Best Brokers for Research

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

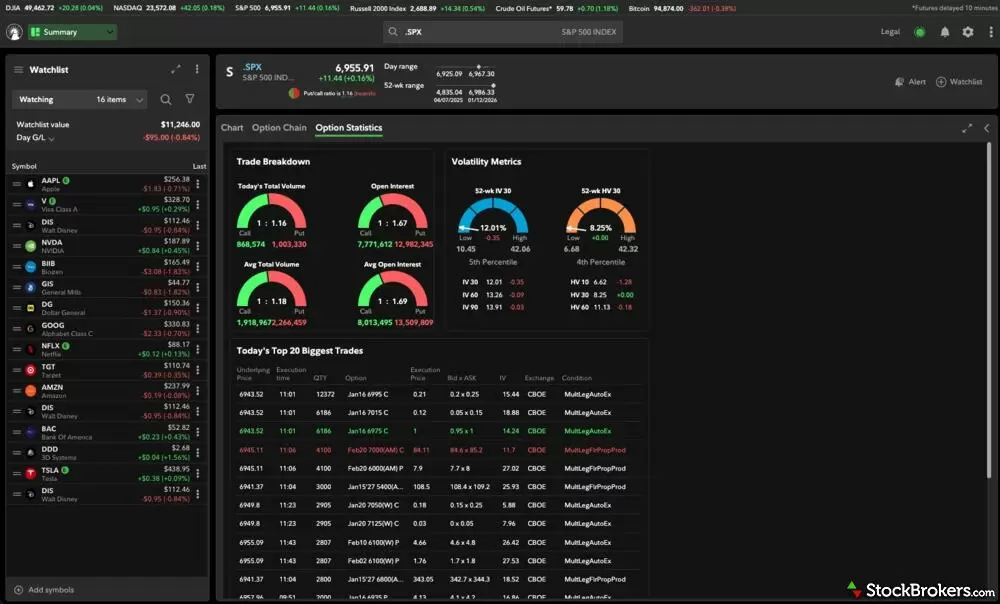

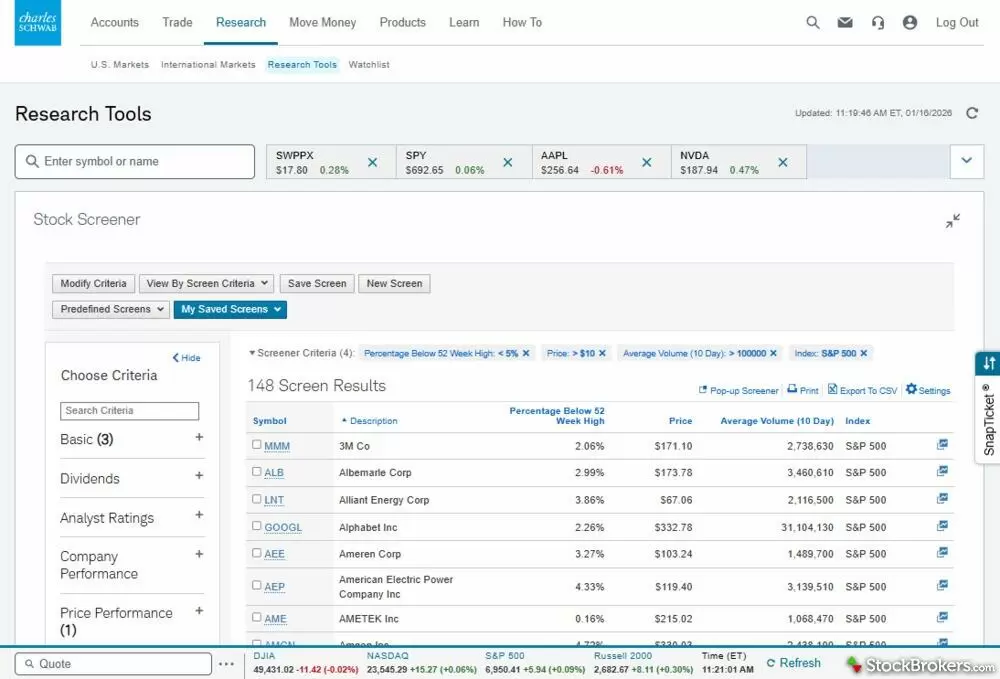

Brokerage research can include everything from third-party analysis by firms like Morningstar and S&P Global to in-house insights on markets, sectors, and individual investments. The strongest platforms don’t just offer a large volume of information, they present research in a way that’s clear, well-organized, and easy to apply to real investing decisions.

To identify the best brokers for research, I looked at both the depth of available resources and how effectively they’re integrated into the platform. That includes hands-on testing to evaluate clarity, usability, and whether the research actually helps self-directed investors make informed choices.

Best Brokers for Research

The brokers listed below met our criteria for delivering strong, reliable research experiences during testing. Each platform provides investors with access to meaningful data, analysis, and insights that support informed decision-making. While the tools and presentation may vary, these brokers consistently demonstrated research offerings that stand out within the broader online brokerage landscape.