Top 5 winners for Range of Investments

Best range of investments - Interactive Brokers

When testing Interactive Brokers (IBKR), it became clear to me that their offering of investments goes far beyond what you'd expect from a full-service brokerage firm. IBKR doesn’t stop at individual taxable and retirement accounts or basic offerings like stocks and ETFs. Instead, they provide access to foreign exchanges, options, futures, bonds, currencies, cryptocurrencies, ETFs, U.S. Spot Gold, hedge funds, and even forecast and event contracts. This comprehensive lineup allows investors to access virtually every type of market and product imaginable.

What truly sets IBKR apart is their ability to integrate this vast range of investments into a cohesive and user-friendly platform. They cater to both individuals and institutions, delivering account types and tools that empower investors to navigate markets seamlessly. True range of investments isn’t just about variety – it’s about access, flexibility, and integration. IBKR checks all these boxes, making them the undisputed leader for investors who want full-service access to global markets.

Check out my Interactive Brokers review.

Best range of Investments with supporting tools - Charles Schwab

| Company |

Overall |

Minimum Deposit |

Range of Investments |

Charles Schwab Charles Schwab

|

|

$0.00 |

|

Charles Schwab offers the full suite of investment products expected from a full-service brokerage – stocks, mutual funds, ETFs, options, and fixed income. During my testing, I found their range of unique offerings exceptional, including the ability to participate in IPOs, access primary and secondary markets, forex and futures trading, and trade in local currencies in foreign markets. Schwab goes beyond offering fixed-income products by providing tools specifically designed to help investors build treasury and brokerage CD ladders.

Schwab’s variety also includes mutual funds, ESG investing solutions, trust services, fractional shares through Stock Slices, and personal indexing for highly customized portfolios. This methodical product suite, with both the tools and products to back it up, is what secured Schwab’s position as the first runner-up in this category.

Check out my Charles Schwab review.

Best range of investments for retirement accounts - Fidelity

| Company |

Overall |

Minimum Deposit |

Range of Investments |

Fidelity Fidelity

|

|

$0.00 |

|

Fidelity offers a broad range of investments with standout features like the ability to participate in treasury auctions directly online. During my testing, I found this feature to be straightforward and easy to use—a rarity among brokers, some of which still require phone calls for similar services. Fidelity also offers a comprehensive charitable giving program and an extensive lineup of mutual funds, many with little to no fees as Fidelity is also a fund company.

Beyond mutual funds and ETFs, Fidelity provides in-house actively managed ETFs, IPO participation, laddering tools, basket trading, youth-oriented tools, and even annuities and life insurance products. Fidelity also excels in retirement services, offering extensive account options for individuals and larger companies alike.

Check out my Fidelity review.

Broad range of investments - E*TRADE from Morgan Stanley

| Company |

Overall |

Minimum Deposit |

Range of Investments |

E*TRADE E*TRADE

|

|

$0.00 |

|

E*TRADE is a full-service brokerage firm that provides access to a wide range of investment products. During my testing, I found the platform offers everything you’d expect: stocks, ETFs, mutual funds, options, futures, fixed-income products, and brokerage CDs. E*TRADE also includes prebuilt portfolios comprised of ETFs or mutual funds, which makes it easier for investors looking for a more hands-off approach.

E*TRADE offers additional tools and features, such as laddering tools for fixed income and IPO participation. With its extensive lineup of investment vehicles and account types, E*TRADE caters to a wide range of investor needs.

Check out my E*TRADE review.

Best range of investments for advanced traders - TradeStation

| Company |

Overall |

Minimum Deposit |

Range of Investments |

TradeStation TradeStation

|

|

$0.00 |

|

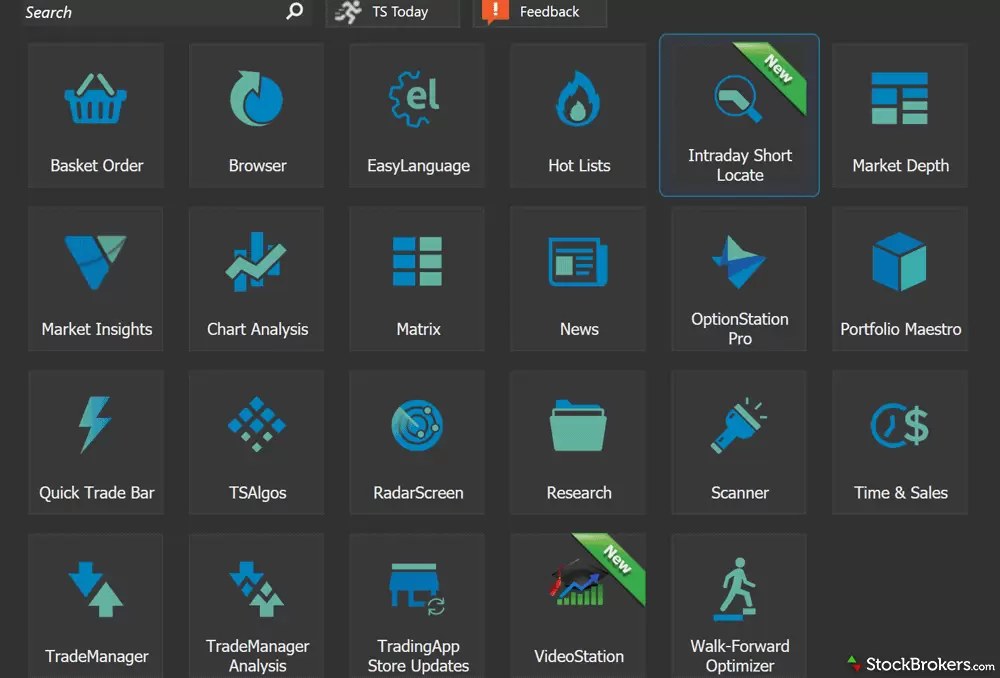

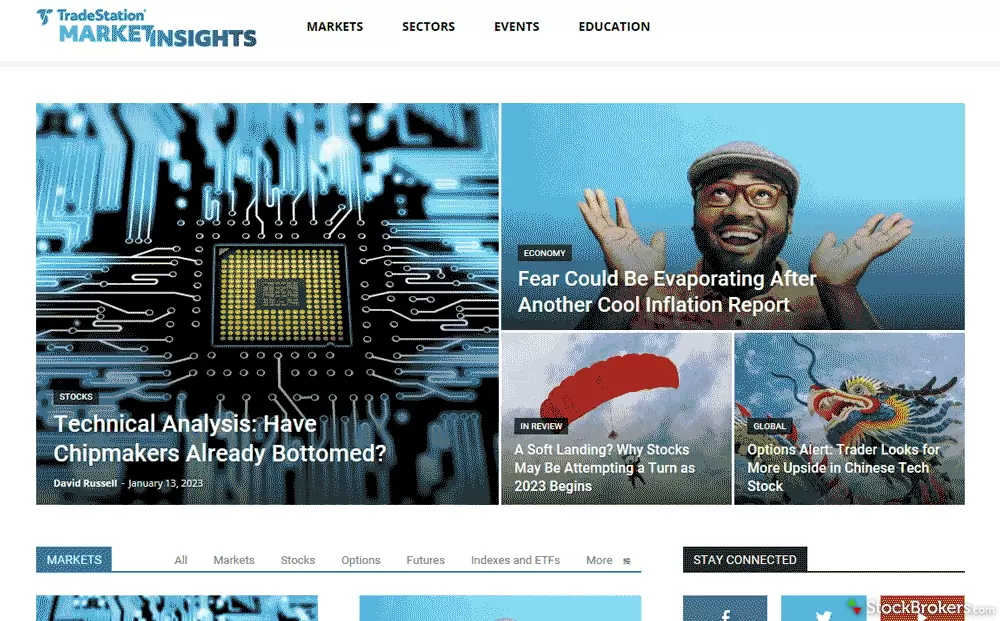

TradeStation is a full-service brokerage offering stocks, ETFs, mutual funds, options, and futures, along with fixed-income products available through broker assistance. During my testing, I found TradeStation’s platforms to be catered towards both individual and institutional traders, delivering advanced tools that cater to a wide range of trading styles.

TradeStation offers the capability to globally trade through TradeStation Global, a partnership with Interactive Brokers. This partnership extends TradeStation’s offerings creating a comprehensive product lineup with robust platform options. TradeStation earns its spot as the fifth-best broker for the best range of investments.

Check out my TradeStation review.

Our testing

Why you should trust us

Jessica Inskip is Director of Investor Research at StockBrokers.com, bringing 15 years of experience in brokerage and trading strategy. A former FINRA-licensed rep, she held Series 7, 63, 66, and 4 licenses. Jessica focuses on investor education and brokerage industry research, appears regularly on CNBC, Bloomberg, The Schwab Network, Fox Business, and Yahoo! Finance, and hosts the Market MakeHer podcast.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Trading platforms tested

We tested 16 online trading platforms for this guide: