Best broker for fractional shares – Fidelity

| Company |

Overall |

Minimum Deposit |

Fractional Shares (Stocks) |

Fidelity Fidelity

|

|

$0.00 |

Yes |

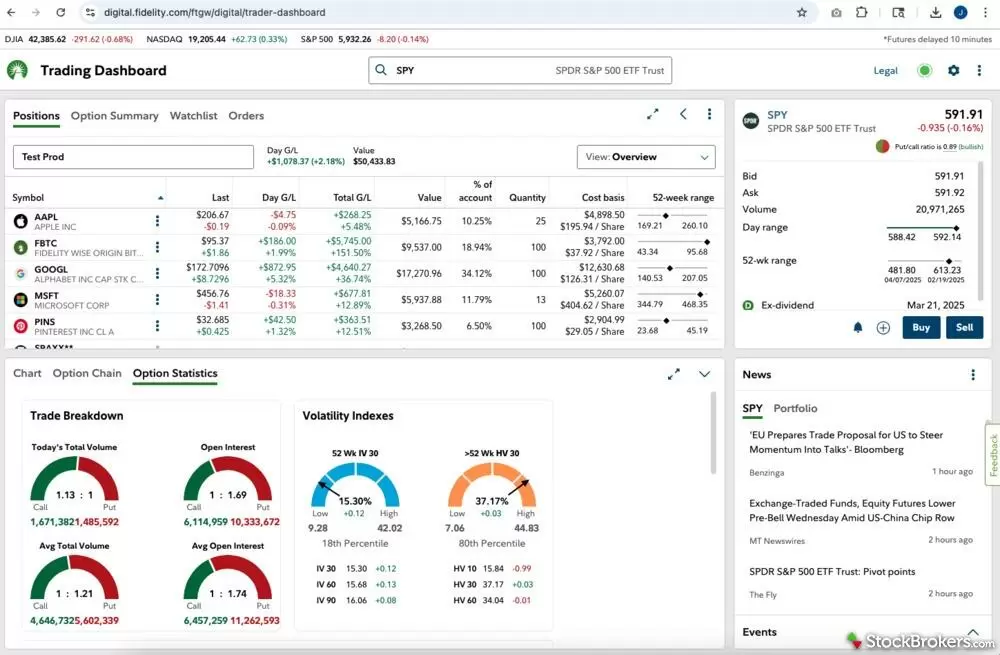

Fidelity is my favorite broker for trading fractional shares in 2025, thanks to its meticulously designed order ticket and dedication to giving customers the lowest-cost executions. Fidelity’s platforms are simple, straightforward, and elegantly designed.

Fidelity’s “Basket Portfolios” feature makes setting up a basket of stocks, including fractional shares, easy. Basket Portfolios allow traders to automate recurring investments or rebalance, buy, or sell the entire basket. If you don’t want to set up your own basket, beginners can get started with prebuilt models provided by Fidelity.

You can trade most of the stocks and ETFs available at markets like the NYSE and NASDAQ as fractional shares at Fidelity, bringing the total to thousands of eligible fractional shares. Additionally, the minimum purchase amount can be as low as $1.

I’ve found that Fidelity delivers value across its entire client experience and, in general, is a winner for beginner stock traders. Check out our Fidelity review to learn more.

Stock Slices of any company in the S&P 500 – Charles Schwab

| Company |

Overall |

Minimum Deposit |

Fractional Shares (Stocks) |

Charles Schwab Charles Schwab

|

|

$0.00 |

Yes |

Charles Schwab is a highly rated broker that got even better with its acquisition of TD Ameritrade. Now, Schwab customers have access to the powerful thinkorswim trading platform as well as a wide range of investment tools and educational resources.

Schwab’s fractional shares, called “Stock Slices,” allow investors to diversify their risks across any of the companies in the S&P 500. With 500 stocks available, Stock Slices provide more than enough choices for individual stock investors. Fractional shares at Schwab come with a minimum purchase price of $5 and are available right from within the all-in-one trade ticket.

Learn more about why Schwab is one of our favorite brokers by checking out our Charles Schwab review.

More than 10,000 fractional shares – Interactive Brokers

Interactive Brokers (IBKR) is known for its professional-grade tools and global reach, offering an impressive range of investment options across 150 markets. It's a solid choice for experienced traders who want access to advanced features, low commissions, and the ability to trade in foreign markets.

Interactive Brokers offers multiple options for fractional share trading across its platforms, including on the TWS (Trader Workstation) for desktop and its IBKR GlobalTrader web and mobile platform.

Fractional share purchases for stock traders in the U.S. and Canada at Interactive Brokers have the same commissions as regular stock trading. IBKR Lite offers commission-free trading of U.S. stocks and ETFs and IBKR Pro provides two options for stock trading: a fixed rate commission of USD 0.005 per share (minimum USD 1.00 per order, capped at 1% of the trade value) and a tiered rate starting at USD 0.0035 per share (minimum USD 0.35, also capped at 1%).

Interactive Brokers offers fractional shares on any eligible U.S., Canadian, or European stocks and ETFs, which functionally brings their total fractional offering to over 10,000 different shares.

It’s worth noting that you can’t currently practice trading fractional shares in a paper trading account at Interactive Brokers.

FAQs

What are fractional shares?

Fractional shares enable investors to own a percentage of a share of company stock. With fractional shares, investors and traders are not required to purchase at least one share in order to invest in a company.

As an example, let’s say you’ve decided to invest in Berkshire Hathaway Inc. (NYSE: BRK.B), which was priced at around $473.73, as of early February 2025. Maybe the price tag on that stock is simply too steep for you; not all traders can afford to pay over $400 for one share. With fractional shares, you can still invest in BRK.B by purchasing a percentage of one share. For example, if you decided that you could afford to invest $100, you could purchase 21.11% of one share at that price.

Are fractional shares worth it?

Yes, fractional shares can be worth it for investors and stock traders of all experience levels. Here are three reasons that fractional shares can have a place in any investor’s portfolio:

- Flexible investment: Fractional shares let you invest according to your budget. Investors can diversify a portfolio by buying multiple stocks without the budget requirements that would be necessary for buying full shares of each stock.

- Customizable portfolios: With fractional shares, you can create a personalized basket of stocks, similar to an ETF, tailored to your investment strategy. This customization can include specific allocations. For example, you might want to set a target weight of 12% for a given stock to allocate from your trading balance; you can purchase fractional shares to hit the exact 12% portfolio allocation.

- Convenience for all investors: Fractional shares aren't just for those on a tight budget. Even seasoned investors with substantial portfolios can benefit by making precise allocations without needing to round up to the nearest whole share.

Do fractional shares pay dividends?

Yes, in most cases you will earn fractional dividends if you own fractional shares (but it’s best to check with your broker to make sure). Your dividend will be proportional to the number of fractions of a share that you own.

What brokers allow you to buy fractional shares of ETFs?

Both Fidelity and Interactive Brokers offer a wide variety of fractional ETFs to trade. Most of the brokers on our list, with the exception of Charles Schwab, allow you to buy fractional shares of ETFs (Exchange-Traded Funds), making it easier than ever to invest in the stock market – regardless of your trading budget. This flexibility allows you to allocate any dollar amount toward your investment strategy, whether you're pursuing a passive approach with ETFs or engaging in more active trading.

For example, consider the Vanguard 500 Index Fund ETF (VOO), which aims to replicate the performance of the S&P 500 Index. As of February 2025, VOO is priced at approximately $560.69. If you wanted to invest $250 per week in this ETF, you could set up a recurring purchase to either allocate that exact dollar amount using fractional shares.

Investing a fixed dollar amount instead of a specific fractional share can be a more consistent approach, especially given the fluctuations in ETF prices. This method allows you to buy into the ETF over time without worrying about the exact share price on the day of your purchase.

How do you buy a fractional share?

On most major platforms, buying a fraction of a share is no different than buying a whole share. In most cases, you’ll simply specify two extra decimals (or more if supported) to any whole number or zero (i.e., you might decide to buy 1.34 shares of a company stock). This is done in the order window before submitting your order for execution with a broker that supports fractional shares.

For example, on Fidelity’s web platform, you can either specify the dollar amount you wish to invest or the number of shares you want to buy. If you choose the dollar amount, the platform will automatically calculate the corresponding fractional share based on the current price of the stock. This flexibility makes it easy to invest exactly how much you want.

Here’s a step-by-step breakdown of the buying process:

- Choose a broker: First, ensure that your online stock broker supports fractional shares. Some of the best stock brokers, like Fidelity, Schwab, and Interactive Brokers offer the ability to buy fractional shares.

- Log in: Access your brokerage account using your credentials.

- Select the stock: Find the stock you want to buy. For example, you might search for “TSLA” for Tesla.

- Enter your order: Click on the option to buy shares of the selected stock. This will bring you to the order entry screen. You’ll need to specify the fraction of shares you want to buy, typically in decimals (e.g., 0.1 for a tenth of a share). You can also just enter the dollar amount you wish to invest. Most platforms will provide a real-time share percentage calculation based on the dollar amount.

- Review and submit your order: Once you’ve reviewed the order details, click on the “Buy” or “Submit” button to execute the trade. Your fractional shares will be added to your portfolio.

What brokers offer fractional shares?

Based on our hands-on testing, here is our full list of brokers that offer fractional shares in 2025 (in alphabetical order):

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on StockBrokers.com is fact-checked by our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the brokerage industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we test

At StockBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the best stock brokers.

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 14.5, and the iPhone XS running iOS 17.6.

- For Android, we use the Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra devices running Android OS 14.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms. Learn more about StockBrokers.com.