Top Winners for Platforms & Tools

Best trading platforms & tools - Charles Schwab

| Company |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Charles Schwab Charles Schwab

|

$0.00 |

$0.00 |

$0.65 |

With the addition of thinkorswim following its merger with TD Ameritrade, Charles Schwab has taken its trading tools to an entirely new level, and any gaps Schwab had before the merger have been seamlessly filled. One feature that stood out to me was its ability to chart economic data like unemployment rates, inflation, and manufacturing trends directly alongside technical charts. The earnings analysis tool was another highlight, overlaying price action and volatility trends from past earnings with Wall Street estimates and crowd-sourced ratings. For anyone trading around earnings season, this tool is invaluable for analyzing implied moves and historical performance.

In my opinion, thinkorswim is the best trading platform on its own, offering unmatched depth and versatility, but Schwab offers more than just thinkorswim for less advanced traders with an easier-to-use Schwab Mobile and web platform. Schwab also caters to newer traders with tools like paper trading, which lets users practice strategies without risk. Additional tools, such as real-time stock scans, social sentiment charts, laddering tools, and workspace sharing, enhance the experience even further. With a solution for every type of investor, Schwab secures the top spot for the best trading platforms and tools.

Take a look at my in-depth Charles Schwab review for a deeper dive into its platforms & tools.

Best platforms & tools for institutional investors - Interactive Brokers

| Company |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Interactive Brokers Interactive Brokers

|

$0.00 |

$0.00 |

$0.65 |

Interactive Brokers (IBKR) delivers tools and features designed to meet the demands of professional traders and institutional investors while still catering to beginners. The MultiSort screener was a personal favorite, allowing me to combine up to 10 factors, like price-to-earnings ratio and dividend yield, and prioritize them to create tailored rankings. This flexibility took screening to a new level. I also loved the options lattice view, which visually displayed option activity alongside a stock’s price history, making it easy to spot trends across expirations and strike prices. Portfolio-specific ratios like Sharpe ratio, alpha, and beta were also integrated into tools helping me measure performance against benchmarks with precision.

IBKR also excels in broader investor tools, like the Impact Dashboard, which aligns portfolios with personal values such as emissions reduction or racial equality, and the Tax Optimizer, perfect for tax-sensitive investors. For professionals, the Advisor Portal offers powerful portfolio management tools, including Rebalance and Tax Loss Harvesting, while the AI Commentary Generator provides detailed performance reports and market insights in seconds. Whether you’re an institutional trader or a values-driven investor, IBKR’s combination of precision, innovation, and customization makes it an industry leader.

Check out my full Interactive Brokers review for more information about its offering.

Best platforms & tools for traders - TradeStation

| Company |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

TradeStation TradeStation

|

$0.00 |

$0.00 |

$0.60 |

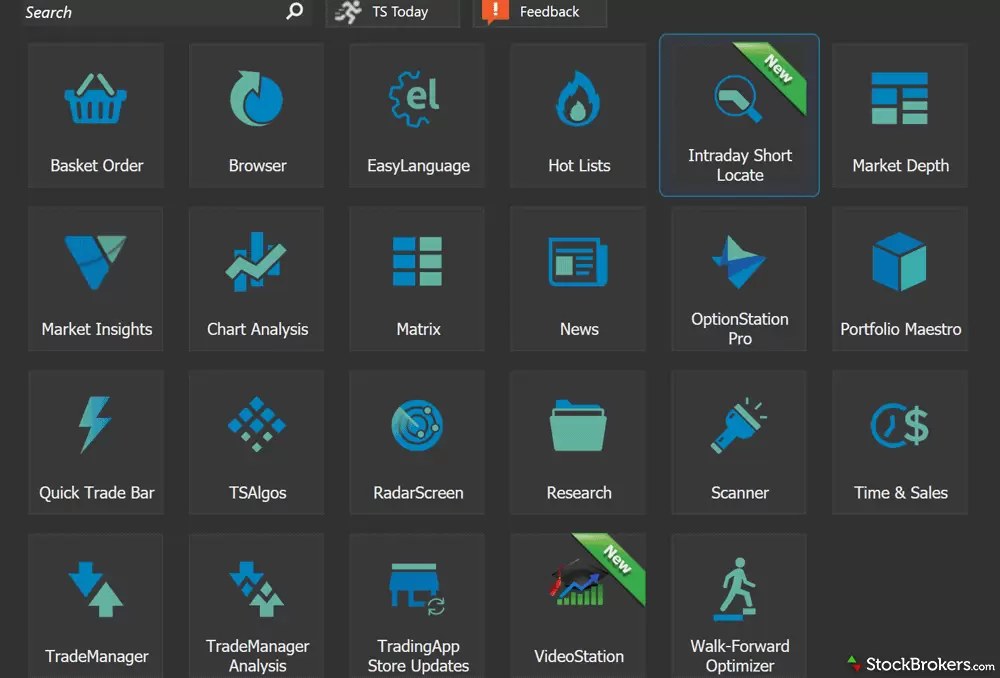

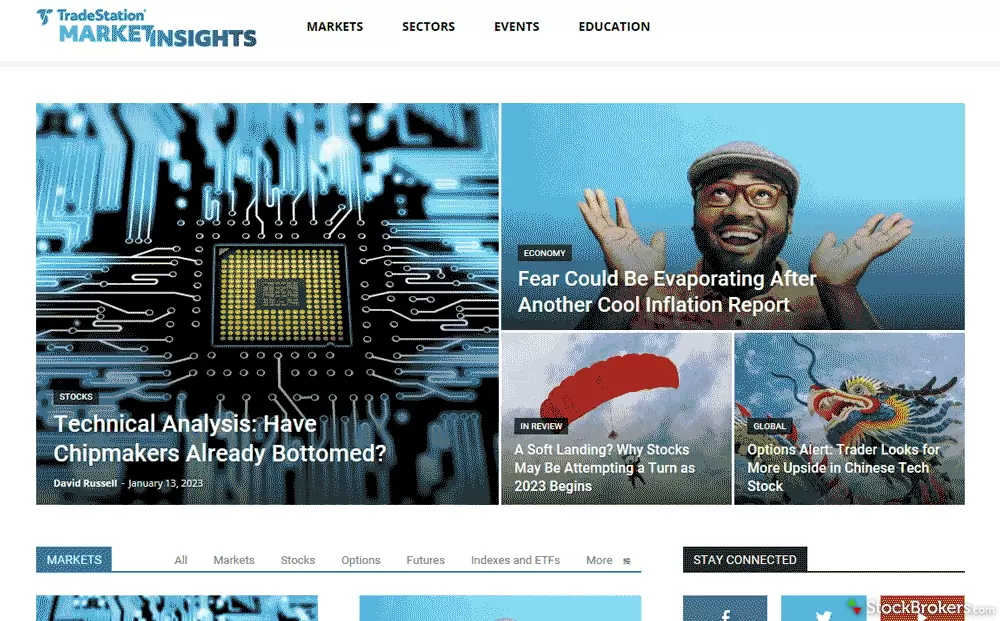

TradeStation’s platforms are built with active traders in mind, offering a suite of powerful tools for advanced analysis and customization. You will find tools like the Radar Screen for real-time streaming watchlists, the Matrix for ladder trading, and the Walk-Forward Optimizer allowing the ability to test strategies under varying market conditions. With nearly 300 customizable indicators and over 30 years of historical data, TradeStation’s platform is a dream for technical analysts and backtesters.

Options traders will appreciate OptionStation Pro, which provides real-time Greeks, position grouping, and advanced analytics, while futures traders benefit from seamless integration across equities and futures tools. Portfolio Maestro offers Monte Carlo simulations and correlation analysis, which I found useful for managing risk and beta weighting. For simpler needs, the web platform offers a streamlined trading experience but lacks the depth of the desktop version. TradeStation’s robust tools make it a top choice for those who were “born to trade.”

Learn more about its full offering at my TradeStation review.

Best platforms & tools for options income - Fidelity

| Company |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Fidelity Fidelity

|

$0.00 |

$0.00 |

$0.65 |

Fidelity offers a robust suite of trading platforms and tools that cater to investors of all levels with platforms like Active Trader Pro (ATP) as well as product-specific and goal-planning tools. For example, Trade Armor, Fidelity’s version of bracket orders, makes managing risk and defining exit strategies straightforward by visualizing the trade directly on the chart as it is constructed. The new OptionsPlay integration is another key feature that simplifies even complex strategies by generating tailored trade ideas. It helps traders align opportunities with portfolio goals, such as income generation or speculation while staying mindful of risks like upcoming earnings or increased assignment risk.

Fidelity’s tools go beyond active trading to provide comprehensive solutions for portfolio management and fixed-income investing. The Fixed Income Dashboard impressed me with its detailed analysis, including comparisons between taxable and tax-exempt securities and tools for modeling hypothetical purchases. Customization is another strength, with a tailored positions pages for specific portfolio types, options pairing views, and tools to adjust DRIP settings or understand margin requirements. Combined with tax-efficient resources and seamless external account integration, Fidelity offers a well-rounded and practical suite of platforms and tools for all types of investors.

Head on over to my complete Fidelity review for more about its platforms & tools.

Best platforms & tools for engaged investors - E*TRADE from Morgan Stanley

| Company |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

E*TRADE E*TRADE

|

$0.00 |

$0.00 |

$0.65 |

E*TRADE’s Power E*TRADE platform is a standout for active traders, offering robust features on both desktop and mobile. During my testing, I found the Live Action Scanner particularly useful for spotting unusual activity, volatility, and technical patterns through predefined screeners. Charting tools impressed me with over 100 technical indicators and intuitive navigation options like panning and scrubbing. The ability to place contingent orders directly from the mobile app adds another layer of convenience for executing complex strategies on the go, making it a top choice for traders who need advanced tools at their fingertips.

Beyond trading, E*TRADE excels in providing tools for self-directed investors. Its portfolio management features allow you to compare performance against benchmarks and dive deeper into asset allocation with Morningstar-powered insights tailored to your risk tolerance. The dedicated tax center simplifies understanding taxable events with contextual FAQs and practical tools like toggling wash sale adjustments. I also appreciated proactive touches like being flagged on the landing page to add a beneficiary, which was quick and easy to update. These seamless features, along with timely content like investing podcasts and comprehensive retirement planning calculators, make E*TRADE a well-rounded platform that balances advanced trading with practical financial tools.

Visit my E*TRADE review for more on its offerings.

Our testing

Why you should trust us

Jessica Inskip is Director of Investor Research at StockBrokers.com, bringing 15 years of experience in brokerage and trading strategy. A former FINRA-licensed rep, she held Series 7, 63, 66, and 4 licenses. Jessica focuses on investor education and brokerage industry research, appears regularly on CNBC, Bloomberg, The Schwab Network, Fox Business, and Yahoo! Finance, and hosts the Market MakeHer podcast.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Trading platforms tested

We tested 16 online trading platforms for this guide: