Winners Summary

Best for futures trading - Tastytrade

| Company |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

tastytrade tastytrade

|

$0.00 |

$0.00 |

$0.50 info |

Tastytrade is my personal favorite for futures trading. It’s a delightful platform with a great default layout and powerful tools. You can zap in and out of positions almost instantaneously. The futures pricing is attractive and the options commissions are even better. It’s best for chart traders rather than event-driven traders; the charts package is terrific, but the news and commentary are sparse. The platform's ease of use and emphasis on risk management and order entry make it an especially great platform for casual traders. Check out my full tastytrade review to explore their entire offering.

- Futures: $1.25 per contract.

- Micro: $0.85 per contract.

- Small: $.25 per contract.

- Futures options: $2.50 to open, $0 to close.

- Micro futures options: $1.50 to open, $0 to close.

- Smalls futures options: $0.50 to open, $0 to close.

Tastytrade platforms and tools gallery

Tastytrade mobile gallery

Best for professional futures trading - Interactive Brokers

| Company |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Interactive Brokers Interactive Brokers

|

$0.00 |

$0.00 |

$0.65 |

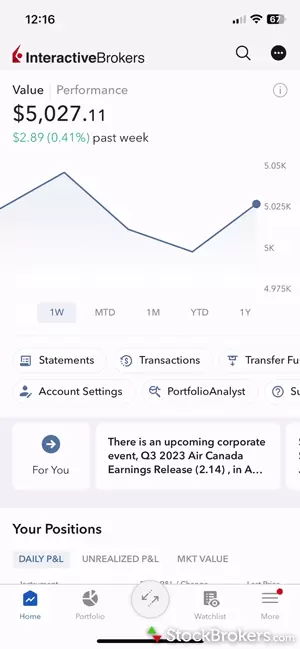

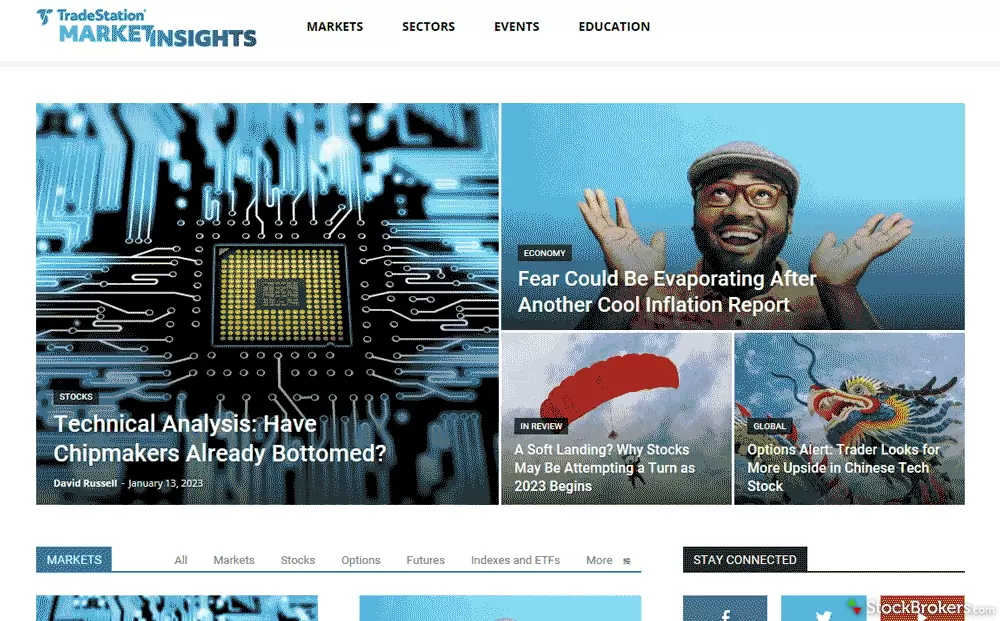

Interactive Brokers’ futures commissions are super low. The commission for trading an E-micro contract or an option on a micro is only a quarter, and Trader Workstation is almost infinitely tweakable, loaded with tools, data, research, and news. It also recently added a vastly better chart package. These features make it a great pick for professional futures traders. Unfortunately, I find setting up a layout on Trader Workstation that works for me to be needlessly frustrating. Happily, IBKR seems to understand that many traders want a simpler workspace, so it’s in the process of rolling out a new and aptly named IBKR Desktop app.

Interactive Brokers has a restrictive compliance department, so it might be difficult to get approved for futures trading. I used a demo account to review futures trading at IBKR because, apparently, having a CFA and a CMT along with teaching investing at a business school isn’t enough for IBKR, and I have had no difficulties being approved for futures at the other brokers I test. That said, if you can get approved, its versatility and low-cost futures trading make it my pick for professionals. Visit my Interactive Brokers review for a more in-depth look.

- Futures and options: $0.85 per contract.

- E-Micro and options: $0.25 per contract.

- Small (all contracts): $.08 per contract (no tiered pricing).

- Crypto: varies.

Interactive Brokers platforms and tools gallery

Interactive Brokers mobile gallery

Great platforms and low commissions - TradeStation

| Company |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

TradeStation TradeStation

|

$0.00 |

$0.00 |

$0.60 |

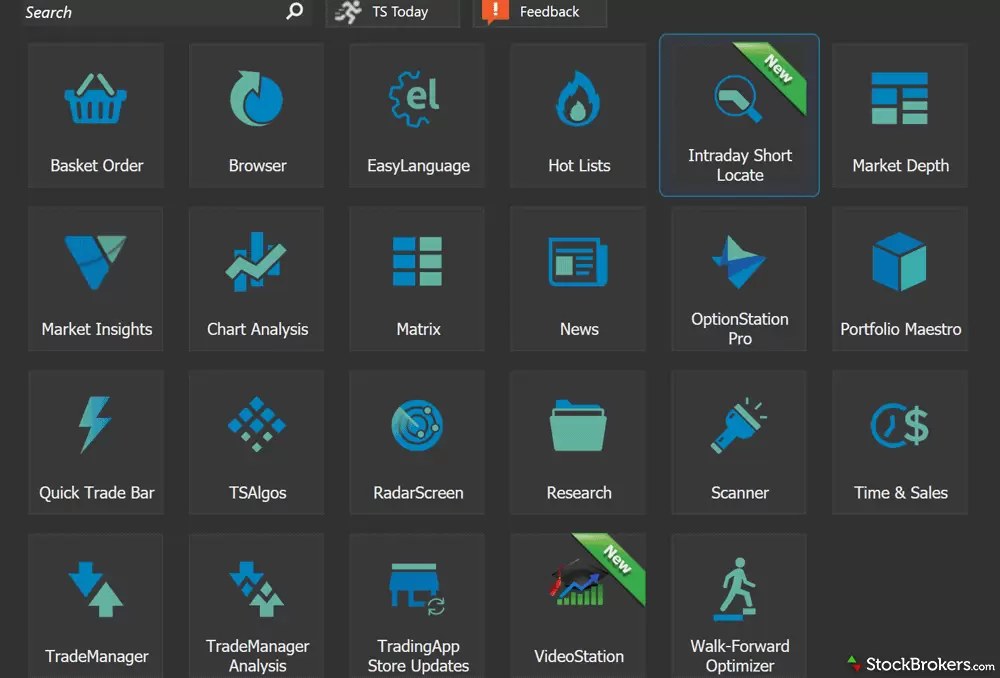

TradeStation is one of my top picks for futures trading due to its powerful desktop platform and competitive pricing. The TradeStation desktop is highly customizable, making it perfect for advanced traders who want to build automated strategies using the proprietary EasyLanguage tool. It offers robust charting with 30+ years of data for backtesting, alongside features like Matrix (ladder trading) and advanced order types.

For futures trading, TradeStation delivers great value at $1.50 per contract (per side), offering low commissions and a seamless trading experience across all its platforms. While the platform has a learning curve, I believe it’s well worth the time to master for those serious about trading futures. Read my full review of TradeStation to learn more more about their platform.

- Futures: $1.50 per contract.

- Micro: $0.50 per contract.

- Future Options: $1.50 per contract.

TradeStation platforms and tools gallery

TradeStation mobile gallery

Best futures trading platforms comparison

|

Feature |

tastytrade tastytrade

|

Interactive Brokers Interactive Brokers

|

TradeStation TradeStation

|

E*TRADE E*TRADE

|

Charles Schwab Charles Schwab

|

|

Desktop Trading Platform

info

|

Yes

|

Yes

|

Yes

|

No

|

Yes

|

|

Web Trading Platform

info

|

Yes

|

Yes

|

Yes

|

Yes

|

Yes

|

|

Paper Trading

info

|

No

|

Yes

|

Yes

|

Yes

|

No

|

|

Trade Journal

info

|

No

|

Yes

|

No

|

No

|

Yes

|

|

Watch Lists - Total Fields

info

|

33

|

659

|

341

|

43

|

580

|

Futures trading platforms trading fees comparison

|

Feature |

tastytrade tastytrade

|

Interactive Brokers Interactive Brokers

|

TradeStation TradeStation

|

E*TRADE E*TRADE

|

Charles Schwab Charles Schwab

|

|

Minimum Deposit

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

|

Stock Trades

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

|

ETF Trade Fee

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

|

Mutual Fund Trade Fee

|

N/A

info |

$14.95

|

$14.95

|

$0.00

|

Varies

|

|

Options (Base Fee)

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

|

Options (Per Contract)

|

$0.50

info |

$0.65

|

$0.60

|

$0.65

|

$0.65

|

|

Futures (Per Contract)

|

$1.25

|

$0.85

|

$1.50

|

$1.50

|

$2.25

|

|

Broker Assisted Trade Fee

|

$0

|

$30

|

$25

|

$25

|

$25

|

FAQs

What is futures trading?

By trading a futures contract, you are agreeing to buy or sell an asset—like commodities, indexes, or even currencies—at a set price on a future date. Essentially, it locks in today’s price for something you'll deliver later. While some traders aim to take physical delivery of goods like oil or wheat, most are in it for the price fluctuations. They settle in cash, pocketing the difference between the contract's strike price and the market price at the time of settlement. Originally, futures markets were designed for farmers and producers to protect themselves from unpredictable price swings, but today they offer opportunities to traders of all different types of commodities and equities.

In the U.S., futures trading operates under strict regulation. The Commodity Futures Trading Commission (CFTC) oversees the market, making sure everything runs smoothly and fairly. They work hand-in-hand with the National Futures Association (NFA), the industry’s self-regulating body. I can tell you from experience that both organizations take their roles seriously—offering protection to traders and ensuring market transparency. Without these safeguards, the high-stakes world of futures trading would be far riskier. Always make sure your broker is properly regulated by these bodies for a safe trading experience if located in the U.S.

What are the hours for futures trading?

Futures trading happens 24/7 around the world, but trading hours vary by market and traders should be aware of any upcoming holidays. Equity index and other futures traded on the CME are typically available between 6 p.m. Eastern Time Sunday (the “open”) and 5 p.m. Friday (the “close”). I recommend that traders bookmark the CME Group’s online trading calendar.

How much does it cost to trade futures?

The per-contract cost depends on which instrument you trade. Interactive Brokers charges as little as $0.08 per Small Exchange futures contract. There are also E-Mini and E-Micro contracts and there are often options on futures contracts available. Each futures broker has its own unique pricing. Commission aside, some brokers also charge monthly platform fees and market data fees, so it’s important to consider all costs before selecting a futures trading platform. Exchanges also levy fees on trades, but they are uniform across brokers.

Each online broker requires a different minimum deposit to trade futures contracts. For most online futures brokerages, the minimum deposit is less than $1,000. Note that before you can trade futures, you must apply for margin trading and futures trading approval.

Do I need a margin account to trade futures?

Yes, a margin account is required to trade futures with an online broker, but the margin requirements differ from stocks.

Unlike a margin loan to buy stock, futures margin is a deposit against potential losses rather than a loan. It’s more like collateral on a loan than a down payment.

The initial margin depends on the instrument being traded, but can be as low as 3% of the contract. Exchanges and your futures broker can change margin requirements at any time.

What is the best platform for trading futures?

My top pick for futures trading is tastytrade due to the overall ease of use and design of its platform. That said, both Interactive Brokers and tastytrade offer attractive pricing and powerful desktop platforms. Interactive Brokers is more geared toward professional investors and has much more news and research, while tastytrade is quick and convenient for individual traders.

Novice traders willing to pay a bit more will find Power E*TRADE’s web platform a great place to get started.

What is the best mobile app for futures trading?

During my testing, Power E*TRADE Mobile from E*TRADE stood out as one of the best mobile apps for futures trading. It offers a robust set of features designed for advanced traders, making futures trading seamless. Power E*TRADE supports multiple futures ladders simultaneously, allowing you to monitor markets and execute trades quickly using the Quick Trade widget. It also provides over 100 indicators for detailed chart analysis, helping you make informed decisions on the go.

While both E*TRADE Mobile and Power E*TRADE are feature-rich, Power E*TRADE is specifically tailored for active traders, offering sophisticated tools like bracket orders and predefined screeners for technical patterns, volatility, and unusual activity. These features make managing and optimizing futures positions easier, even from your phone.

Can you trade futures with Fidelity?

No, Fidelity does not currently offer futures trading. Investments provided by Fidelity include stocks, fractional shares, OTC stocks, options, mutual funds, bonds, and, in some U.S. states, crypto. Futures and forex are not available. Read our full review of Fidelity.

Our Research

Why you should trust us

Sam Levine, CFA, CMT, formerly a lead writer for StockBrokers.com, has over 30 years of investing experience and actively trades stocks, ETFs, options, futures, and options on futures. He's held roles as a portfolio manager, financial consultant, investment strategist and journalist. He holds the Chartered Financial Analyst (CFA) and the Chartered Market Technician (CMT) designations and served on the board of directors of the CMT Association.

Blain Reinkensmeyer, head of research at StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Blain created the original scoring rubric for StockBrokers.com and oversees all testing and rating methodologies.

For this guide:

- Whenever possible, we used our own brokerage accounts for testing. For several brokers, we used a test account that was provided to us.

- We collected multiple data points concerning futures trading for each broker.

- We tested each online broker's futures trading capabilities, including placing live trades.

- We took over 100 platform screenshots.

How we tested

For this guide to the best platforms for futures trading, our research team compared pricing, including contract charges and margin rates, and evaluated each broker’s platform features, including its trading tools; quality of market research; app, desktop and web usability; and available order types. All research, writing and data collection at StockBrokers.com is done by humans, for humans. Read our generative AI policy here.

StockBrokers.com uses a variety of computing devices to evaluate trading platforms. Our reviews were conducted using the following devices: iPhone 12 Pro, iPhone 15 Pro Max, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro. In testing platforms and apps, our reviewers place actual trades for a variety of instruments.

As part of our data check process, we sent a data profile link to each broker summarizing the data we had on file and the data they provided us last year, with a field for entering any data that had since changed. For the brokers that filled out these profiles, we audited the information for any discrepancies between our data and the broker’s data to ensure accuracy.

As part of our review process, all brokers had the opportunity to provide updates and key milestones in a live meeting that took place in the fall. Meetings with broker teams also took place throughout the year as new products rolled out. Insights gathered from these calls helped steer our testing efforts to ensure every feature and tool was assessed.

Trading platforms tested

We tested 17 online trading platforms for this guide:

Read next

More guides

Popular stock broker reviews

About the Editorial Team

Sam Levine has over 30 years of experience in the investing field as a portfolio manager, financial consultant, investment strategist and writer. He also taught investing as an adjunct professor of finance at Wayne State University. Sam holds the Chartered Financial Analyst and the Chartered Market Technician designations and is pursuing a master's in personal financial planning at the College for Financial Planning. Previously, he was a contributing editor at BetterInvesting Magazine and a contributor to The Penny Hoarder and other media outlets.

Carolyn Kimball is a former managing editor for StockBrokers.com and investor.com. Carolyn has more than 20 years of writing and editing experience at major media outlets including NerdWallet, the Los Angeles Times and the San Jose Mercury News. She specializes in coverage of personal financial products and services, wielding her editing skills to clarify complex (some might say befuddling) topics to help consumers make informed decisions about their money.

Steven Hatzakis is the Global Director of Research for ForexBrokers.com. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative.

Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. He heads research for all U.S.-based brokerages on StockBrokers.com and is respected by executives as the leading expert covering the online broker industry. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets.