Best Brokers for Customer Service

Jessica Inskip has over 15 years of experience in the brokerage industry and is a sought-after guest and commentator at financial outlets such as CNBC, Fox Business, and Yahoo Finance.

Customer service can make or break your brokerage experience, especially when you need fast answers about trading tools, account options, or rollovers. To help you find the best brokers for customer service, StockBrokers.com partnered with Confero to conduct 130 phone tests across the U.S., measuring wait times and service quality. We evaluated brokers based on responsiveness, professionalism, and knowledgeability to ensure you get the support you need.

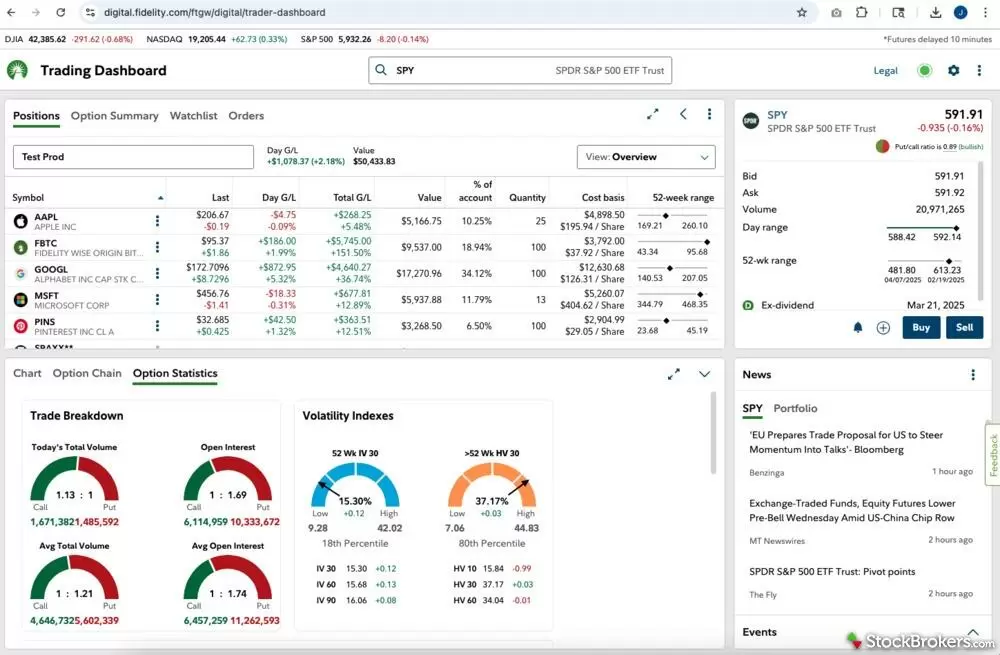

This guide highlights the top five brokers for customer service — Fidelity, Charles Schwab, Merrill Edge, Ally Invest, and E*TRADE. Each broker earned its spot by consistently demonstrating quick response times and well-trained representatives who delivered clear, actionable information.