Top 5 Winners for User Experience

Best broker for user experience - Charles Schwab

| Company |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Charles Schwab Charles Schwab

|

$0.00 |

$0.00 |

$0.65 |

Charles Schwab takes the top spot for user experience, excelling on multiple fronts. During testing, one standout example was Schwab’s fixed-income offering. When navigating the fixed-income screener, I was immediately presented with research highlighting the current opinion on the rate environment, along with contextual education explaining the credit markets. To top it off, the experience included a clear call-to-action suggesting fixed-income funds as an alternative option for exposure. This seamless integration of research, education, and actionable options exemplifies what makes Schwab’s user experience exceptional.

Schwab’s standard for user experience is about anticipating investor needs and integrating solutions across every touchpoint. Whether you’re exploring research, analyzing investments, or executing trades, the platform consistently connects education, actionable tools, and relevant insights. It's this methodical integration and proactive design that make Schwab the industry leader for ease of use.

Discover more about its full offering at my Charles Schwab review.

Best compelling visuals - E*TRADE from Morgan Stanley

| Company |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

E*TRADE E*TRADE

|

$0.00 |

$0.00 |

$0.65 |

E*TRADE stands out in the user experience category for its exceptional data visualization, which makes complex information easy to interpret and act on. For example, I loved how the platform broke down stock analysis by visually displaying revenue drivers in clear, digestible tables. Advanced/declines were shown in a simple histogram format, making it effortless to gauge market sentiment. Another standout feature was the ability to view total assets under management (AUM) of funds in a table, providing an at-a-glance way to assess trends and opportunities.

E*TRADE also enhanced ease of use with practical, proactive touches. Upon logging in, the platform flagged that I hadn’t added a beneficiary, an easy-to-update feature that added a layer of personalization. The positions page was equally intuitive, featuring a toggle for wash sale adjustments to simplify tax tracking. Combined with a robust tax center, complete with FAQs, timelines, and educational content, E*TRADE integrates these visuals and tools seamlessly into the investor experience.

Find out more about its features at my full E*TRADE review.

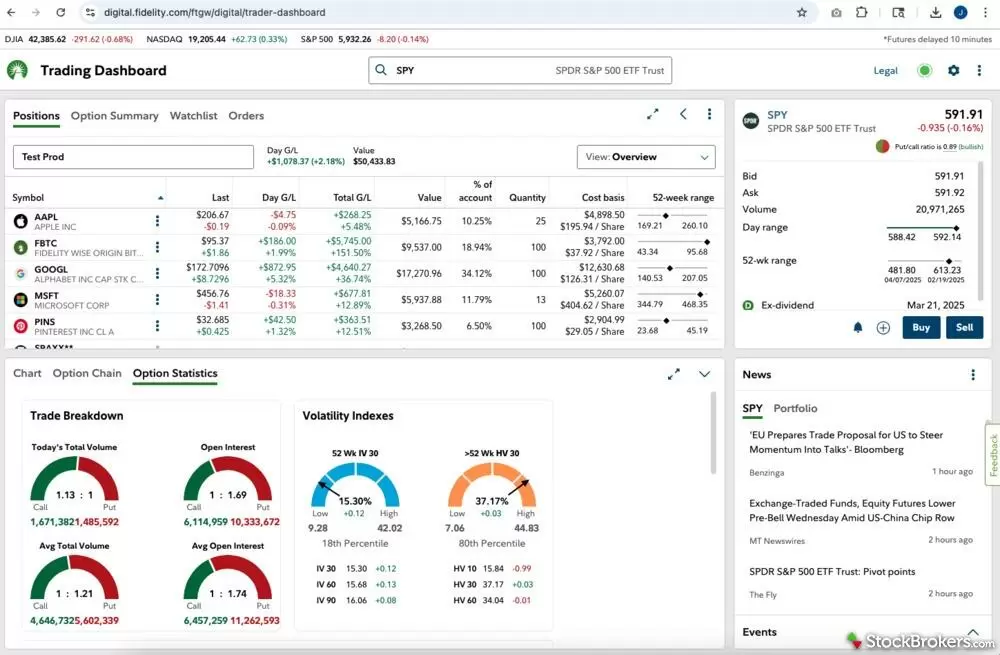

Best user experience for position management - Fidelity

| Company |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Fidelity Fidelity

|

$0.00 |

$0.00 |

$0.65 |

Fidelity’s widgetized landing page immediately sets a personalized tone with a tailored dashboard upon logging in. One feature that really stood out during my testing was the positions page. I loved the ability to switch views based on my portfolio type, whether income-focused or trading-focused, and easily set up dividend reinvestment programs (DRIP), view tax lots, wash sales (or exclude them), and fully understand my unrealized gains and losses.

The options summary page was another favorite. The pairing view made tracking multileg options simple, with clear distinctions of gains and losses, original execution prices, and margin requirements all grouped by expiration or underlying.

I also loved Fidelity’s Equity Summary Score, which takes stock analysis to the next level by combining analyst accuracy with a weighted bullish/bearish scoring system. It’s a thoughtful way to turn overwhelming amounts of data into actionable insights. From the big picture to the smallest details, Fidelity delivers a user experience that’s both intuitive and powerful.

Check out more about its platform and tools at my complete Fidelity review.

Best bank and brokerage user experience - Merrill Edge Self-Directed

| Company |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Merrill Edge Merrill Edge

|

$0.00 |

$0.00 |

$0.65 |

Merrill Edge Self-Directed, backed by Bank of America, offers a seamless “one app” experience. Whether you’re accessing through the bank, benefits, or investing portals, the interface is cohesive and consistent. This integration eliminates unnecessary friction and provides a unified approach across all accounts.

Merrill also stands out for enhancing traditional data profiles through its story experiences. These features anticipate the questions investors should be asking, answer them clearly, and provide simple explanations to help navigate the learning curve. There is a different story experience for stocks, funds, and even your own portfolio.

Merrill also excels in integrating contextual education throughout the platform. Hover-over definitions are thoughtfully placed on nearly every term, simplifying complex concepts and making the experience more accessible. This approach minimizes jargon and ensures investors can easily understand and navigate the tools and data provided.

Learn more about its different implementations of these tools at my review of Merrill Edge.

Best user experience for professional and active traders - Interactive Brokers

| Company |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Interactive Brokers Interactive Brokers

|

$0.00 |

$0.00 |

$0.65 |

Interactive Brokers (IBKR) delivers an unmatched range of investments, and while this breadth comes with a learning curve, IBKR has an extensive learning center matching the range of investments. During my testing, I found the Portfolio tab to be a standout feature. It centralizes everything I needed—holdings, performance, balances, and even an impact dashboard—in one place. I loved being able to view my allocation by asset class, sector, and industry. For heavy traders, the balances page was incredibly helpful, especially with its clearly labeled overnight balances that made position management straightforward.

Despite its advanced capabilities, IBKR makes it easier to get started with intuitive tutorials, like the one I received when launching the app for the first time. Pairing its powerful tools with an educational learning center ensures that IBKR remains accessible to investors at all levels. From professional traders to self-directed investors, IBKR’s thoughtful approach to usability sets it apart earning a top spot as one of the best user experiences.

Discover more about its full range of investments and platforms at my full Interactive Brokers review.

Our testing

Why you should trust us

Jessica Inskip is Director of Investor Research at StockBrokers.com, bringing 15 years of experience in brokerage and trading strategy. A former FINRA-licensed rep, she held Series 7, 63, 66, and 4 licenses. Jessica focuses on investor education and brokerage industry research, appears regularly on CNBC, Bloomberg, The Schwab Network, Fox Business, and Yahoo! Finance, and hosts the Market MakeHer podcast.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Trading platforms tested

We tested 14 online trading platforms for this guide: