | Yes |

| Screener - Mutual Funds | Yes |

| Research - Pink Sheets / OTCBB | Yes |

| Research - Fixed Income | Yes |

Education

While some brokers stop at providing a generic, static library of help articles, Fidelity has curated a full-scale university tailored to every stage of an investor's life, which helped secure Fidelity’s 2026 Annual Award for #1 Education. Whether you’re navigating a divorce, saving for a newborn, or learning how to trade iron condors, Fidelity has curated a specific learning path that feels both personal and professional.

Learning Center: I appreciated the "Life Events" section, which steers away from dry financial jargon to address real-world milestones like "Becoming a Parent" or "Buying a Home." Finding content on custodial accounts or 529 plans was intuitive, fitting perfectly into the "Life Event" narrative rather than getting lost in a product menu. I also found the "Save" feature to be a lifesaver; being able to bookmark an article to a "Read Later" library is a small UX detail that makes a massive difference for a busy investor.

Beginner education: I’ve found that Fidelity occasionally struggles to speak the language of the absolute novice. When I read its "What is the Stock Market?" article, I was greeted with a definition so dense and jargon-heavy that it would likely scare off a true beginner. I also noticed that the introductory stock investing section surprisingly failed to clearly define "what a stock is" in its opening piece, jumping straight into valuation concepts. Despite these minor stumbling blocks, Fidelity’s blend of webinars, detailed strategy guides, and life-centric planning makes it the undisputed leader in financial education.

Advanced education: Fidelity offers a surprisingly deep educational experience for advanced traders. The "Technical Indicator Guide" is so comprehensive that I used it as my personal bible when I worked on a trade desk. Similarly, the fixed income education goes beyond the basics, covering complex concepts like convexity and duration risk with institutional-grade detail. If you want to master technical analysis, the sheer volume of resources, including access to the Trading Strategy Desk and live coaching sessions, is unmatched.

Fidelity’s Learning Center is a robust educational hub covering everything from financial essentials and major life events to advanced trading strategies and market insights. It also features specialized content like the “Women Talk Money” series and a calendar of live and on-demand events.

| Feature |

Fidelity Fidelity

|

|---|---|

| Education (Stocks) | Yes |

| Education (ETFs) | Yes |

| Education (Options) | Yes |

| Education (Mutual Funds) | Yes |

| Education (Fixed Income) | Yes |

| Education (Retirement) | Yes |

| Videos | Yes |

| Webinars | Yes |

| Progress Tracking | Yes |

| Interactive Learning - Quizzes | Yes |

Customer service

To score Customer Service, StockBrokers.com partners with customer experience research firm Confero to conduct phone tests from locations throughout the United States. For this year's testing, 132 customer service tests were conducted over six weeks, with wait times logged for each call.

Customer service representatives were asked for assistance or details for prospective customers in several areas of broker services, including account opening, trading tools, apps, crypto offerings, active trading, and more. Here are the results for Fidelity.

- Average Connection Time: Under a minute

- Average Net Promoter Score: 9.2 / 10

- Average Professionalism Score: 8.9 / 10

- Overall Score: 9.08 / 10

- Ranking: 2nd of 11

Banking services

Fidelity may not be a bank, but for many investors, it renders the distinction irrelevant. With access to mortgage loans and an extensive inventory of CDs, Fidelity proves it can handle the liability side of your balance sheet just as well as the asset side. Fidelity offers a suite of cash management tools that integrate so seamlessly with your portfolio, you might find yourself closing your traditional checking account entirely.

Cash Management Account: The centerpiece of Fidelity’s “banking” services is the Fidelity Cash Management Account (CMA). While technically a brokerage account, it functions as a high-powered checking alternative. The standout feature here is the ATM fee reimbursement. Fidelity reimburses fees charged by other banks globally, which is a massive convenience for travelers. Coupled with bill pay, mobile check deposit, and a debit card, it manages daily liquidity without the nuisance fees often found at brick-and-mortar institutions.

| Feature |

Fidelity Fidelity

|

|---|---|

| Bank (Member FDIC) | No |

| Checking Accounts | No |

| Savings Accounts | No |

| Credit Cards | Yes |

| Debit Cards | Yes |

| Mortgage Loans | Yes |

Fidelity IRA review

Fidelity won our #1 Retirement Accounts award in 2026, securing its position as the industry standard for retirement planning. While many brokers view an IRA as a box to check on a list of features, Fidelity treats it as a primary focus. Fidelity clearly recognizes that retirement planning is a multi-decade process requiring specific tools for every stage of life.

Retirement accounts: Fidelity offers over 25 variations of retirement accounts, ranging from the standard Traditional and Roth IRAs to specialized accounts for the self-employed, including SEP, SIMPLE, and Self-Employed 401(k)s, and even crypto-enabled IRAs. For the next generation of investors, Fidelity offers the Roth IRA for Kids, which allows parents to jumpstart a child’s compounding interest journey with custodial oversight. There’s also the award-winning Fidelity Youth Account, owned and managed by teens (age 13-17).

Retirement planning: When it comes to planning, the "Fidelity Retirement Score" is far more than a static calculator; it is a dynamic health check that tracks your progress against your goals, using a simple color-coded system to show if you are on track. With $0 annual fees and $0 closure fees, Fidelity creates a frictionless environment for building generational wealth.

Limited margin: For the investor who wants to actively manage their retirement capital, Fidelity offers limited margin for IRAs. While you can’t borrow against your IRA or use leverage, limited margin allows you to trade on unsettled funds and execute defined-risk options strategies like spreads, bridging the gap between passive saving and active portfolio management in a tax-advantaged environment.

Fidelity crypto review

Crypto-native exchanges may offer hundreds of coins, but Fidelity offers a curated, streamlined environment that feels less like a casino and more like a traditional bank.

Crypto offering: Fidelity’s crypto selection is intentionally sparse, limited to just three assets: Bitcoin, Ethereum, and Litecoin. This won’t satisfy crypto traders chasing the latest meme coin, but if you’re an investor looking to add relatively established cryptocurrency to a diversified portfolio, these coins are likely all you’ll need. It’s worth noting that you can also trade these assets within a dedicated Fidelity Crypto IRA, allowing you to hold Bitcoin and Ethereum in a tax-advantaged environment alongside your stocks and bonds.

Crypto transfers: What impressed me most, however, is that Fidelity respects the ethos of the asset class. Unlike many brokers that lock your coins in a closed ecosystem (allowing you to buy but never withdraw), Fidelity allows you to transfer crypto in and out of the platform. This capability to move assets to self-custody is a massive differentiator that separates Fidelity from its brokerage peers.

Crypto fees: The cost of this convenience is a built-in spread. While trades are marketed as "commission-free," a 1% spread is baked into every buy and sell transaction.

Final thoughts

Fidelity defines what a modern brokerage should be. A perennial industry leader and award-winner, Fidelity offers a comprehensive financial ecosystem that supports investors at every stage of wealth building.

Whether you’re opening a Youth Account, managing a trust, or executing defined-risk options strategies in an IRA, Fidelity provides specialized tools for the task. This attention to detail helped Fidelity earn #1 rankings across Research, Education, and Retirement Accounts in 2026.

While the absence of futures trading and a limited crypto selection may deter a specific niche of active traders, these are minor gaps in an otherwise exhaustive offering. For the vast majority of investors seeking a single, capable home for their financial life, Fidelity is the benchmark.

Fidelity Star Ratings

| Feature |

Fidelity Fidelity

|

|---|---|

| Overall |

|

| Range of Investments |

|

| Mobile Trading Apps |

|

| Advanced Trading |

|

| Research |

|

| Customer Service |

|

| Education |

|

| Ease of Use |

|

StockBrokers.com Review Methodology

Why you should trust us

Jessica Inskip is Director of Investor Research at StockBrokers.com, bringing 15 years of experience in brokerage and trading strategy. A former FINRA-licensed rep, she held Series 7, 63, 66, and 4 licenses. Jessica focuses on investor education and brokerage industry research, appears regularly on CNBC, Bloomberg, The Schwab Network, Fox Business, and Yahoo! Finance, and hosts the Market MakeHer podcast.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Trading platforms tested in 2026

We tested 14 online trading platforms in 2026:

Read next

- Best Paper Trading Apps & Platforms for 2026

- Best Futures Trading Platforms for 2026

- Best Stock Trading Platforms for Beginners of 2026

- Best Stock Trading Apps for 2026

- Best Options Trading Platforms for 2026

- Best Brokers for Penny Stock Trading of 2026

- Best Day Trading Platforms of 2026 for Beginners and Active Traders

- Best Stock Brokers for 2026

More Guides

Popular Stock Broker Reviews

About Fidelity

Headquartered in Boston, Massachusetts, Fidelity Investments was founded in 1946 and has grown into one of the world's largest asset managers. As of June 2024, Fidelity manages $5.4 trillion in assets under management and oversees $14.1 trillion in assets under administration.