TradingView pros and cons

thumb_up_off_alt Pros

- Powerful charting tool with a massive selection of features, such as over 400 indicators and over 110 drawing tools.

- Easy to join and start using; it took less than a minute to open an account.

- Active social network to share ideas and user-built strategies for the tool.

- Offers a free plan and 30-day free trials of the non-professional plans.

thumb_down_off_alt Cons

- The free plan is ad-supported and restricts features like multi-chart layouts and advanced indicators.

- Frequent prompts to upgrade can be annoying when using the free plan.

- All the indicators and other tools can feel overwhelming at first.

- Educational resources are available, but limited guidance on the platform itself.

- The most advanced professional plans do not have a free trial.

Overall summary

|

Feature |

TradingView TradingView

|

|

Overall

info

|

|

|

Features

info

|

|

|

Ease of Use

info

|

|

|

Cost

info

|

|

|

Free version

info

|

Yes

|

|

Monthly Pricing

info

|

$14.95/mo

|

|

Annual Pricing

info

|

$155.40/yr

|

Cost and plans

TradingView offers a wide range of plans, from a completely free version to those designed for professional investors. All plans give you access to the main analysis tools and features, such as charting, screeners, and alerts. The more you pay, the more you get in terms of capabilities.

TradingView has two categories of pricing: “Non-professional” and “Professional.” Each pricing tier within those categories offers different levels of access to the various TradingView tools and features.

| Category |

Plan |

Price (Monthly) |

Price (Yearly) |

| Non-professional |

| Basic |

Free |

Free |

| Essential |

$14.95/month |

$155.40/year |

| Plus |

$29.95/month |

$299.40/year |

| Premium |

$59.95/month |

$599.40/year |

| Professional |

| Expert |

$199.95/month |

$1,199.40/year |

| Ultimate |

$239.95/month |

$2,399.40/year |

Free version

If you want to test TradingView, you can join using a free account. All you need to provide is your email and a password. With a free TradingView account, you can try TradingView’s main charting tool. However, what you can do is limited.

With a free account, you can only use one chart per tab to track a single investment at a time. You are also restricted in design, such as only being able to add two indicators per chart. If you try to go beyond your capabilities, you’ll get an ad blocking you and suggesting you sign up for a paid plan. Video commercials also pop up occasionally, distracting you from the charts.

The free version is a way to test the waters, but the ads and restrictions will quickly get frustrating if you use it regularly for investment research.

Non-professional plans

The TradingView paid plans open more capabilities than the free version, such as creating multiple watchlists to organize your research or using customized time frames on your charts (eg. intervals of 54 minutes versus only using hours). There are three plans for non-professional investors, with a discount on the TradingView cost if you sign up annually:

- Essential = $14.95 per month, $155.40 per year (40% off monthly)

- Plus = $29.95 per month, $299.40 per year (50% off monthly)

- Premium = $59.95 per month, $599.40 per year (60% off monthly)

You can try any of these plans for free for 30 days. None of these paid plans have ads. The more expensive the plan, the more you can do, especially with the charting tool.

For example, the Essential plan lets you create and manage two charts per tab, Plus lets you create up to four charts, and Premium lets you create up to eight. You can add more indicators per chart, set up more alerts, and create more connections as your subscription tier increases (see below).

The Premium subscription also offers more advanced functions than the other plans. For example, it lets you set up volume candles that combine price and time in one chart and set up alerts that don’t expire, which is ideal for long-term strategies. With Essential and Plus, alerts expire after two months, so you must set them up again.

Consider the size of your portfolio and the research needed to find the correct tier and TradingView cost. How many investments do you plan on tracking at once during the trading day? Do you need more than a few indicators per chart? If you’re unsure, take advantage of the 30-day free trial to see just how much power you need from TradingView.

Professional plans

TradingView also offers plans for professional investors who trade on behalf of a business. This includes investors registered with a financial regulatory body like FINRA. These plans provide even more charting capabilities, the option to buy professional market data, and premium support.

However, they are considerably more expensive: $199.95 monthly ($1,199.40 / yr) for Expert and $239.95 ($2,399.40 / yr) for Ultimate. The professional plans also do not come with a free trial.

Features

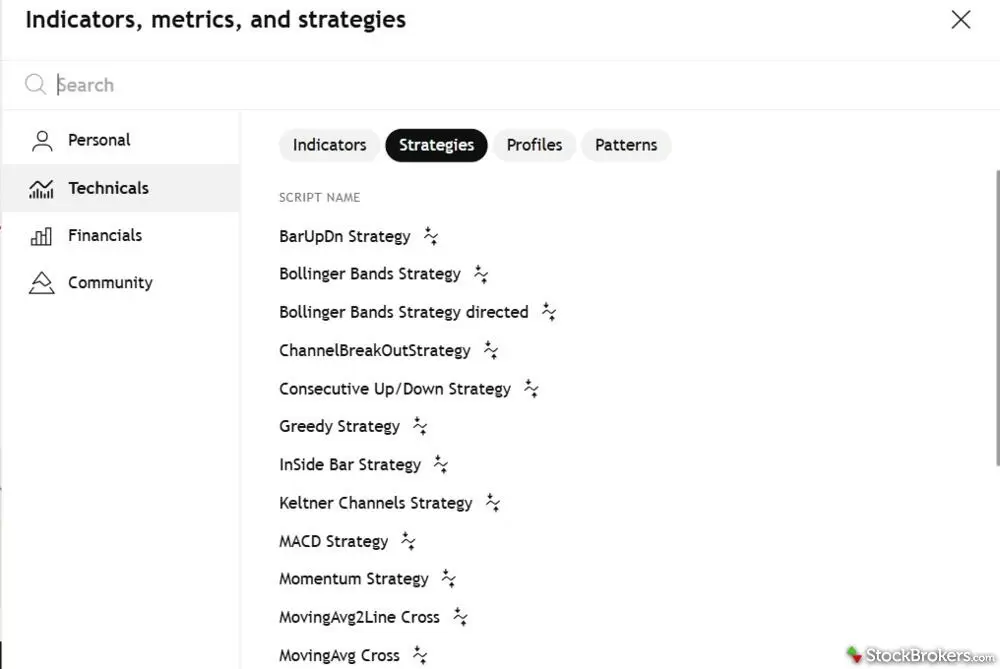

TradingView stands out for its Supercharts platform. All the features, such as screeners, alerts, and community input, connect to the charting tool to improve performance.

If you are an active investor or day trader who frequently uses technical analysis to plan trades, this is a powerful combination, but it can feel a little overwhelming for someone who only wants more basic screeners and alerts. Here’s more on how these features work.

Charting

TradingView is primarily a charting platform and one of the very best around. You can create charts for stocks, ETFs, crypto, bonds, futures, and forex. You can also create charts for markets internationally.

You have a massive level of control over designing the charts. Depending on your subscription, you have potential access to:

- Over 100,000 indicators, including over 400 built-in indicators and strategies

- Over 110 smart drawing tools

- Over 20 chart types

- Dozens of drawing tools

- Customizable timeframes

While sorting through all these options can initially feel overwhelming, TradingView’s platform is user-friendly. Each feature is clearly labeled for the charting, and it feels intuitive to add and remove information and save charts.

You can link many brokers directly to the charting tool, such as TradeStation, tastytrade, and Interactive Brokers. That way, you can process trades while still on the TradingView platform and react immediately to market trends, when every second counts.

You see your screeners, watchlists, market news, and other information all on the charting platform. The interface can get busy quickly, though you can minimize sections you aren’t using.

Screeners

If you’re trying to identify your next investment, TradingView offers screeners for stocks, bonds, ETFs, crypto, crypto pairs, DEX, and CEX. This tool lets you sort through thousands of possible investments across data like recent price changes, P/E ratios, revenue growth, and dividend yield.

TradingView also gives some input on the quality of investments, for example, showing what percentage of a return on equity is profitable versus not profitable. For more advice, TradingView includes analyst ratings and its own ratings for investments. You can access this same screening information on the charting tool as well.

The TradingView screener is decent, with a large selection of metrics and the ability to screen investments in both U.S. and international markets. If you want even more data, there are companies specializing in screeners that provide even more metrics, like Stock Rover. However, the TradingView capabilities are enough for the typical investor, especially since they can be used right on the charting tool.

In addition to the screening tools, TradingView offers heatmaps. You can pick a sector or index and see the overall performance. That can visually help you see trends and find opportunities. TradingView’s heatmaps are easy to set up and visually effective. They handle this feature well.

Watchlists and Alerts

TradingView lets you quickly set up watchlists for investments you want to watch for real-time market data. You get a basic view of your watchlist on the charting platform and can dive deeper into that information on the watchlist page.

More importantly, TradingView allows you to set up investment alerts, such as price changes or alerts that trigger a strategy you’ve drawn on your chart. If so, you’ll receive alarms and pop-ups if you are on the TradingView platform, as well as email and SMS notifications.

While watchlists and alerts are common features on investment platforms, I was impressed by the sheer volume and versatility at TradingView. With a Premium plan, you can set up hundreds of price and technical alerts at once, helping you keep track of a large portfolio with tons of data automatically.

Bar Replay

TradingView offers a Bar Replay function that lets you look at historical market data on a chart and see how your strategies would have worked. It’s a way to test trading strategies and charting functions without committing money in real time.

You pick the timeframe for your target investment. You then hit play, like a video. TradingView will slowly show the pricing data and any strategy you set up to test.

You can fast-forward and rewind until you find patterns that you think would be useful for trading in the future. The Bar Replay function is unique and not seen on other popular charting tools. It’s a nice addition for investors who want to backtest past strategies and practice trading without losing money.

Community Ideas and Strategies

TradingView prides itself on having an active investor community working together to share ideas and strategies. TradingView actually describes itself as a social network on top of a charting platform, showing how committed it is to connecting investors.

TradingView also runs a Community Ideas forum where popular users post ideas and thoughts on market conditions. You can even download and use analysis tools built and designed for the TradingView trading platform. This creates way more possibilities for the platform. For example, TradingView has built roughly 400 indicators and strategies itself, but users have developed over 100,000 additional public indicators.

Investing can get lonely, especially as you try to develop new strategies, so this active community could help you stay motivated.

Ease of use

TradingView is generally easy to use, if you're an experienced investor. It took me less than a minute to create a free account and start experimenting for our TradingView review. The different research tools are all easy to find. The more basic tools, like the screeners, are also easy to figure out as a first-timer.

However, the charting tool can feel a little overwhelming, especially to beginner investors new to charting and technical analysis. There’s a ton going on and many functions to navigate. The tools are labeled, but there are limited instructions on what each one does. While it’s simple enough to dive in and start creating charts, there isn’t much explanation on how to do so effectively. When you first join, the welcome video focuses more on rock climbing than the platform itself.

For more help, you can go to the extensive TradingView Knowledge Base. Here, you can find detailed articles and videos on TradingView. Beginners may prefer a tool with more support built throughout the charts themselves, but TradingView is designed with the impression that you already know what you’re getting into.

Final thoughts

Is TradingView worth it?

TradingView deserves its place as one of the most popular investment tools on the market today. Its charting platform is robust, with tons of research features. Despite the almost overwhelming amount of capabilities, the platform is well-designed so that you can dive right in.

I also loved the community aspect of this tool that lets you work with the over 100 million other investors on TradingView. Ultimately, TradingView offers something for investors of all types, from its free version that appeals to beginners to plans designed for professional investors.

Alternatives to TradingView

If you want something low-cost or free, you could potentially gain more charting features from Stock Rover. StockCharts also does a better job building in education to teach you technical analysis while you use the tools; you don’t have to go to a separate educational library like TradingView.

Finally, while you can connect TradingView to your broker to make trades, some investors may prefer handling research through their broker, so they only have one account. Fidelity and TradeStation are two brokers that provide decent charting. All that being said, investors who want top-notch charting capabilities will have trouble finding something better than TradingView.

FAQs

How do you paper trade on TradingView?

TradingView offers paper trading automatically through its charting platform. This lets you practice trades with free money to test the platform and your strategies. At the bottom of the charting tool, you’ll see the Trading Panel. Here, you can either link your broker or select Paper Trading.

If you log into your Paper Trading account, you’ll start with $100,000 of play money. From there, when you execute trades, they’ll happen using your free money. Over time, you can see how you would have performed. You can request more free money from TradingView if you run out by resetting the account.

Does TradingView provide buy and sell signals?

Yes, TradingView provides buy and sell signals through its indicators and alerts. You pick what indicators you want to use for your charts, such as relative strength.

These indicators will then flash according to their process. For example, an exponential moving index indicator can help show when a stock is overbought or oversold on your chart to help with trade decisions. You can also use analyst ratings on the screeners to see buy and sell recommendations for different assets.

Does TradingView have a trading journal?

No, TradingView doesn’t have a built-in trading journal as part of its tool suite. While it offers charting, analysis, and paper trading features, traders looking to log and analyze their trade history will need to use a third-party journal. For the best options, check out our guide to the best trading journals for 2025.

Can you do automatic trading with TradingView?

Yes, you can do automatic trading with TradingView. You must combine the alert function with a broker allowing automated trades. You will also need to link a trading bot or API that will receive the email alerts from TradingView to trade on your behalf. With this setup, email alerts will automatically trigger trades through your broker.

Is TradingView free?

Yes, TradingView does offer a free version, and it’s a great way to test the waters before committing to a paid plan. I opened a free account in under a minute, no credit card required, and was able to access the core charting tools immediately. You’ll get a single chart per tab, a couple of indicators, and access to TradingView’s community content and screeners.

That said, it’s not without limits. Ads pop up, multi-chart layouts are restricted, and you’ll quickly run into alerts telling you a feature is locked behind a paywall. If you're just exploring or learning technical analysis, it’s more than enough. But once you get serious about building strategies or tracking multiple markets at once, you’ll likely feel the push toward a paid tier.

Are there any free alternatives to TradingView?

You can get free charting through brokers such as Fidelity and TradeStation. Other companies like Stock Rover and Yahoo Finance also offer free charting. Keep in mind that TradingView offers a free plan as well. You access all the same tools, just with ads and restricted capabilities.

Our mission at StockBrokers.com is simple: provide thorough and unbiased reviews of online brokers, based on an extraordinary level of hands-on testing and data collection. Our ratings and awards are based on this data and our in-house experts’ deep authority in the field; brokers cannot pay for preferential treatment. Here’s more about trustworthiness at StockBrokers.com.

Our research team conducts thorough testing on a wide range of features, products, services, and tools for U.S. investors, collecting and validating thousands of data points in the process; this makes StockBrokers.com home to the largest independent database on the web covering the online broker industry. We test all available trading platforms for each broker and evaluate them based on a host of data-driven variables.

As part of our process, all brokers had the annual opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy. Brokers also were offered the opportunity to provide executive time for an annual update meeting.

Our rigorous data validation process yields an error rate of less than .001% each year, providing site visitors quality data they can trust. Learn more about how we test or about StockBrokers.com.